In the realm of real estate, understanding market dynamics is essential for making informed decisions. One of the most critical metrics for this analysis is Housing starts economic indicator, which refer to the number of new residential construction projects that have begun during a specific period. This economic indicator serves not only as a barometer for the health of the housing market but also as a reflection of broader economic conditions.

Housing starts are pivotal in forecasting market movements because they indicate future supply levels in the housing market. When housing starts increase, it often suggests a growing demand for housing, driven by factors such as population growth, improved economic conditions, and consumer confidence. Conversely, a decline in housing starts can signal economic sluggishness and potential downturns in the real estate sector.

This article aims to explore the intricate relationship between housing starts and market forecasting. By delving into the significance of this economic indicator, we will equip real estate professionals with the insights needed to predict market trends effectively. Understanding how to analyze housing starts data will enable practitioners to make strategic decisions that align with market movements, ultimately enhancing their ability to serve clients and capitalize on investment opportunities.

As we navigate through the complexities of housing starts as an economic indicator, we will discuss the methodologies for data analysis, forecasting models, and the practical applications of these insights in real estate decision-making. Whether you are a seasoned professional or new to the field, grasping the implications of housing starts can provide a competitive edge in today’s dynamic real estate landscape.

What Are Housing Starts?

Housing starts represent the initial stage of construction for new residential buildings and are a vital economic indicator for assessing the real estate market’s health. Specifically, this metric counts the number of new homes that have been authorized for construction but not yet completed, providing crucial insights into future housing supply.

Definition and Measurement

Housing starts are typically measured on a monthly basis and reported by various government agencies, such as the U.S. Census Bureau. The data is collected from building permits, which require developers to secure authorization before they can commence construction. This ensures that the figures reflect actual market activity rather than speculative or abandoned projects.

Types of Housing Starts

Housing starts can be categorized into two primary types:

- Single-Family Housing Starts: These refer to the construction of standalone homes designed for one family. This segment is often seen as a crucial indicator of consumer confidence, as it reflects individual investment in real estate.

- Multi-Family Housing Starts: This category includes buildings with multiple units, such as apartment complexes and condominiums. Multi-family starts are typically influenced by factors such as urbanization and demographic shifts, including the increasing preference for rental housing among younger populations.

Historical Context and Trends

Understanding the historical context of housing starts is essential for making informed predictions about future market movements. Over the past decade, housing starts have experienced significant fluctuations, influenced by various economic factors, including:

- The 2008 Financial Crisis: The housing market faced a steep decline, leading to a dramatic drop in housing starts. It took several years for the market to recover and regain stability.

- Pandemic Impact (2020): The COVID-19 pandemic created unique challenges and opportunities in the housing market. Initially, housing starts plummeted due to lockdowns and economic uncertainty. However, as the economy began to reopen, demand surged, leading to a rapid increase in construction activity.

- Current Trends (2023): As of 2023, housing starts have shown resilience, reflecting a rebound in consumer confidence and a strong demand for housing. However, challenges such as rising interest rates and supply chain disruptions continue to impact the market.

The Role of Housing Starts as an Economic Indicator

Connection to the Overall Economy

Housing starts are not merely a reflection of residential construction activity; they serve as a critical economic indicator that provides insights into the broader economic landscape. Understanding this connection helps real estate professionals make informed decisions about market trends and investment opportunities.

Correlation with GDP and Employment Rates

Housing starts have a direct correlation with Gross Domestic Product (GDP) because the construction of new homes stimulates economic activity. When housing starts rise, it often signifies increased consumer spending in related sectors such as construction materials, appliances, and furnishings. This, in turn, contributes to GDP growth.

Moreover, the construction industry is a significant employer. An increase in housing starts leads to job creation in various sectors, including architecture, engineering, and skilled trades. According to the National Association of Home Builders (NAHB), each new home built creates approximately 3.1 jobs for a year and generates around $90,000 in tax revenue. As employment rates rise, consumer confidence typically improves, further fueling demand in the housing market.

Also Read: How GDP Growth Rates Reflect Economic Health

Influence on Related Sectors

Housing starts also have a cascading effect on various related industries. For instance:

Construction Materials: An uptick in housing starts drives demand for materials such as lumber, concrete, and steel, thereby boosting manufacturers and suppliers in these sectors.

Appliance and Furnishing Markets: New homeowners often invest in appliances and furnishings, which stimulates retail sales and contributes to overall economic health.

Financial Services: Increased housing starts can lead to higher mortgage origination volumes, benefiting lenders and financial institutions.

Significance in the Real Estate Market

Within the realm of real estate, housing starts are a leading indicator of market trends, providing insights into future supply and demand dynamics.

- Impact on Supply and Demand Dynamics

When housing starts are on the rise, it typically indicates that builders are responding to increased demand for housing. This can lead to a more balanced market, where supply meets demand, ultimately stabilizing home prices. Conversely, a decline in housing starts may suggest a slowdown in demand, potentially leading to reduced inventory and increasing home prices.

- Indicator of Consumer Confidence

Housing starts serve as a barometer for consumer sentiment and confidence. High levels of housing starts often reflect optimism in the economy, as consumers are more likely to invest in new homes when they feel secure in their financial situation. Conversely, low housing start numbers can signal economic uncertainty, prompting consumers to hold off on significant investments.

For a deeper understanding of economic indicators in real estate, check out the National Association of Realtors for comprehensive reports and insights.

Analyzing Housing Start Data

How to Access and Interpret Housing Start Data

To effectively forecast market movements, real estate professionals need to know how to access and interpret housing start data accurately. Understanding the nuances of this data is crucial for making informed decisions.

Sources of Data

Housing start data is primarily collected and reported by government agencies and industry organizations. Key sources include:

- U.S. Census Bureau: This agency provides official statistics on housing starts, including monthly reports that detail new residential construction activity. Their data includes breakdowns by region, type of housing, and historical trends. You can access the latest reports on their Housing Starts page.

- National Association of Home Builders (NAHB): The NAHB offers insights into housing market trends and forecasts, as well as data on construction costs and market conditions. Their reports can complement Census data by providing industry perspectives.

- Local Building Departments: Many cities and municipalities publish their own reports on building permits and housing starts, offering localized insights that can be invaluable for regional analysis.

Tools and Techniques for Analysis

With access to the right data, real estate professionals can employ various tools and techniques to analyze housing starts effectively.

Statistical Methods for Forecasting

Utilizing statistical methods can enhance the accuracy of market predictions. Common techniques include:

- Time Series Analysis: This method allows professionals to analyze historical data to identify trends and patterns over time. By applying time series forecasting models, real estate professionals can predict future housing start activity based on historical trends.

- Regression Analysis: This technique can help identify relationships between housing starts and other economic indicators, such as interest rates or employment levels, allowing for more nuanced forecasts.

Data visualization tools can help professionals make sense of complex datasets. Popular software options include:

Microsoft Excel: A widely-used tool for data analysis, Excel allows users to create graphs and charts that visualize trends in housing starts.

Tableau: This powerful data visualization tool can help create interactive dashboards, enabling real estate professionals to track housing start trends and market conditions in real-time.

GIS Software: Geographic Information Systems (GIS) can be used to map housing starts geographically, allowing for spatial analysis of market trends and regional demand.

Forecasting Future Market Movements

Predictive Models

Forecasting future market movements using housing start data involves employing various predictive models that can analyze trends and project future conditions. Understanding these models is crucial for real estate professionals aiming to make informed decisions.

Econometric Models Using Housing Start Data

Econometric models are statistical models that utilize economic data to forecast future trends. These models often incorporate housing starts as a key variable alongside other economic indicators. Common approaches include:

- Multiple Regression Analysis: This method examines the relationship between housing starts and multiple independent variables, such as interest rates, unemployment rates, and consumer confidence. By quantifying these relationships, real estate professionals can predict how changes in these factors may impact housing starts and, in turn, the overall market.

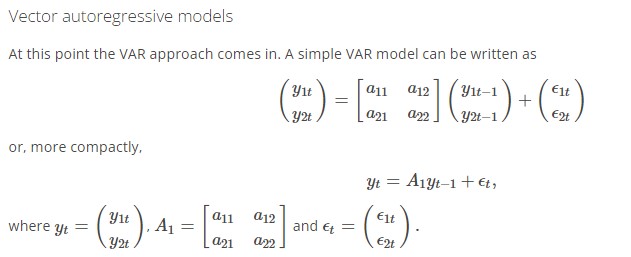

- Vector Autoregression (VAR): VAR models are used to capture the linear interdependencies among multiple time series data. In the context of housing starts, a VAR model can analyze how housing starts interact with other economic indicators over time, allowing for dynamic forecasting.

Incorporating Other Economic Indicators

To enhance forecasting accuracy, housing starts should be analyzed in conjunction with other relevant economic indicators. Key indicators to consider include:

- Interest Rates: Changes in mortgage interest rates can significantly affect housing demand. Rising interest rates may deter potential homebuyers, leading to decreased housing starts, while lower rates can stimulate demand.

- Employment Rates: Employment levels directly impact consumer confidence and purchasing power. Higher employment typically correlates with increased housing demand, leading to more housing starts.

- Consumer Confidence Index (CCI): This index gauges consumer sentiment regarding the economy’s health. A high CCI often correlates with increased housing activity, while a low index may indicate caution among potential buyers.

Application of Forecasting in Decision-Making

Understanding and applying housing start data in forecasting are crucial for real estate professionals, as these insights can directly influence strategic planning and investment decisions. Here’s how to effectively leverage this information:

Identifying Investment Opportunities

By analyzing trends in housing starts, real estate professionals can identify emerging markets that are ripe for investment. For example:

Geographic Hotspots: Areas experiencing a significant increase in housing starts may indicate a growing demand for residential properties. Real estate professionals can target these regions for investments, whether for new developments, rental properties, or resale opportunities.

Market Segments: Insights into the types of housing being constructed (single-family vs. multi-family) can guide investment decisions. For instance, if multi-family units are on the rise, it may signify a shift towards rental living, prompting professionals to invest in rental properties or consider multi-family development projects.

Timing for Buying or Selling Properties

Forecasting housing starts can also inform the optimal timing for buying or selling properties:

- Buyer’s Market vs. Seller’s Market: An increase in housing starts typically indicates a balanced or buyer’s market, while decreasing starts may signal a seller’s market. This knowledge allows professionals to advise clients on the best times to enter the market.

- Strategic Sales Decisions: For existing property owners, understanding housing start trends can inform decisions about when to sell. If housing starts are declining, it may be prudent to sell before the market shifts further.

Long-term vs. Short-term Strategies

Real estate professionals should develop both long-term and short-term strategies based on housing start forecasts. Here’s how to balance these approaches:

Adapting to Market Shifts

The ability to adapt to changing market conditions is vital. Professionals should regularly revisit their strategies based on updated housing start data and economic indicators:

- Short-term Adjustments: If housing starts show a sudden decline due to economic shifts, real estate professionals may need to adjust their marketing strategies, rethink pricing, or shift focus to more stable investment opportunities.

- Long-term Planning: Conversely, sustained growth in housing starts may prompt professionals to pursue larger development projects or expand their portfolios in high-demand areas, aligning with long-term market trends.

Risk Management and Contingency Planning

Understanding the inherent risks associated with housing starts and economic fluctuations is crucial for effective strategic planning:

- Diversification: By diversifying investments across different types of properties or geographical areas, real estate professionals can mitigate risks associated with downturns in specific markets.

- Contingency Plans: Developing contingency plans for various market scenarios can help professionals navigate unexpected changes. This might include having alternative financing options or flexible project timelines to accommodate market fluctuations.

Factors Affecting Housing Starts

While housing starts are a valuable economic indicator, several factors can influence their accuracy and reliability. Real estate professionals must be aware of these challenges to interpret the data effectively.

Economic Downturns and Unexpected Events

Housing starts are highly sensitive to broader economic conditions. Events such as recessions, natural disasters, or geopolitical tensions can lead to sudden changes in consumer confidence and spending behavior. For instance:

Recessions: Economic downturns often result in reduced consumer spending and increased uncertainty, which can lead to a decline in housing starts as builders pull back on new projects.

Natural Disasters: Events like hurricanes or wildfires can disrupt construction schedules and lead to temporary spikes or drops in housing starts, complicating trend analysis.

Policy Changes and Regulations

Government policies and regulations can have a significant impact on housing starts:

- Zoning Laws: Changes in zoning regulations can either facilitate or hinder new construction projects. Stricter zoning laws may limit the number of housing starts in certain areas, while relaxed regulations can encourage development.

- Interest Rates and Monetary Policy: Fluctuations in interest rates, driven by monetary policy decisions, can affect mortgage affordability and, consequently, demand for new homes. Rising interest rates may deter potential buyers, leading to lower housing starts.

Limitations of Forecasting Models

While forecasting models can provide valuable insights, they also have inherent limitations that real estate professionals should consider:

Uncertainty and Variability in Data

Forecasting models rely on historical data, which can be subject to revision as new information becomes available. This variability can lead to inaccuracies in predictions:

- Revised Data: Initial reports on housing starts may be adjusted as more accurate information is collected. Real estate professionals need to stay updated on revisions to ensure they are working with the most current data.

- External Influences: Unforeseen events—such as pandemics, geopolitical issues, or economic shocks—can drastically alter market conditions, rendering previous forecasts obsolete.

The Importance of Flexibility in Planning

Given the unpredictable nature of the real estate market, flexibility in planning is crucial:

- Adaptive Strategies: Real estate professionals should be prepared to adjust their strategies based on new data and emerging trends. This adaptability can help mitigate risks associated with sudden market shifts.

- Scenario Planning: Developing multiple scenarios based on varying assumptions about housing starts and economic conditions can provide a framework for navigating uncertainty. This approach allows professionals to plan for best-case, worst-case, and moderate scenarios.

Conclusion

As we have explored throughout this article, housing starts serve as a crucial economic indicator, providing invaluable insights into the real estate market. By understanding the nuances of housing start data, real estate professionals can enhance their ability to forecast market movements and make informed strategic decisions.

Real estate professionals are encouraged to actively incorporate housing start data into their decision-making processes. By leveraging this vital economic indicator, they can position themselves for success in a competitive market. Whether you’re assessing new investment opportunities, advising clients, or planning development projects, understanding housing starts will provide a strategic advantage.

By staying informed and adaptable, real estate professionals can navigate the complexities of the market and seize opportunities as they arise. The insights gained from housing start data will not only enhance individual practices but also contribute to the overall health and growth of the real estate sector.