Currency exchange rates economic indicator serve as vital indicators of economic health, reflecting the relative value of one currency against another. They are influenced by a myriad of factors, including interest rates, inflation, political stability, and overall economic performance. For economists, understanding these rates is crucial not only for analyzing current economic conditions but also for forecasting future trends and informing policy decisions.

As economies become increasingly interconnected through globalization, the impact of currency fluctuations transcends national borders. A change in the exchange rate can significantly affect trade balances, investment flows, and economic growth. For instance, a weaker domestic currency may boost exports by making them cheaper for foreign buyers, while also increasing the cost of imports, thereby influencing inflation rates.

This article aims to explore the intricate relationship between currency exchange rates and broader economic conditions. It will examine how fluctuations in these rates can signal underlying economic trends and how they, in turn, influence monetary policy decisions. By delving into empirical data, case studies, and theoretical frameworks, this analysis will provide economists with a comprehensive understanding of market dynamics related to currency exchange rates as economic indicators.

Through this exploration, we hope to equip economists with the insights necessary to navigate the complexities of modern economies and contribute to informed policy-making that can enhance economic stability and growth.

The Relationship Between Exchange Rates and Economic Conditions

Currency exchange rates are not just numbers that fluctuate daily; they are a reflection of a country’s economic health and a key indicator of its economic dynamics. The relationship between exchange rates and various economic conditions is multifaceted, encompassing numerous factors that can both influence and be influenced by fluctuations in currency values.

Key Economic Indicators Influenced by Exchange Rates

GDP Growth

Exchange rates can significantly affect a country’s Gross Domestic Product (GDP). A depreciated currency can enhance a nation’s export competitiveness, leading to increased sales abroad and, consequently, higher GDP growth. Conversely, a strong currency may reduce export demand, negatively impacting GDP growth.

Inflation Rates

The exchange rate also plays a crucial role in determining inflation. A weaker currency can lead to higher import prices, contributing to inflationary pressures within the economy. This relationship underscores the importance of monitoring exchange rates when assessing inflation trends.

Unemployment Rates

Changes in exchange rates can influence employment levels, particularly in export-driven sectors. A weaker currency may support job growth in industries reliant on exports, while a stronger currency can lead to job losses as companies face decreased competitiveness in international markets.

Mechanisms of Influence

Trade Balance and Export Competitiveness

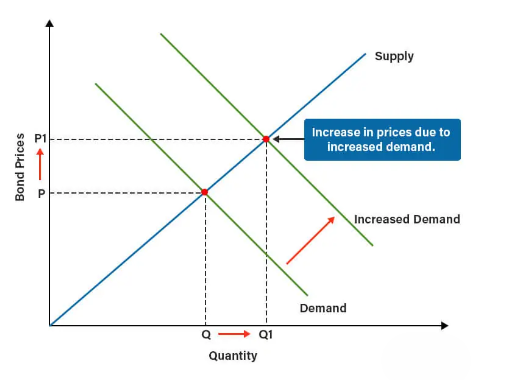

The trade balance, defined as the difference between a country’s exports and imports, is directly affected by exchange rates. A weaker currency makes exports cheaper for foreign buyers, potentially increasing export volumes. Conversely, imports become more expensive, which may reduce demand for foreign goods. This shift can lead to an improved trade balance, stimulating economic growth.

Capital Flows and Investment Decisions

Exchange rates can influence foreign direct investment (FDI) and portfolio investment decisions. A stable and strong currency can attract foreign investors, while a volatile or depreciating currency may deter investment. This dynamic is crucial, as capital inflows can provide necessary funding for domestic businesses, supporting economic expansion.

Exchange Rates as a Reflection of Economic Health

Exchange rates are not merely financial metrics; they encapsulate the health and stability of an economy. Fluctuations in exchange rates can provide insights into investor sentiment, market confidence, and the overall economic landscape. This section delves into how exchange rate movements can serve as indicators of economic health and stability.

Analyzing Exchange Rate Movements

Appreciation vs. Depreciation

- Appreciation occurs when a currency increases in value relative to others. This can signal strong economic fundamentals, such as robust GDP growth, low inflation, and high interest rates. However, excessive appreciation can harm export competitiveness, leading to trade deficits.

- Depreciation, on the other hand, indicates a decline in currency value. This can make exports cheaper and more competitive internationally, but it can also raise import costs, leading to inflationary pressures. Economists often analyze these movements to gauge economic health and determine potential policy responses.

Also Read: How Stock Market Performances Reflect Economic Health

Short-Term vs. Long-Term Trends

Short-term fluctuations in exchange rates may be driven by market speculation, geopolitical events, or temporary economic data releases. In contrast, long-term trends reflect underlying economic fundamentals. For example, sustained currency depreciation might indicate structural economic issues, while long-term appreciation generally suggests a stable and growing economy.

Indicators of Economic Confidence

- Impact of Investor Sentiment: Exchange rate movements can be heavily influenced by investor sentiment and market psychology. A strong currency often reflects positive investor perceptions of a country’s economic prospects. Conversely, a sudden drop in currency value might indicate a loss of confidence, often triggered by political instability, economic mismanagement, or adverse economic data.

- Speculative Activities in Currency Markets: Speculation plays a significant role in currency markets. Traders often react to economic indicators, news releases, and geopolitical events, which can lead to rapid changes in exchange rates. For example, if investors anticipate a rate hike by a central bank, they may buy that currency, leading to its appreciation. Understanding these speculative dynamics helps economists gauge market expectations and potential future movements.

The Role of Monetary Policy in Shaping Exchange Rates

Monetary policy is a critical tool used by central banks to manage economic stability and growth. The relationship between monetary policy and exchange rates is complex, as changes in policy can directly influence currency values, which in turn can affect broader economic conditions. This section explores how monetary policy affects exchange rates and the subsequent implications for the economy.

Central Bank Interventions

Interest Rate Adjustments

Central banks use interest rates as a primary tool to influence economic activity. When a central bank raises interest rates, it typically leads to currency appreciation. Higher interest rates offer better returns on investments denominated in that currency, attracting foreign capital. Conversely, lowering interest rates can lead to depreciation, as lower returns may cause capital to flow out of the country.

For example, when the U.S. Federal Reserve raised interest rates in response to inflation concerns, the U.S. dollar appreciated against other currencies, reflecting increased confidence among investors.

Quantitative Easing and Its Effects

Quantitative easing (QE) involves the central bank purchasing financial assets to inject liquidity into the economy. This policy can lead to currency depreciation because it increases the money supply, which may reduce the currency’s value relative to others.

For instance, during the post-2008 financial crisis, many central banks, including the Federal Reserve and the European Central Bank, implemented QE, leading to significant depreciation of their currencies. This was intended to stimulate economic growth by making exports cheaper and encouraging domestic lending.

Policy Tools and Their Impact on Exchange Rates

Open Market Operations

Open market operations (OMO) are conducted by central banks to regulate the money supply. By buying or selling government securities, central banks can influence interest rates and, consequently, exchange rates. For example, purchasing securities typically lowers interest rates and can lead to currency depreciation, while selling them can increase rates and lead to appreciation.

Currency Pegs and Floating Exchange Rates

- Some countries implement fixed or pegged exchange rate systems, where the currency’s value is tied to another major currency (like the U.S. dollar). This can stabilize exchange rates but may require significant reserves to maintain the peg.

- In contrast, countries with floating exchange rates allow market forces to dictate currency values. This flexibility can help absorb shocks but may lead to more volatility. Central banks in these systems may still intervene occasionally to stabilize their currencies, especially in times of extreme volatility.

Global Events and Their Impact on Currency Exchange Rates

Global events play a significant role in shaping currency exchange rates, influencing economic conditions and investor behavior. From geopolitical tensions to economic crises, these events can lead to rapid fluctuations in currency values, making it essential for economists to understand their implications. This section explores the key global events that affect exchange rates and their broader economic impact.

Political Instability and Uncertainty

- Political events such as elections, regime changes, and social unrest can create uncertainty in financial markets. For example, a change in government leadership can lead to significant shifts in economic policy, influencing investor confidence and currency values.

- The Brexit referendum in 2016 is a prime example, where uncertainty surrounding the UK’s future relationship with the EU led to a sharp depreciation of the British pound. This event highlighted how political developments can directly impact currency exchange rates, as markets react to perceived risks.

Trade Agreements and Tariffs

- Trade policies and agreements can also influence exchange rates. Positive developments, such as the signing of a free trade agreement, can boost investor confidence and strengthen a currency. Conversely, the imposition of tariffs can lead to depreciation as markets react to potential trade disruptions and economic slowdowns.

- The U.S.-China trade tensions that escalated in recent years provide a clear illustration. Tariffs imposed by both nations led to currency volatility and affected global supply chains, demonstrating how trade policies directly impact exchange rates and economic conditions.

Natural Disasters

- Natural disasters can disrupt economic activity and have lasting effects on a country’s economy and currency value. For example, significant earthquakes or hurricanes can cause immediate economic disruptions, leading to currency depreciation as markets anticipate increased government spending for recovery.

- The 2011 earthquake and tsunami in Japan resulted in a temporary depreciation of the Japanese yen as markets reacted to the expected economic impact and reconstruction costs. However, the yen later appreciated as Japan’s trade balance improved due to decreased imports of energy.

Health Crises

- The COVID-19 pandemic is a recent example of a health crisis that dramatically affected global economies and currency exchange rates. Initial fears and uncertainty led to widespread currency depreciation, particularly in emerging markets with weaker economic fundamentals.

- As countries implemented lockdowns and stimulus measures, currencies fluctuated based on perceived recovery trajectories. Central banks’ responses, including interest rate cuts and quantitative easing, also influenced currency values during this period.

Analyzing Data for Informed Decision-Making

Utilizing Economic Models

Economists can employ various economic models to analyze the relationship between exchange rates and key economic indicators. Models such as the Purchasing Power Parity (PPP) and the Mundell-Fleming model help in understanding how exchange rates adjust to changes in economic fundamentals. By applying these models, economists can make more accurate predictions about future currency movements and their impact on the economy.

Monitoring Real-Time Data

The availability of real-time exchange rate data allows economists to react promptly to market changes. By continuously monitoring exchange rates alongside economic indicators like inflation, interest rates, and GDP growth, economists can identify trends and anomalies that may require policy intervention or adjustment.

Importance of Understanding Market Dynamics

Informing Monetary Policy

A deep understanding of exchange rate dynamics is crucial for central banks when formulating monetary policy. For instance, if a central bank recognizes that currency depreciation is leading to rising inflation, it may consider tightening monetary policy to stabilize the currency. Conversely, if a strong currency is hindering export competitiveness, the central bank might explore measures to promote a weaker currency.

Enhancing Economic Stability

By analyzing the factors influencing exchange rates, economists can contribute to strategies aimed at enhancing economic stability. Recognizing potential risks from external shocks, such as geopolitical tensions or global economic downturns, allows policymakers to implement preemptive measures to mitigate adverse impacts on the economy.

Read more: What Indicators Are Used in Exchange Rate Forecasting?

Recommendations for Further Research and Analysis

Exploring Behavioral Economics

Exploring Behavioral Economics

Future research could delve into the behavioral aspects of currency markets, examining how investor sentiment and market psychology influence exchange rates. Understanding these dynamics could provide valuable insights into short-term currency movements that traditional economic models may overlook.

Impact of Digital Currencies

As digital currencies and cryptocurrencies gain prominence, further research is warranted on their impact on traditional exchange rates and monetary policy. Economists should explore how these new financial instruments affect global capital flows and exchange rate stability.

Regional Studies

Conducting region-specific studies can enhance understanding of how exchange rates interact with local economic conditions. For instance, analyzing the impact of exchange rates on economies heavily reliant on exports can provide tailored insights for policymakers in those regions.

Interdisciplinary Approaches

Collaborations between economists and experts in fields such as political science, environmental science, and technology can yield comprehensive analyses of how various factors influence exchange rates. This interdisciplinary approach can improve the robustness of economic models and enhance policy recommendations.

Conclusion

In the modern global economy, currency exchange rates serve as critical indicators of economic health and stability. This article has explored the intricate relationships between exchange rates and various economic conditions, emphasizing how fluctuations can reflect broader economic trends and influence monetary policy decisions.

In light of the complexities discussed, it is imperative for economists to engage in ongoing research and analysis of currency exchange rates and their economic implications. By employing rigorous methodologies and interdisciplinary approaches, economists can enhance their understanding of market dynamics and contribute to effective policy recommendations.

As we move forward, the ability to interpret currency fluctuations in the context of broader economic conditions will be essential for fostering economic stability and growth. Economists are encouraged to stay vigilant and proactive in exploring this vital area of study, ensuring they are equipped to navigate the challenges and opportunities that lie ahead in the global economic landscape.