In the fast-paced world of cryptocurrency, discussions often revolve around buzzwords like blockchain, wallets, and decentralization, but one crucial concept that fuels the market is liquidity in cryptocurrency, ensuring seamless transactions and price stability. Whether you’re a seasoned trader or just dipping your toes into crypto, understanding liquidity can help you make smarter investment decisions and avoid getting stuck in financial limbo.

Let’s dive into what liquidity means in the context of cryptocurrency and why it’s a crucial factor for every investor to consider.

What Is Liquidity?

In cryptocurrency, liquidity refers to how easily a digital asset can be bought or sold without causing major price swings. Just like cash is the most liquid asset in traditional finance, a highly liquid crypto can be quickly converted into fiat (USD, EUR) or other digital assets. The higher the liquidity, the faster trades, fairer prices, and smoother market movements—keeping the crypto ecosystem thriving!

For example:

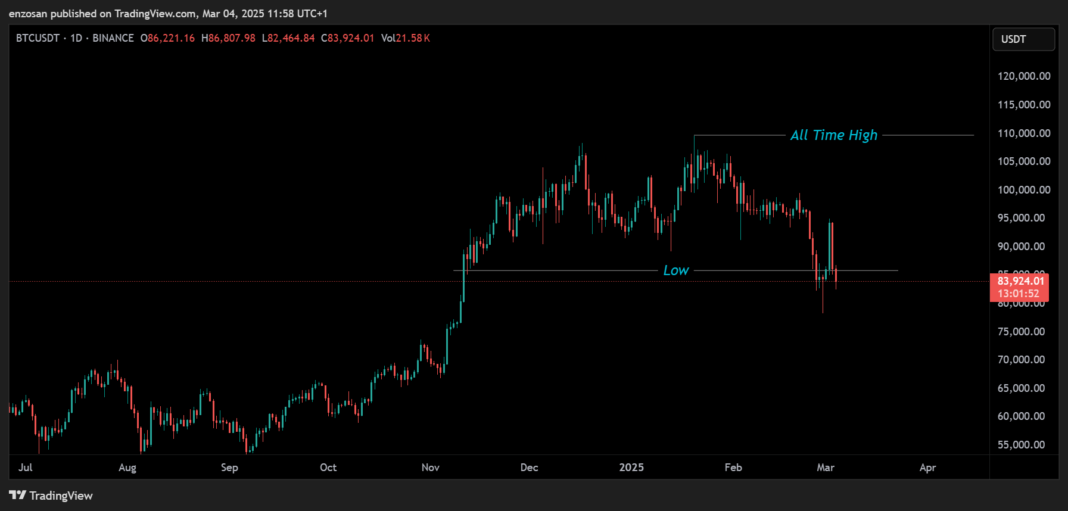

• High liquidity: Bitcoin and Ethereum, which have large trading volumes and numerous buyers and sellers, are highly liquid.

• Low liquidity: Smaller altcoins with limited trading activity are less liquid, making it harder to buy or sell them quickly.

Why Does Liquidity Matter for Investors?

- Faster Transactions

High liquidity means you can enter and exit positions quickly. If you’re trading a liquid asset, you won’t need to wait long for your order to be filled, which is especially crucial in a volatile market where prices change rapidly. - Reduced Price Slippage

Slippage happens when the price of an asset changes between the time you place an order and when it gets executed. In low-liquidity markets, slippage can be significant, leading to higher costs or lower profits. High liquidity minimizes this risk, ensuring you get closer to your intended price. - Better Market Stability

More liquidity often leads to more stable prices. Cryptos with higher liquidity are less susceptible to wild price swings caused by large trades. This stability is appealing to both short-term traders and long-term investors. - Easier Entry and Exit

If you’re investing in a highly liquid cryptocurrency, it’s easier to sell your holdings whenever you need to. In contrast, low-liquidity assets may leave you stuck, unable to sell without significantly dropping the price, or worse, finding no buyers at all.

How Is Liquidity Measured in Cryptocurrency?

Liquidity in the crypto market is typically assessed using the following metrics:

• Trading Volume: The total amount of a cryptocurrency traded within a specific period. Higher volume generally means higher liquidity.

• Order Book Depth: A deeper order book, filled with buy and sell orders, indicates strong market interest and better liquidity.

• Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is asking for (ask). A smaller spread suggests higher liquidity.

What Affects Liquidity in the Crypto Market?

Cryptocurrency liquidity is shaped by several key factors:

Exchange Listings: The more platforms a crypto is listed on, the easier it is to trade, boosting liquidity.

Trading Pairs: More pairs (e.g., BTC/USD, BTC/ETH) mean greater accessibility and smoother transactions.

Market Sentiment: Positive news attracts buyers, increasing liquidity, while negative sentiment can dry up trading activity.

Regulations: Clear rules encourage institutional investors, adding stability and deeper liquidity.

Trading Volume: Higher daily trading volumes indicate strong market participation, ensuring easier buy/sell execution.

Tips for Investors to Navigate Liquidity Challenges

- Stick to Well-Known Assets: If you’re new, consider focusing on high-liquidity cryptocurrencies like Bitcoin, Ethereum, or stablecoins.

- Monitor Trading Volume: Before making a trade, check the 24-hour trading volume. Low volume may signal poor liquidity.

- Use Multiple Exchanges: Diversifying where you trade can give you access to different liquidity pools and better pricing.

- Set Limit Orders: Instead of market orders, use limit orders to control the price at which your trades are executed, reducing the impact of slippage.

Conclusion:

Liquidity (The Lifeblood of Crypto Investing)

Liquidity is more than just a technical term—it’s a vital part of your crypto trading experience. Whether you’re looking to make quick trades, protect your profits, or simply avoid getting stuck with unsellable assets, understanding liquidity can give you a major edge in the market.

As the cryptocurrency space continues to evolve, staying aware of liquidity trends and how they affect your investments will help you navigate this dynamic world with greater confidence. So, next time you’re evaluating a cryptocurrency, don’t just look at its price—check its liquidity too.