A Political Powerhouse Enters the Multi-Crypto ETF Arena

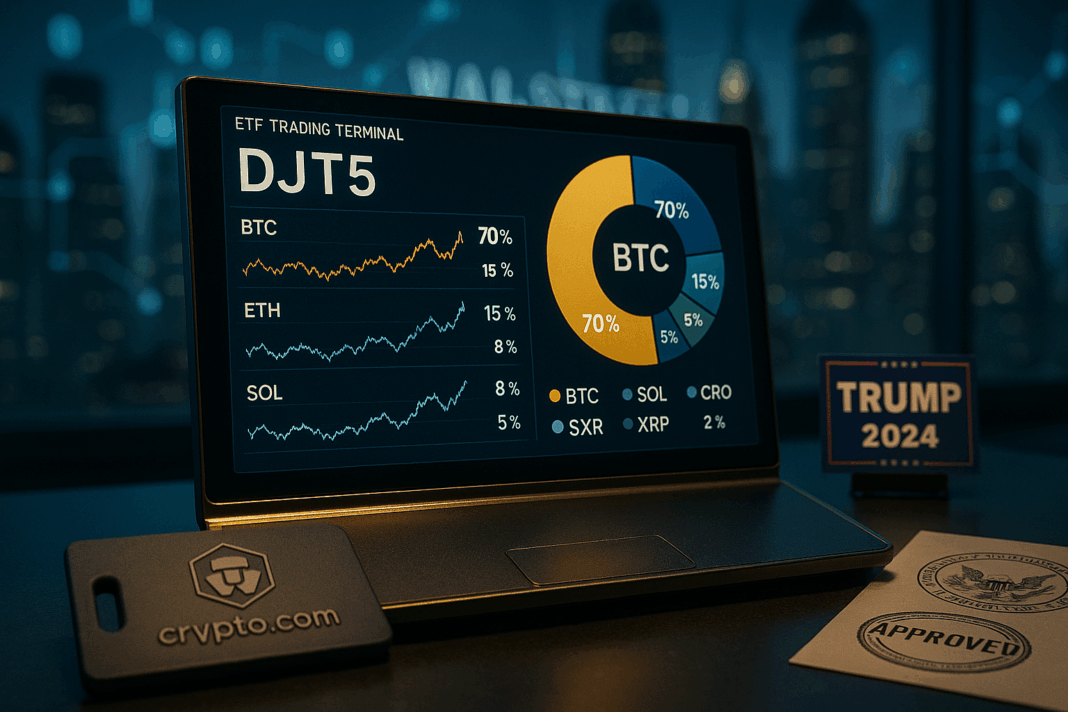

Trump Media & Technology Group just escalated the crypto ETF race with its newly filed Crypto Blue Chip ETF, targeting a diversified basket of five major cryptocurrencies—a first in U.S. markets. Unlike existing single-asset funds, this product allocates 70% to Bitcoin, 15% to Ethereum, 8% to Solana, 5% to Ripple, and 2% to Cronos . This marks Trump Media’s third crypto ETF proposal within months, completing a trilogy that includes a Bitcoin-only ETF and a dual Bitcoin-Ethereum fund . The timing aligns with President Trump’s remarkable pivot from cryptocurrency skeptic to champion, having vowed to make the U.S. the “world capital for crypto” while implementing relaxed SEC enforcement and new ETF guidelines easing multi-token approvals . For ETF traders, the Crypto Blue Chip ETF solves two critical problems: diversified exposure without direct custody complexities and first U.S. spot market access to Solana and XRP. However, controversies shadow this innovation. Cronos’ inclusion raises eyebrows since its 2% allocation exceeds its market-cap weight, potentially benefiting custodian Crypto.com . Political ethics questions also persist as critics perceive troubling overlap between Trump’s policies and his company’s financial ambitions . This Crypto Blue Chip ETF transcends a financial product—it signals cryptocurrency’s accelerating collision with political influence and traditional finance.

ETF Mechanics: Structure, Custody, and Strategic Weightings

A Multi-Token Basket with Bitcoin Dominance

Trump Media’s Crypto Blue Chip ETF diverges sharply from single-asset competitors through its five-cryptocurrency portfolio with fixed allocations. Bitcoin anchors the fund at 70% for stability and liquidity, reflecting its status as the world’s most valuable cryptocurrency . Ethereum claims 15% for smart contract platform exposure, while Solana holds 8%, targeting high-throughput chains and meme coin appeal. Ripple takes 5% following its regulatory clarity from a partial SEC court victory, and Cronos rounds it out at 2% as an exchange utility token . This allocation strategically prioritizes Bitcoin’s dominance while offering calculated altcoin upside potential. Solana’s 8% weighting is particularly notable—nearly double SOL’s current market-cap share among top cryptos—signaling a deliberate overweight for higher growth potential .

Vertical Custody Integration

The fund employs a direct custody model that bypasses third-party risks through deep integration with Crypto.com. The exchange serves three critical, intertwined roles: custodian physically holding all assets, staking agent earning yield on stakable tokens (ETH, SOL, CRO), and liquidity provider ensuring efficient ETF creations/redemptions . This vertical integration reduces counterparty exposure but concentrates operational power with a single entity—Crypto.com—whose affiliate token, CRO, holds a 2% allocation in the ETF. This weighting is four times larger than Cronos’ relative market cap within the basket, creating potential conflicts . Furthermore, Crypto.com’s 2024 $780M MiCA penalty in Europe introduces compliance concerns that institutional investors must weigh .

Controversial Weightings: Strategy or Bias?

The Crypto Blue Chip ETF‘s allocations invite scrutiny on multiple fronts. Solana’s 8% targets volatility for amplified returns but exceeds its approximate 4.5% crypto market share, essentially making it a high-growth satellite holding rather than a true blue-chip . Cronos presents a more glaring issue—it isn’t a top-15 token by market cap, and its inclusion directly benefits the custodian . Trump Media defends the mix as “strategic diversification,” while Morningstar’s Bryan Armour acknowledges the Cronos overweight “might appeal to some investors” seeking this specific mix . Nevertheless, this Crypto Blue Chip ETF forces the market to confront a fundamental question: can ETF issuers objectively weight assets when structurally tied to their custodians?

Regulatory Implications: Tailwinds from the Trump Administration

SEC’s New Playbook for Multi-Crypto ETFs

The Crypto Blue Chip ETF benefits directly from updated SEC guidelines issued in April 2025 that simplify approvals for diversified crypto funds . These rules allow basket structures holding five or more tokens (previously capped at 2-3 assets), permit single custodian models like Crypto.com’s integrated custody/staking approach, and streamline disclosures for tokens with “established regulated futures markets” (BTC, ETH) or “significant litigation clarity” (XRP) . This regulatory shift aligns seamlessly with President Trump’s public pledge to make the U.S. the “crypto capital of the planet,” a vision advanced through his SEC Chair appointee who actively dismantled barriers to crypto ETFs . The administration’s urgency stems partly from geopolitical competition, with Trump warning, “If we didn’t have it, China would” .

Enforcement Thaw: Ripple and Beyond

The SEC’s enforcement posture has softened markedly under Trump’s presidency. Lawsuits against Ripple Labs halted entirely following its 2024 partial court victory, despite ongoing legal ambiguities . Regulatory scrutiny on Solana diminished significantly despite its 2024 “security” designation, and Crypto.com avoided U.S. enforcement actions despite prior overseas penalties . Critics connect this leniency to political financing—Ripple was “one of the biggest donors to Trump’s inaugural committee,” and crypto interests have “showered him with campaign and other types of contributions” . The White House consistently denies any policy coordination, but the optics fuel ethical concerns.

Ethical Quicksand: Policy or Self-Interest?

Trump Media’s Crypto Blue Chip ETF amplifies conflict-of-interest allegations that have dogged the administration. “As a stakeholder in crypto assets, President Trump will likely profit from the very policies he is pursuing,” warned the advocacy group Democracy Defenders Fund . Noah Bookbinder of Citizens for Ethics emphasizes that “policy changes directly benefiting the President’s business erode public trust” . The SEC hasn’t recused Trump-appointed officials from reviewing DJT filings, creating a potential approval pathway that could spark legal challenges questioning regulatory impartiality .

The Approval Pathway

Trump Media’s regulatory journey hinges on two critical filings: the Form S-1 detailing fund structure (undergoing standard 45-90 day SEC review) and Form 19b-4 for exchange rule changes requiring public comment . The company projects a late Q4 2025 launch, post-election, but acknowledges possible delays if ethics probes escalate or political dynamics shift . This timeline creates an unusual market dynamic where the ETF’s fate becomes partially tied to electoral outcomes—a novel risk factor for traders.

Market Positioning: Battling Giants in a Crowded Arena

The Saturated Single-Asset ETF Landscape

Trump Media’s Crypto Blue Chip ETF enters a market dominated by established financial giants. Bitcoin ETFs from firms like BlackRock and Fidelity control 97% of the $68 billion crypto ETF assets, while Ethereum ETFs hold $4.2 billion collectively since their July 2025 launch . Crucially, zero U.S. spot ETFs currently offer exposure to more than two tokens, creating a narrow but valuable opening for Trump Media’s diversified approach. Globally, only Switzerland’s $1 billion “5-Token Index ETF” serves as precedent, highlighting the untapped potential in the U.S. market .

Trump Media’s Competitive Edge

The fund’s multi-token structure provides distinct advantages against single-asset competitors. Coverage of five tokens versus the standard one or two offers broader diversification in a single trade. It delivers the first U.S. spot market access to SOL and XRP—assets lacking standalone ETFs . Crypto.com’s vertically integrated custody-staking-liquidity model differentiates it from competitors’ fragmented third-party arrangements. Most uniquely, alignment with a pro-crypto administration offers regulatory tailwinds unavailable to rivals . However, undisclosed fees remain a critical vulnerability. Current crypto ETFs charge 0.19-0.25%, and BlackRock’s rumored 0.12% fee for its own multi-token filing could severely undercut Trump Media’s pricing .

Niche Appeal vs. Mainstream Hurdles

VettaFi’s Head of Sector Research, Roxanna Islam, pinpoints the likely adopters: “This ETF will attract Trump’s retail base and anti-establishment traders. But that can only go so far” . Institutions demand lower fees, custody transparency, and proven custodian resilience—hurdles Trump Media must clear. Regulatory clarity for SOL/XRP could boost growth, while Crypto.com’s staking yields (projected 3-5% APY on ETH/SOL/CRO) may enhance returns versus passive competitors . “Trump trade” rallies among retail investors offer another potential catalyst, but fee competitiveness remains paramount. Islam stresses the ETF thrives only if “fees beat BlackRock, custody proves robust, and Trump wins”—requiring two of three conditions to hold .

Trader Strategies: Leveraging Diversification and Political Volatility

Portfolio Use Cases

The Crypto Blue Chip ETF offers ETF traders three tactical advantages. First, it provides instant exposure to approximately 90% of the crypto market capitalization through BTC/ETH, supplemented by high-growth alts . Second, it creates unique regulation-play opportunities: XRP’s legal clarity offers stability, while SOL’s resurgent institutional interest (post-enforcement pause) provides growth potential . Third, integrated staking generates yield on ETH/SOL/CRO—a feature absent in Bitcoin-only ETFs—potentially adding 3-5% in annualized returns .

Hedging and Volatility Tactics

Strategic traders can exploit the basket’s internal dynamics. XRP’s low volatility (30-day: ~2.1%) can partially offset SOL’s sharper price swings (30-day: ~8.7%), creating a natural hedge within the fund . Political event positioning around debates, Trump rallies, or regulatory announcements offers tactical entry/exit points. Custodial arbitrage emerges through shorting CRO futures when ETF-driven demand disproportionately lifts its price relative to fundamentals.

Risk Management Non-Negotiables

Bitcoin’s 70% weighting provides stability but significantly dampens altcoin upside during crypto bull runs—a structural limitation for alpha seekers. Crypto.com’s outage history (2023/2024) threatens staking rewards and liquidity, creating operational vulnerability . Unknown management fees could erase staking yields if they exceed 0.4%, making fee disclosure critical. Bernstein ETF strategist Kelsey Ramirez frames it concisely: “This ETF isn’t for the faint-hearted. It’s a leveraged bet on altcoin adoption and political continuity” .

Allocation Framework

For ETF traders evaluating this instrument, three approaches emerge. Conservative portfolios should allocate ≤5% as satellite diversification paired with established Bitcoin ETFs. Aggressive strategies can deploy 10-15% alongside direct CRO shorts to hedge custodian concentration risk. Most analysts recommend avoiding it as a core holding until fees are disclosed and Crypto.com demonstrates prolonged operational stability .

Market Impact: Catalysts and Critical Roadblocks

Bitcoin’s Political Fuel Injection

Bitcoin surged 55% to $108,000 since Trump’s October 2025 policy shift—a rally fueled by three interconnected drivers . The SEC’s new multi-crypto ETF guidelines opened diversification pathways, paused enforcement against major tokens reduced regulatory overhang, and institutional inflows chased “politicized crypto assets.” The Crypto Blue Chip ETF filing amplified this momentum, with traders increasingly pricing in a “Trump premium” around key political events. This intertwining of digital asset valuations and electoral politics marks a paradigm shift for crypto markets.

Approval Timeline: Election-Dependent Pathway

Trump Media’s regulatory pathway faces unusual political sensitivity. Standard SEC Form S-1 review (45-90 days) and Form 19b-4’s mandatory public comment period set baseline milestones . Projected effectiveness in October 2025 precedes November elections, but ethics probes could delay this. Exchange approval would follow in November, with a December 2025 launch contingent on Crypto.com’s operational readiness. A Trump loss could freeze the entire process pending new SEC leadership, creating election-linked binary risk for prospective investors.

Institutional Adoption Barriers

While retail interest appears strong, institutional adoption faces three formidable barriers. BlackRock’s rumored 0.12% fee for its multi-token ETF would severely undercut Trump Media’s undisclosed pricing . Crypto.com’s 2024 $780M European penalty under MiCA regulations worries compliance officers, despite avoiding U.S. action . CRO’s inclusion faces fundamental skepticism—Fidelity’s crypto research lead questions, “Why 2% for CRO? It’s not a blue chip,” highlighting allocation credibility issues . VettaFi’s Islam summarizes the institutional calculus: fee competitiveness, custody resilience, and political continuity must align for serious capital allocation.

High-Stakes Experiment in Politicized Finance

Trump Media’s Crypto Blue Chip ETF transcends traditional finance—it represents a litmus test for cryptocurrency’s collision with political power. For ETF traders, this fund offers unprecedented multi-token exposure but demands vigilant management of unique risks. Three make-or-break factors will determine its trajectory.

SEC approval timing faces election-driven uncertainty—late 2025 launch requires maintaining current regulatory momentum. Fees must undercut BlackRock’s rumored 0.12% to prevent erasing staking yield advantages; anything above 0.4% makes the product non-competitive for yield-focused investors. Crypto.com must demonstrate operational stability after past outages and transparently report staking rewards. Success could accelerate tokenization of traditional assets like stocks and bonds while forcing regulatory clarity for “hybrid” securities like SOL and XRP. This ETF essentially inaugurates “political beta” for crypto assets—their performance partially tied to electoral outcomes.

The Crypto Blue Chip ETF is ultimately a leveraged bet on altcoin adoption, regulatory continuity, and concentrated political capital. It delivers diversification but demands scrutiny of fees, custody, and the ballot box. In this pioneering fund, financial markets and political influence share a single ticker symbol, creating both opportunity and unprecedented risk dimensions for ETF traders.