Inflation rates play a crucial role in shaping economic landscapes, influencing decisions made by policymakers, businesses, and consumers alike. Defined as the rate at which the general level of prices for goods and services rises, inflation erodes purchasing power and can significantly impact economic stability. As such, understanding and forecasting inflation is essential for economists who aim to interpret economic trends and provide guidance on fiscal and monetary policies.

The importance of accurate inflation forecasting cannot be overstated. It serves as a vital tool in the decision-making process, allowing central banks to adjust interest rates, guiding investors in their strategies, and equipping businesses to set competitive pricing. Moreover, consumers rely on these forecasts to make informed choices about spending and saving.

This article will delve into the various models and methodologies used to forecast inflation rates, examining their effectiveness and the factors that influence their accuracy. By exploring historical trends and current economic indicators, we aim to provide a comprehensive understanding of how future inflation rates can be predicted and their potential implications on the broader economy.

Understanding Inflation

Inflation is a complex economic phenomenon that refers to the sustained increase in the general price level of goods and services in an economy over time. It is typically measured by indices such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). Understanding inflation is essential for economists, as it helps to gauge the health of an economy and informs various policy decisions.

What is Inflation?

At its core, inflation represents the decrease in purchasing power of a currency. When inflation rises, each unit of currency buys fewer goods and services, leading to an increase in the cost of living. This can be caused by several factors, including demand-pull inflation, where demand for products exceeds supply, and cost-push inflation, where supply chain disruptions or increased production costs drive prices higher.

Types of Inflation

- Demand-Pull Inflation: This occurs when aggregate demand in an economy outpaces aggregate supply. Factors contributing to this type of inflation include increased consumer spending, government expenditure, and investment.

- Cost-Push Inflation: This type happens when the costs of production increase, causing producers to raise prices to maintain profit margins. Key factors include rising wages, increased costs of raw materials, and supply chain constraints.

- Built-In Inflation: Also known as wage-price inflation, this occurs when businesses and workers expect prices to rise, leading to higher wages and, in turn, higher costs for businesses, perpetuating the cycle.

Historical Context: Past Trends in Inflation Rates

Analyzing historical trends in inflation rates provides valuable insights into how economies respond to various shocks and policy measures. For instance, the hyperinflation of the 1970s in the United States, driven by oil price shocks and expansive monetary policy, serves as a critical case study in understanding the complexities of inflation.

In contrast, the post-2008 financial crisis saw central banks implementing quantitative easing to stimulate economic growth, leading to concerns about potential future inflation. Monitoring these historical contexts helps economists develop better forecasts for future inflation rates.

Understanding these foundational concepts prepares economists to engage with advanced forecasting models and economic indicators, ultimately allowing them to make informed predictions about future inflation rates and their economic impact.

The Importance of Forecasting Inflation

Forecasting inflation is a fundamental aspect of economic analysis that holds significant implications for policymakers, businesses, and consumers. Accurate inflation forecasts enable stakeholders to make informed decisions, mitigate risks, and adapt to changing economic conditions. This section explores the critical reasons why forecasting inflation is essential and its broader impact on the economy.

Role in Economic Policy

Central banks, such as the Federal Reserve in the United States, rely heavily on inflation forecasts to guide monetary policy. By anticipating inflation trends, policymakers can adjust interest rates to either stimulate economic growth or curb excessive inflation. For instance, if forecasts predict rising inflation, central banks may choose to increase interest rates to cool down spending and investment. Conversely, if deflationary pressures are anticipated, lowering interest rates can encourage borrowing and spending.

Understanding the relationship between inflation forecasts and monetary policy is crucial for maintaining economic stability. The European Central Bank provides insights into how inflation expectations influence policy decisions across Europe.

Impact on Investment Decisions

Investors closely monitor inflation forecasts to make strategic decisions regarding asset allocation. Inflation erodes the real returns on investments, prompting investors to seek inflation-protected securities or commodities that tend to retain value during inflationary periods. Additionally, sectors such as real estate and energy often perform differently based on inflation expectations.

For example, during periods of rising inflation, investors may flock to real assets, while in deflationary environments, they might seek safer investments like bonds. Understanding these dynamics allows investors to optimize their portfolios based on anticipated inflation trends.

Influence on Consumer Behavior

Consumers also react to inflation forecasts, adjusting their spending and saving habits accordingly. When consumers expect rising prices, they may accelerate purchases to avoid higher costs in the future. This behavior can lead to increased demand, further fueling inflation. Conversely, expectations of falling prices might prompt consumers to delay purchases, impacting overall economic activity.

Research has shown that consumer sentiment regarding inflation can significantly influence economic outcomes. For instance, the University of Michigan’s Consumer Sentiment Index regularly tracks consumer expectations about inflation and its impact on spending behavior.

In summary, forecasting inflation is vital for informed decision-making across various sectors. By understanding its role in economic policy, investment strategies, and consumer behavior, stakeholders can better navigate the complexities of the economic landscape and mitigate risks associated with inflation fluctuations.

Also Read: How Currency Volatility Affects Emerging Markets

Models for Forecasting Inflation

Forecasting inflation accurately requires a range of models and methodologies, each offering unique insights into future price movements. Economists utilize various approaches, from traditional economic theories to advanced statistical methods, to predict inflation trends and make informed policy recommendations. This section explores some of the prominent models used in inflation forecasting.

Traditional Economic Models

Phillips Curve

The Phillips Curve illustrates the inverse relationship between unemployment and inflation. Historically, it suggested that lower unemployment rates correlate with higher inflation rates, as increased demand for labor drives wages—and consequently prices—up. While the relationship has evolved over time, it remains a foundational concept for understanding inflation dynamics. Central banks may use variations of the Phillips Curve to gauge the trade-offs between inflation and unemployment when formulating monetary policy.

Quantity Theory of Money

This theory posits that inflation is directly proportional to the money supply in an economy. It can be summarized by the equation MV = PQ, where M is the money supply, V is the velocity of money, P is the price level, and Q is the quantity of goods and services produced. Economists use this model to predict inflation based on expected changes in money supply and economic output. The Federal Reserve often references this theory when discussing monetary policy implications.

Statistical and Econometric Models

- Time Series Analysis: Time series analysis involves examining historical inflation data to identify patterns and trends that can inform future predictions. Econometric models, such as ARIMA (AutoRegressive Integrated Moving Average), are frequently used to project future inflation rates based on past values. By analyzing seasonal fluctuations and cyclical trends, economists can develop robust forecasts that account for historical data.

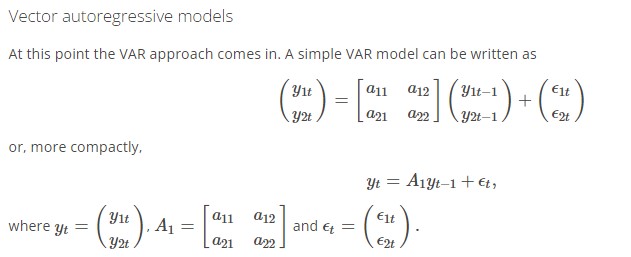

- Vector Autoregression (VAR): VAR models capture the relationship between multiple time series variables, allowing economists to analyze how inflation interacts with other economic indicators, such as GDP growth and unemployment. This multi-dimensional approach helps to understand the broader economic context and potential causal relationships.

Machine Learning Approaches

- Regression Analysis: Regression models, including linear regression, are used to identify relationships between inflation and various predictor variables, such as oil prices, wage growth, and consumer sentiment. By quantifying these relationships, economists can generate forecasts that adapt to changing economic conditions.

- Neural Networks: Increasingly, economists are turning to machine learning techniques, such as neural networks, for inflation forecasting. These models can analyze vast datasets and identify complex patterns that traditional models might overlook. By training algorithms on historical inflation data, economists can improve the accuracy of their predictions.

Current Trends and Indicators

Understanding the current trends and indicators that influence inflation is crucial for accurate forecasting. Various economic metrics and global factors play a significant role in shaping inflation rates. This section examines the key indicators and trends that economists analyze to predict future inflation movements.

Key Economic Indicators Influencing Inflation

Consumer Price Index (CPI)

The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is one of the most widely used indicators for inflation and reflects the cost of living. Economists closely monitor CPI trends to assess inflationary pressures within the economy. A rising CPI often signals increasing inflation, prompting policymakers to consider adjustments to interest rates.

Producer Price Index (PPI)

The PPI measures the average changes in selling prices received by domestic producers for their output. It serves as an early indicator of inflation since increases in producer prices can lead to higher consumer prices as businesses pass on costs. Tracking PPI trends helps economists anticipate future CPI movements and identify inflationary pressures at the production level.

Core Inflation Rate

The core inflation rate excludes volatile items such as food and energy prices, providing a clearer view of long-term inflation trends. By focusing on core inflation, economists can better understand underlying inflationary pressures without the noise of short-term price fluctuations. This measure is particularly useful for central banks when setting monetary policy.

Wage Growth

Rising wages can contribute to inflation, as higher labor costs may lead businesses to increase prices to maintain profit margins. Monitoring wage growth helps economists assess potential inflationary pressures and consumer spending capacity. When wage growth outpaces productivity gains, it can signal an impending rise in inflation.

Global Economic Factors

Supply Chain Disruptions

Global events, such as natural disasters, geopolitical tensions, or pandemics, can severely disrupt supply chains, leading to shortages and increased production costs. Such disruptions have been particularly evident during the COVID-19 pandemic, where bottlenecks in supply chains contributed to rising prices across various sectors. Economists analyze these disruptions to forecast potential impacts on inflation.

Geopolitical Events

Political instability or conflicts can influence global oil prices and other commodities, affecting inflation rates. For example, tensions in oil-producing regions can lead to spikes in energy prices, which subsequently drive up overall inflation. Economists must consider these geopolitical risks when forecasting inflation trends.

Central Bank Policies

Central banks play a pivotal role in influencing inflation through monetary policy. Actions such as adjusting interest rates, engaging in quantitative easing, or altering reserve requirements can significantly affect inflation expectations. Economists closely monitor central bank communications and policy changes to understand their potential impact on inflation.

Current Economic Climate

As of 2023, many economies are grappling with the aftereffects of pandemic-related disruptions and heightened inflationary pressures. Central banks worldwide are adjusting their monetary policies in response to rising inflation, which has been fueled by factors like supply chain issues and increased consumer demand. Understanding the interplay of these current trends and indicators is essential for economists as they develop more refined forecasts for future inflation rates.

In summary, monitoring key economic indicators and global factors is vital for accurate inflation forecasting. By analyzing CPI, PPI, wage growth, and the influence of supply chain dynamics and geopolitical events, economists can better predict inflation trends and their potential economic implications.

Challenges in Forecasting Inflation

Despite the importance of accurate inflation forecasting, economists face numerous challenges that can complicate their efforts. Understanding these challenges is crucial for improving forecasting models and strategies. This section explores the primary obstacles encountered in inflation forecasting and their implications.

Data Limitations

Quality and Availability of Data

Accurate inflation forecasting relies heavily on high-quality, timely data. However, many countries face issues related to the collection and reporting of economic data. Inconsistent methodologies, outdated statistics, or incomplete datasets can lead to inaccurate predictions. For instance, some emerging markets may lack comprehensive data on consumer behavior, making it difficult to gauge inflation trends accurately

Lagging Indicators

Many economic indicators used in inflation forecasting are lagging, meaning they reflect past economic activity rather than current conditions. This can result in delayed responses to emerging inflationary pressures. For example, by the time wage growth data is released, inflation may have already begun to rise, leaving policymakers scrambling to adjust their strategies.

Unpredictability of External Factors

Geopolitical Events

Global events, such as political instability, natural disasters, or conflict, can have immediate and profound impacts on inflation. For example, a sudden oil supply disruption due to geopolitical tensions can lead to rapid price increases. Economists may struggle to incorporate these unpredictable events into their models, making it challenging to provide accurate forecasts.

Pandemic and Health Crises

The COVID-19 pandemic highlighted the unpredictable nature of health crises and their economic ramifications. Many economists were caught off guard by the rapid shifts in supply and demand dynamics, which led to unforeseen inflationary pressures. Future forecasting efforts must consider the potential for similar crises and their impact on inflation.

Model Limitations and Assumptions

Overreliance on Historical Data

Many existing forecasting models are built on historical data and relationships, which may not hold in changing economic environments. For instance, the relationship between unemployment and inflation as depicted by the Phillips Curve may not apply during periods of stagflation or when supply shocks occur. This overreliance can lead to inaccurate forecasts.

Simplistic Assumptions

Economic models often rely on simplifying assumptions that may not reflect the complexities of real-world economies. For example, models that assume rational behavior among consumers and firms may overlook behavioral economics factors that drive inflation. Consequently, forecasts may fail to account for irrational market reactions or shifts in consumer sentiment.

Future Directions in Inflation Forecasting

As the economic landscape continues to evolve, so too must the methodologies and approaches used in inflation forecasting. The challenges faced in recent years, particularly during crises like the COVID-19 pandemic, have prompted economists to explore new directions and innovations in forecasting practices. This section outlines potential future directions in inflation forecasting, focusing on advancements in modeling, the use of big data, and interdisciplinary approaches.

Innovations in Economic Modeling

Dynamic Models

Future inflation forecasting may increasingly rely on dynamic models that can adapt to changing economic conditions in real-time. Unlike traditional static models, which assume fixed relationships between variables, dynamic models can incorporate new data as it becomes available, allowing for more responsive and accurate predictions. Such models can better account for sudden shocks and shifts in consumer behavior.

Hybrid Models

The integration of different modeling techniques—such as combining traditional econometric models with machine learning algorithms—can enhance forecasting accuracy. Hybrid models can leverage the strengths of both approaches, allowing for a more comprehensive analysis of inflation drivers. For instance, machine learning can identify complex patterns in large datasets, while traditional models provide theoretical frameworks for understanding economic relationships.

The Role of Big Data and AI

Utilizing Big Data

The advent of big data offers economists unprecedented access to diverse datasets, including real-time consumer spending patterns, social media sentiment, and global supply chain metrics. By harnessing these data sources, economists can gain deeper insights into inflation dynamics and improve their forecasting models. For example, analyzing online price changes can provide early indicators of inflationary trends.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning technologies are transforming the field of economic forecasting. These technologies can process vast amounts of data and identify complex relationships that may not be apparent through traditional analysis. By training algorithms on historical inflation data, economists can create models that adapt to new information, improving both accuracy and responsiveness.

Conclusion

Inflation forecasting is a critical endeavor that significantly influences economic policy, investment strategies, and consumer behavior. As we’ve explored throughout this article, understanding inflation requires a multifaceted approach that incorporates various models, current trends, and historical contexts. The ability to accurately forecast inflation not only aids policymakers in making informed decisions but also empowers businesses and consumers to navigate economic uncertainties.

For economists and researchers, the path forward involves embracing innovation and collaboration. By leveraging interdisciplinary insights and advanced technologies, the field of inflation forecasting can evolve to meet the challenges of a dynamic global economy. As we look ahead, fostering a deeper understanding of inflation dynamics will be key to guiding effective policy responses and promoting economic stability.

The pursuit of accurate inflation forecasting is not just an academic exercise; it has real-world implications that affect the livelihoods of individuals and the health of economies. By committing to ongoing improvement and adaptation, economists can better serve society in navigating the complexities of inflation and its impacts.