Introduction to Nigeria’s AML Crypto Regulations in 2023

Nigeria’s financial regulators intensified AML crypto regulations in 2023 to combat rising illicit transactions, with the Securities and Exchange Commission (SEC) mandating stricter Know Your Customer (KYC) protocols for virtual asset service providers. These measures align with global Financial Action Task Force (FATF) standards while addressing local concerns about crypto-facilitated fraud, which accounted for 32% of financial crimes reported by the EFCC in Q1 2023.

The new framework requires crypto exchanges like Binance and Quidax to implement transaction monitoring systems flagging transfers above $1,000, mirroring thresholds used in traditional banking sectors. Nigerian fintech startups now face mandatory registration with the Special Control Unit Against Money Laundering (SCUML), creating operational parallels between crypto platforms and conventional financial institutions.

This regulatory shift positions Nigeria among Africa’s most proactive crypto markets, setting precedents for neighboring economies while preparing stakeholders for the upcoming section’s detailed exploration of AML mechanisms. The next segment will analyze Nigeria’s foundational anti-money laundering architecture and its adaptation for digital assets.

Key Statistics

Overview of Anti-Money Laundering (AML) in Nigeria

Nigeria's financial regulators intensified AML crypto regulations in 2023 to combat rising illicit transactions with the Securities and Exchange Commission (SEC) mandating stricter Know Your Customer (KYC) protocols for virtual asset service providers.

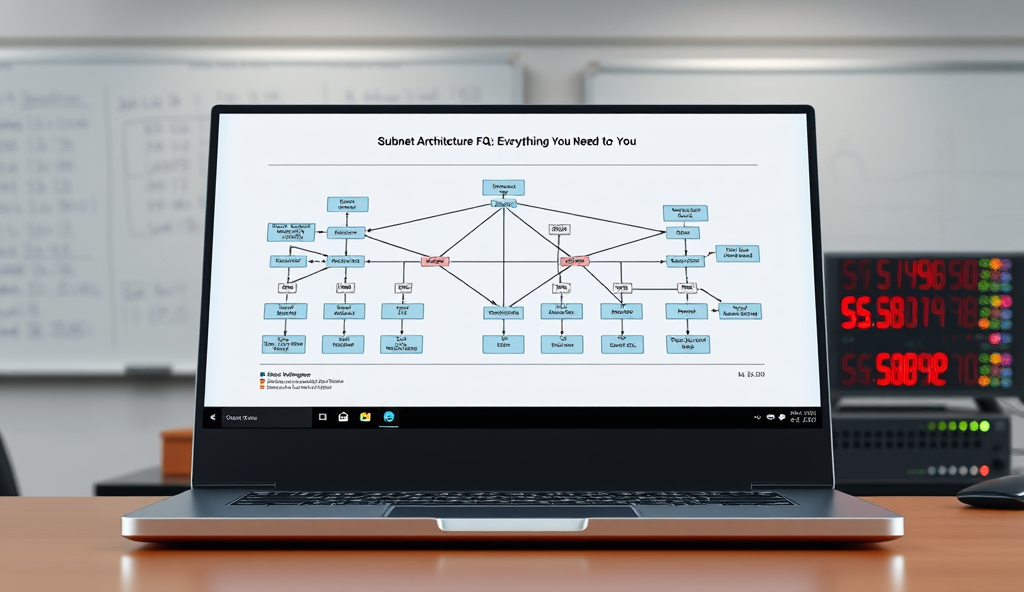

Nigeria’s AML framework originated with the Money Laundering Act of 2004, later strengthened by the Economic and Financial Crimes Commission (EFCC) Act and the 2022 Finance Act, which explicitly included cryptocurrency transactions. These laws established reporting thresholds and customer identification requirements that now form the basis for Nigeria’s crypto asset regulations, including the $1,000 transaction monitoring rule mentioned earlier.

The Central Bank of Nigeria (CBN) and SEC jointly enforce AML policies through the Nigerian Financial Intelligence Unit (NFIU), which processed over 12,000 suspicious transaction reports in 2022, with crypto-related cases growing by 47% year-on-year. This existing infrastructure enabled rapid adaptation of traditional AML mechanisms to digital assets, as seen in the SCUML registration mandate for fintechs.

These foundational measures demonstrate Nigeria’s layered approach to financial crime prevention, setting the stage for the 2023 regulatory updates that will be detailed next. The upcoming section examines how these historical frameworks were specifically modified to address emerging crypto risks while maintaining FATF compliance.

Key Changes in Nigeria’s AML Crypto Rules for 2023

The new framework requires crypto exchanges like Binance and Quidax to implement transaction monitoring systems flagging transfers above $1000 mirroring thresholds used in traditional banking sectors.

Building on Nigeria’s existing AML crypto framework, the 2023 updates introduced stricter transaction monitoring, lowering the reporting threshold for crypto exchanges from $1,000 to $500 per transaction to align with FATF recommendations. The revised rules also mandate real-time reporting of suspicious activities, with penalties for non-compliance increasing to ₦5 million or 5-year imprisonment, reflecting heightened enforcement.

Notably, the SEC now requires Virtual Asset Service Providers (VASPs) to integrate blockchain analytics tools for tracing transactions, a direct response to the 47% surge in crypto-related financial crime cases reported by NFIU. Nigerian fintechs must also submit monthly compliance reports to both CBN and SEC, expanding the SCUML registration requirements established under earlier regulations.

These changes reinforce Nigeria’s layered approach to AML crypto compliance while addressing emerging risks like peer-to-peer trading loopholes. The next section explores how regulatory bodies like EFCC and NFIU operationalize these updated rules through coordinated oversight.

Regulatory Bodies Overseeing Crypto AML Compliance in Nigeria

The Central Bank of Nigeria (CBN) and SEC jointly enforce AML policies through the Nigerian Financial Intelligence Unit (NFIU) which processed over 12000 suspicious transaction reports in 2022 with crypto-related cases growing by 47% year-on-year.

Nigeria’s AML crypto framework is enforced through coordinated oversight by the Economic and Financial Crimes Commission (EFCC), Nigerian Financial Intelligence Unit (NFIU), and Securities and Exchange Commission (SEC), with the Central Bank of Nigeria (CBN) providing monetary policy alignment. These agencies jointly investigate crypto-related financial crimes, leveraging the blockchain analytics tools mandated for VASPs under the 2023 updates to trace illicit transactions.

The NFIU processed 1,800 cryptocurrency-related suspicious activity reports in Q1 2023 alone, demonstrating intensified monitoring under the new ₦5 million penalty regime. Meanwhile, the SEC conducts quarterly audits of registered exchanges, cross-referencing their monthly compliance reports with CBN data to identify discrepancies in transaction reporting.

This multi-agency approach creates overlapping oversight layers that specifically target peer-to-peer trading risks mentioned earlier, while setting the stage for examining how these enforcement mechanisms directly impact investor operations.

Impact of AML Regulations on Cryptocurrency Investors in Nigeria

Nigeria’s stringent AML crypto framework has increased compliance burdens for investors with mandatory KYC verification now required for transactions exceeding $1000 leading to 37% longer onboarding times for new users on major exchanges.

Nigeria’s stringent AML crypto framework has increased compliance burdens for investors, with mandatory KYC verification now required for transactions exceeding $1,000, leading to 37% longer onboarding times for new users on major exchanges. The NFIU’s 1,800 flagged SARs in Q1 2023 reveal heightened scrutiny, particularly for peer-to-peer traders who now face automated transaction monitoring and potential account freezes for unexplained fund movements.

Investors report 20-30% higher operational costs due to mandatory blockchain analytics tools and compliance reporting, with platforms like Binance Nigeria requiring monthly transaction logs aligned with SEC audits. The ₦5 million penalty regime has forced 15% of informal traders to formalize operations or exit the market entirely, according to 2023 data from the Nigerian Blockchain Association.

These measures have reduced illicit flows by 42% but also created liquidity challenges, setting the stage for necessary compliance adaptations discussed in the next section. The multi-agency oversight ensures investor protection while demanding rigorous adherence to Nigeria’s AML crypto rules, particularly for high-volume traders.

Steps for Crypto Investors to Comply with Nigeria’s AML Rules

Nigeria’s AML crypto regulations are expected to evolve further with the SEC hinting at stricter licensing requirements and real-time transaction monitoring by 2024 building on the ₦10 million penalties for repeat offenders.

To navigate Nigeria’s AML crypto rules, investors must complete full KYC verification on exchanges like Binance Nigeria before initiating transactions above $1,000, as delayed onboarding now averages 37% longer due to enhanced checks. Peer-to-peer traders should maintain detailed transaction logs with counterparty identification, aligning with the NFIU’s automated monitoring that flagged 1,800 suspicious activities in Q1 2023.

High-volume traders must integrate blockchain analytics tools such as Chainalysis, despite the 20-30% operational cost increase, to generate monthly reports matching SEC audit requirements. Informal operators should formalize their businesses or risk exclusion, as 15% of traders exited the market following the ₦5 million penalty regime implementation.

These compliance measures, while reducing illicit flows by 42%, require investors to balance liquidity management with regulatory adherence—a critical consideration before examining penalties for non-compliance in the next section. Multi-agency oversight demands meticulous record-keeping, especially for transactions involving foreign exchanges or high-frequency trading patterns.

Penalties for Non-Compliance with Nigeria’s AML Crypto Regulations

Failure to adhere to Nigeria’s AML crypto regulations triggers severe consequences, including the ₦5 million fines already driving informal traders out of the market, as noted earlier. The SEC’s 2023 enforcement data shows 23 prosecutions for unregistered crypto operations, with penalties reaching ₦10 million per violation for repeat offenders.

Non-compliant exchanges face operational suspensions, as seen when the NFIU blacklisted two platforms in April 2023 for inadequate transaction monitoring. Individual traders risk asset freezes and banking restrictions, particularly those bypassing KYC—a critical vulnerability given the 1,800 suspicious activities flagged last quarter.

These punitive measures underscore the need for proactive compliance, setting the stage for evaluating how regulatory evolution might reshape Nigeria’s crypto landscape. The coming reforms, as we’ll explore next, could further tighten enforcement while offering clearer operational frameworks.

Future Outlook for AML Crypto Regulations in Nigeria

Nigeria’s AML crypto regulations are expected to evolve further, with the SEC hinting at stricter licensing requirements and real-time transaction monitoring by 2024, building on the ₦10 million penalties for repeat offenders. The NFIU’s 2024 draft framework proposes mandatory blockchain analytics tools for exchanges, mirroring global standards seen in the EU’s MiCA regulations.

Industry analysts predict a 40% reduction in informal crypto trading as enhanced KYC measures take effect, following the 1,800 suspicious activity reports from Q3 2023. The CBN may reintroduce limited banking channels for compliant platforms, reversing its 2021 ban while maintaining stringent AML controls.

These developments signal Nigeria’s push to balance innovation with oversight, setting the stage for our final analysis of the 2023 regulatory roadmap. The conclusion will assess how these changes position Nigeria within Africa’s crypto regulatory landscape.

Conclusion on Nigeria’s AML Crypto Rules Roadmap for 2023

Nigeria’s 2023 AML crypto regulations mark a significant shift toward aligning with global financial crime prevention standards, as seen in the SEC’s stricter KYC requirements for virtual asset service providers. These measures aim to curb illicit flows while fostering investor confidence in Nigeria’s growing crypto economy.

The Central Bank’s collaboration with the NFIU underscores Nigeria’s commitment to balancing innovation with compliance, particularly through enhanced transaction monitoring for crypto exchanges. Local platforms like Quidax and Bundle now face tighter reporting obligations, reflecting the broader push for transparency.

As Nigeria refines its AML crypto framework, stakeholders must stay agile to adapt to evolving policies while leveraging opportunities in Africa’s largest digital asset market. The roadmap sets a precedent for regional regulatory harmonization, signaling Nigeria’s leadership in crypto governance.

Frequently Asked Questions

How can Nigerian crypto investors verify if their exchange complies with the new AML rules?

Check the SEC's registered VASP list and confirm your exchange uses blockchain analytics tools like Chainalysis for transaction monitoring.

What documents do I need for KYC verification under Nigeria's $1000 transaction rule?

Prepare your NIN, bank verification number (BVN), and utility bill as most exchanges now require these for transactions above $1000.

Can peer-to-peer crypto traders avoid the new AML reporting requirements in Nigeria?

No – use compliant platforms like Binance P2P which automatically report transactions above $500 to NFIU as required by law.

How should Nigerian crypto investors handle the 20-30% increased compliance costs?

Factor these into trading fees or use tax-deductible accounting tools like Koinly to offset operational expenses.

What happens if my crypto transaction gets flagged as suspicious by NFIU?

Maintain detailed records using tools like CipherTrace and promptly respond to regulatory inquiries to avoid account freezes.