Interest rates play a pivotal role in shaping the economic landscape. Defined as the cost of borrowing money or the return on savings, interest rates influence a wide range of economic activities, from consumer spending to business investment. Understanding how these rates are determined and their implications is crucial for economists, policymakers, and financial analysts alike.

The significance of interest rates extends beyond mere financial transactions; they are integral to the functioning of economies. When interest rates rise, borrowing becomes more expensive, which can dampen consumer spending and slow down business investment. Conversely, lower interest rates can stimulate economic activity by making credit more accessible, encouraging spending, and fostering growth.

In this article, we will explore the complex relationship between interest rates and economic trends, focusing on how fluctuations in these rates can influence overall economic activity and growth. By examining the mechanisms behind interest rates, their impact on investment and consumption, and historical case studies, we aim to provide a comprehensive understanding of how interest rates are not just numbers, but vital indicators of economic health.

The Mechanism of Interest Rates

Understanding how interest rates are determined and their various types is essential for grasping their impact on economic activity. This section explores the mechanisms behind interest rates, focusing on how they are set and the implications of different types of rates.

- Central Bank Policies: Central banks use tools like the discount rate and open market operations to influence the money supply and, consequently, interest rates. For instance, when a central bank lowers its benchmark rate, borrowing becomes cheaper, stimulating economic activity.

- Inflation Expectations: Interest rates are often influenced by expectations of future inflation. If inflation is expected to rise, lenders will demand higher interest rates to compensate for the decrease in purchasing power over time. Conversely, low inflation expectations can lead to lower interest rates.

- Economic Conditions: Current economic conditions, such as GDP growth, unemployment rates, and consumer confidence, affect interest rate levels. A robust economy typically sees higher interest rates due to increased demand for credit, while a struggling economy may lead to lower rates to encourage spending and investment.

- Global Factors: Interest rates are also impacted by international economic conditions. For example, changes in interest rates in major economies, like the Eurozone or Japan, can influence domestic rates through capital flows and exchange rates.

Further Read: The Role of Business Investment in Economic Forecasting

Types of Interest Rates

Interest rates can be categorized into several types, each serving different purposes in the economy:

- Nominal vs. Real Interest Rates: Nominal interest rates are the stated rates without adjustment for inflation, while real interest rates account for inflation, reflecting the true cost of borrowing. Understanding the difference is crucial for economists analyzing economic health.

- Short-term vs. Long-term Rates: Short-term interest rates, typically influenced by central bank policies, affect immediate borrowing costs. Long-term rates, which reflect expectations about future economic conditions, play a significant role in investment decisions. For instance, a rise in long-term rates may signal expectations of higher inflation or stronger economic growth.

Implications for Economic Growth

Understanding the mechanisms of interest rates is vital for economists analyzing their impact on economic growth. As we explore further in this article, the relationship between interest rates and economic activity is complex and multifaceted, affecting everything from consumer spending to business investment.

For deeper insights into how interest rates affect economic conditions, consider reviewing resources such as the Federal Reserve’s Economic Research, which offers a wealth of information on monetary policy and its implications.

This section lays the groundwork for our exploration of how interest rates influence economic growth and stability, setting the stage for the next discussion on their impact on investment and consumption.

Interest Rates and Economic Growth

Understanding how interest rates affect economic growth is crucial for economists seeking to analyze and predict economic trends. This section delves into the theoretical frameworks that link interest rates to economic activity, examining how fluctuations in these rates influence investment and consumption decisions.

Theoretical Framework

Various economic theories explain the relationship between interest rates and economic growth. Two prominent perspectives include:

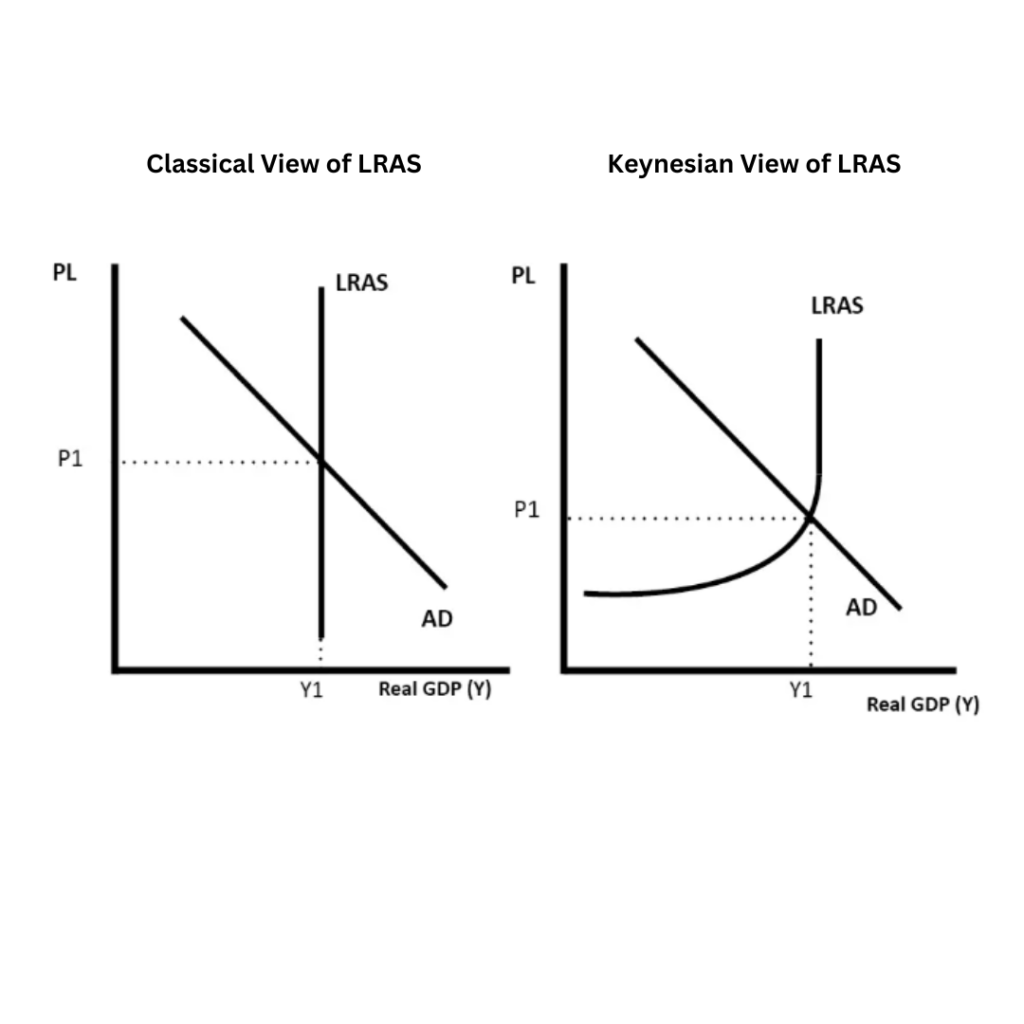

- Keynesian Perspective: According to Keynesian economics, lower interest rates stimulate economic growth by reducing the cost of borrowing. This encourages businesses to invest in expansion and consumers to increase spending. For example, during periods of economic downturn, central banks may lower interest rates to spur growth by making credit more accessible.

- Classical Perspective: Classical economists argue that interest rates are determined by savings and investment levels. They believe that higher interest rates incentivize savings, which can lead to increased capital accumulation and, ultimately, economic growth. This perspective emphasizes the role of interest rates in balancing savings and investment in an economy.

Investment and Consumption

Interest rates significantly impact both business investment and consumer spending:

Business Investment: Lower interest rates reduce the cost of financing for businesses, encouraging them to invest in new projects, equipment, and hiring. This can lead to increased productivity and economic growth. Conversely, higher rates can deter investment, leading to slower growth.

Consumer Spending: Interest rates directly affect consumer borrowing costs. When rates are low, consumers are more likely to finance large purchases, such as homes and cars, through loans. Increased consumer spending boosts demand for goods and services, driving economic growth. For instance, a study by the International Monetary Fund (IMF) highlights the positive correlation between lower interest rates and higher consumer spending.

The Role of Credit Availability

The availability of credit, influenced by interest rates, is another critical factor in economic growth. When interest rates are low, banks are more likely to lend, increasing the money supply in the economy. This liquidity can lead to:

Increased Entrepreneurship: Lower borrowing costs foster an environment where new businesses can emerge, contributing to job creation and innovation.

Enhanced Consumer Confidence: When credit is accessible, consumers feel more secure about their financial situation, leading to higher spending levels.

You can also Read: What is a Chartered Financial Analyst

Interest Rates and Economic Stability

In addition to their influence on economic growth, interest rates play a critical role in maintaining economic stability. This section examines how fluctuations in interest rates affect financial markets, control inflation, and contribute to overall economic resilience.

Impact on Financial Markets

Interest rates significantly influence the behavior of financial markets, affecting asset prices, investor sentiment, and market volatility. Key aspects include:

- Bond Markets: When interest rates rise, existing bonds with lower rates become less attractive, leading to a decline in their prices. Conversely, when rates fall, bond prices typically rise. Investors closely monitor interest rate changes to adjust their portfolios accordingly. This relationship is crucial for understanding fixed-income investments and overall market dynamics.

- Stock Markets: Higher interest rates can dampen corporate profits by increasing borrowing costs, leading to lower stock prices. Investors may shift their allocations toward fixed-income securities when rates rise, impacting stock market performance. Historical analysis shows that significant interest rate hikes often correlate with downturns in equity markets, as seen during the early 2000s and the 2008 financial crisis.

- Currency Markets: Interest rates also influence currency values. Higher interest rates offer higher returns on investments denominated in that currency, attracting foreign capital. This can lead to currency appreciation, impacting international trade and investment flows. For example, the Bank for International Settlements (BIS) provides insights into how changes in interest rates affect currency stability.

Also Read: How Currency Exchange Rates Affect International Trade

Inflation Control

One of the primary roles of interest rates is to control inflation. Central banks adjust interest rates to manage price levels and ensure economic stability. Key relationships include:

Inflation Targeting: Central banks often set inflation targets, using interest rates as a tool to achieve these goals. When inflation rises above the target, central banks may increase rates to cool down the economy. Conversely, if inflation is below target, lowering rates can stimulate demand and promote price growth.

Expectations Management: Interest rates influence public expectations about future inflation. If consumers and businesses believe that rates will remain low, they may be more likely to spend and invest, which can drive inflation higher. Effective communication by central banks regarding their interest rate policies is crucial for managing these expectations.

Recession and Recovery

Interest rates play a pivotal role during economic downturns and recoveries:

- During Recessions: Central banks typically lower interest rates to stimulate economic activity. This can include measures such as quantitative easing, which increases the money supply and encourages lending. Historical examples, such as the response to the 2008 financial crisis, illustrate how aggressive rate cuts can support recovery by encouraging borrowing and spending.

- Path to Recovery: As economies recover, central banks may gradually raise interest rates to prevent overheating and excessive inflation. The timing and pace of these increases are critical to maintaining stability without stifling growth. For instance, the gradual rate hikes following the recovery from the 2008 crisis were aimed at balancing growth while keeping inflation in check.

Case Studies

Analyzing historical examples of interest rate changes provides valuable insights into their profound effects on economic outcomes. This section explores significant periods of interest rate adjustments and their impacts on economic stability and growth, illustrating the multifaceted relationship between interest rates and economic dynamics.

The Volcker Shock (1979-1982):

In response to rampant inflation that reached nearly 14% in 1980, then-Federal Reserve Chairman Paul Volcker implemented aggressive interest rate hikes. The federal funds rate peaked at over 20% in June 1981. While these measures successfully curtailed inflation, they also triggered a severe recession, leading to unemployment rates exceeding 10%. This case illustrates the delicate balance central banks must maintain between controlling inflation and supporting economic growth. For a detailed analysis, refer to the Federal Reserve’s history of monetary policy.

The Dot-Com Bubble (1997-2000):

During the late 1990s, the Federal Reserve raised interest rates several times to prevent the overheating of the economy driven by the tech boom. The gradual increase in rates aimed to curb excessive investment in technology stocks, ultimately leading to the burst of the dot-com bubble in 2000. This case highlights the impact of interest rates on speculative investments and market stability, emphasizing the importance of timely interventions.

The Global Financial Crisis (2007-2009):

As the housing market collapsed, the Federal Reserve slashed interest rates to near-zero levels in an effort to stimulate economic recovery. The unprecedented low rates aimed to encourage borrowing and spending, resulting in a slow but steady recovery. The case of the financial crisis underscores the role of interest rates in crisis management and economic stabilization. More insights can be found in the Bank for International Settlements’ analysis.

Comparative Analysis

Examining different countries’ responses to interest rate changes offers valuable lessons. For instance:

Japan’s Lost Decade (1990s): After the asset price bubble burst, Japan maintained low interest rates for an extended period. While this was intended to revive the economy, it led to stagnation and deflation, showcasing the risks of prolonged low rates without effective structural reforms.

Australia’s Interest Rate Policy: Australia managed to avoid recession during the global financial crisis by maintaining lower interest rates and implementing fiscal stimulus. This proactive approach highlights the importance of adaptive monetary policies in stabilizing the economy.

Further Read: The Role of Currency Exchange Rates in Economic Forecasting

Current Trends and Future Outlook

As the global economy continues to evolve, understanding current trends is essential for economists and policymakers. This section examines recent developments in interest rates across major economies and provides projections for their future impacts on economic growth and stability.

Recent Developments

Post-Pandemic Recovery:

In the wake of the COVID-19 pandemic, many central banks implemented unprecedented monetary stimulus measures, including slashing interest rates to near-zero levels. As economies began to recover, there was growing concern about inflationary pressures due to supply chain disruptions and increased consumer demand. For example, the U.S. Federal Reserve and the European Central Bank faced the challenge of balancing recovery efforts with rising inflation rates.

Inflationary Pressures:

Throughout 2021 and into 2022, inflation rates surged in various economies, prompting central banks to rethink their monetary policies. In the U.S., inflation reached levels not seen in decades, spurring the Federal Reserve to signal potential interest rate hikes. The Bureau of Labor Statistics provides ongoing data on inflation trends, highlighting the relationship between rising prices and monetary policy adjustments.

Global Interest Rate Hikes:

As inflation became a pressing concern, several central banks, including the Federal Reserve, Bank of England, and Bank of Canada, initiated a series of interest rate hikes in 2022 and 2023. These actions aimed to curb inflation while supporting economic stability. The coordinated response among central banks illustrates the interconnectedness of global economies and the shared challenges they face.

Economic Projections

Interest Rate Outlook:

Looking ahead, many economists project a gradual increase in interest rates as central banks navigate the delicate balance between controlling inflation and supporting economic growth. The consensus among analysts is that interest rates will remain higher than the historically low levels seen during the pandemic, reflecting a shift towards normalization in monetary policy.

Impact on Economic Growth:

Higher interest rates may slow economic growth as borrowing costs rise for consumers and businesses. This could lead to a decrease in consumer spending and business investment, potentially impacting overall economic activity. However, some economists argue that a controlled increase in rates is necessary to prevent the economy from overheating and to maintain long-term stability.

Sector-Specific Impacts:

Different sectors of the economy will react variably to rising interest rates. For instance:

Housing Market: Higher mortgage rates may cool the housing market, reducing affordability for buyers and slowing new construction.

Financial Sector: Banks may benefit from higher rates as they can charge more for loans while maintaining lower rates on deposits, potentially boosting profitability.

Policy Implications

The management of interest rates is a critical function of central banks and has profound implications for economic policy. This section explores how interest rates are used as a tool for monetary policy, discusses strategies for effective management, and offers recommendations for policymakers aiming to foster sustainable economic growth.

Monetary Policy Strategies

Central banks employ various monetary policy strategies to influence interest rates and, consequently, economic activity. Key strategies include:

Interest Rate Adjustments:

Central banks adjust benchmark interest rates to achieve specific economic objectives. Lowering rates can stimulate borrowing and spending, while raising rates can help control inflation. The timing and magnitude of these adjustments are crucial for maintaining economic stability.

Quantitative Easing (QE):

In times of economic distress, central banks may implement QE, purchasing government bonds and other securities to inject liquidity into the economy. This approach aims to lower long-term interest rates, encouraging lending and investment. The effectiveness of QE has been a topic of extensive debate among economists, particularly regarding its long-term impacts on inflation and asset bubbles.

Forward Guidance:

Central banks use forward guidance to communicate their future policy intentions to influence market expectations. By signaling their likely path for interest rates, central banks can shape economic behavior, encouraging or discouraging spending and investment based on anticipated monetary policy.

Also Read: Why Retail Sales Figures Are a Leading Economic Indicator

Conclusion

The exploration of interest rates reveals their central role in shaping economic activity and growth. Throughout this article, we have examined how interest rates are determined, their impact on investment and consumption, and their broader implications for economic stability. Here is a summary of the key points discussed:

Understanding the dynamics of interest rates is essential for economists, policymakers, and financial analysts. As interest rates continue to evolve in response to changing economic conditions, ongoing research and analysis will be vital to inform effective monetary policy and foster a stable economic environment.

The intricate relationship between interest rates and economic health underscores the importance of maintaining a vigilant approach to monetary policy. By leveraging the lessons learned from historical case studies and current trends, stakeholders can better prepare for the challenges and opportunities that lie ahead in the ever-changing economic landscape.