Economic forecasting plays a crucial role in guiding decision-making for businesses, governments, and organizations. It involves predicting future economic conditions based on historical data, trends, and various economic indicators. Accurate forecasts are essential for effective planning, resource allocation, and risk management. However, traditional forecasting methods often face limitations, such as reliance on historical data and the inability to adapt quickly to changing economic conditions.

In recent years, advancements in technology have significantly transformed the landscape of economic forecasting. The integration of sophisticated tools and methodologies has enhanced the accuracy and reliability of forecasts, enabling organizations to make more informed decisions. As technology continues to evolve, its impact on economic forecasting becomes increasingly profound, offering new opportunities for improvement.

The intersection of technology and economics has led to the development of innovative forecasting techniques that leverage data analytics, machine learning, and real-time information. These advancements allow for a more nuanced understanding of economic dynamics and enable forecasters to respond swiftly to emerging trends. For technology companies, staying ahead of economic shifts is vital for maintaining competitive advantage and driving growth.

The Evolution of Economic Forecasting

Traditional Forecasting Methods

Economic forecasting has traditionally relied on a variety of statistical methods and models to predict future economic conditions. Some of the most common traditional forecasting techniques include:

- Time Series Analysis: This method uses historical data to identify trends and patterns over time. It assumes that past behavior will continue into the future, which can be effective but may not account for sudden changes in the economic environment.

- Regression Analysis: This statistical method examines the relationship between dependent and independent variables to forecast future outcomes. While useful, it often requires a significant amount of historical data and can be limited by the assumptions made about the relationships between variables.

- Qualitative Forecasting: Techniques such as expert judgment and market research are used to make predictions based on subjective assessments rather than quantitative data. While valuable in certain contexts, these methods can be prone to bias and may lack the rigor of quantitative approaches.

Despite their utility, traditional forecasting methods have notable limitations:

- Inflexibility: These methods often struggle to adapt to rapid changes in economic conditions, such as those caused by technological disruptions or global events.

- Data Limitations: Traditional models may rely heavily on historical data, which can be outdated or unrepresentative of current conditions.

- Complexity: Many traditional forecasting techniques require a deep understanding of statistical methods, making them less accessible to non-experts.

Also Read: Why Long-Term Economic Forecasts Are Often Uncertain

Introduction of Technology in Forecasting

The advent of technology has revolutionized economic forecasting, enabling the development of more sophisticated and accurate forecasting methods. Key technological advancements that have influenced this evolution include:

Computational Power: The increase in computational capabilities has allowed for the processing of vast amounts of data, enabling more complex models and analyses. This has made it possible to incorporate a wider range of variables and data sources into forecasting models.

Data Availability: The rise of big data has transformed the landscape of economic forecasting. Organizations now have access to a wealth of real-time data from various sources, including social media, financial markets, and IoT devices. This abundance of data allows for more granular and timely insights into economic trends.

Automation and Machine Learning: The integration of machine learning algorithms into forecasting processes has significantly improved accuracy. These algorithms can identify patterns and relationships in data that may not be apparent through traditional methods. They also allow for continuous learning and adaptation as new data becomes available.

Cloud Computing: The shift to cloud-based solutions has facilitated collaboration and accessibility in economic forecasting. Organizations can now share data and insights in real-time, enabling more informed decision-making across teams and departments.

Key Technological Advancements

The integration of technology into economic forecasting has led to significant improvements in accuracy and reliability. This section explores the key technological advancements that are reshaping the landscape of economic forecasting.

Big Data Analytics

Big data analytics refers to the process of examining large and varied data sets to uncover hidden patterns, correlations, and insights. In the context of economic forecasting, big data plays a crucial role in enhancing accuracy through:

- Diverse Data Sources: Economic forecasts can now incorporate data from multiple sources, including social media, transaction records, and sensor data from IoT devices. This diversity allows for a more comprehensive view of economic conditions.

- Real-time Analysis: The ability to analyze data in real-time enables organizations to respond quickly to emerging trends and shifts in the economy. For example, e-commerce companies can adjust inventory levels based on real-time sales data and consumer behavior patterns.

- Predictive Analytics: Advanced analytics techniques, such as predictive modeling, allow forecasters to identify potential future outcomes based on historical data. This approach can significantly improve the accuracy of forecasts by considering a wider range of influencing factors.

Further Read: How Globalization Is Transforming the Service Industry

Machine Learning and AI

Machine learning (ML) and artificial intelligence (AI) have revolutionized economic forecasting by enabling more sophisticated modeling techniques. Key benefits include:

Pattern Recognition: ML algorithms can analyze vast datasets to identify complex patterns that traditional methods may overlook. For instance, AI can detect subtle shifts in consumer behavior that may indicate broader economic trends.

Adaptive Learning: Machine learning models can continuously learn from new data, allowing them to adapt to changing economic conditions. This adaptability enhances the reliability of forecasts over time.

Automated Forecasting: AI-driven tools can automate the forecasting process, reducing the time and resources required for analysis. This efficiency allows organizations to focus on strategic decision-making rather than manual data processing.

Cloud Computing

Cloud computing has transformed the way organizations manage and analyze data for economic forecasting. Its impact includes:

- Scalability: Cloud platforms provide the ability to scale resources up or down based on demand, allowing organizations to handle large datasets without the need for significant upfront investment in infrastructure.

- Collaboration: Cloud-based tools facilitate collaboration among teams by enabling real-time data sharing and analysis. This collaborative approach ensures that all stakeholders have access to the same information, leading to more informed decision-making.

- Cost Efficiency: By leveraging cloud services, organizations can reduce costs associated with data storage and processing. This cost efficiency makes advanced forecasting tools more accessible to a wider range of businesses.

Learn more:

Emerging Technology Trends You Must Know About | TrueProject

Enhanced Visualization Tools

The development of advanced data visualization tools has improved the way economic forecasts are presented and understood. Key features include:

Interactive Dashboards: Modern visualization tools allow users to create interactive dashboards that display real-time data and forecasts. This interactivity enables stakeholders to explore different scenarios and gain insights quickly.

Geospatial Analysis: Visualization tools can incorporate geospatial data, allowing organizations to analyze economic trends based on geographic factors. This capability is particularly useful for businesses looking to expand into new markets.

User-Friendly Interfaces: Enhanced visualization tools often feature intuitive interfaces that make it easier for non-experts to interpret complex data. This accessibility empowers more stakeholders to engage with economic forecasting processes.

Real-time Data Integration

Real-time data integration is a pivotal advancement in economic forecasting, enabling organizations to make timely and informed decisions based on the most current information available. This section explores the significance of real-time data, the technologies that facilitate its integration, and the benefits it brings to economic forecasting.

Importance of Real-time Data

Real-time data refers to information that is collected and processed immediately as events occur. In the context of economic forecasting, real-time data is crucial for several reasons:

- Timeliness: Economic conditions can change rapidly due to various factors, including market fluctuations, geopolitical events, and consumer behavior shifts. Real-time data allows organizations to react promptly to these changes, improving the accuracy of forecasts.

- Enhanced Decision-Making: Access to real-time data empowers decision-makers to base their strategies on the latest information, reducing the reliance on outdated or static data sets. This leads to more effective resource allocation and risk management.

- Dynamic Adjustments: Organizations can continuously adjust their forecasts based on real-time insights, allowing for a more agile approach to economic planning. This adaptability is particularly important in volatile markets.

Further Read: How Globalization Is Changing the Landscape of Higher Education

Technologies Enabling Real-time Data Integration

Several technologies facilitate the integration of real-time data into economic forecasting processes:

Internet of Things (IoT): IoT devices collect data from various sources, such as sensors and smart devices, providing real-time insights into economic activities. For example, retail companies can track inventory levels and consumer foot traffic in real-time, allowing for immediate adjustments to supply chain strategies.

Cloud Computing: Cloud platforms enable organizations to store and process large volumes of real-time data efficiently. With cloud-based analytics tools, businesses can access and analyze data from anywhere, facilitating collaboration and timely decision-making.

Data Streaming Technologies: Technologies such as Apache Kafka and Amazon Kinesis allow organizations to process and analyze data streams in real-time. These tools enable the continuous flow of data from various sources, ensuring that forecasts are based on the most current information.

APIs and Data Integration Tools: Application Programming Interfaces (APIs) facilitate the integration of real-time data from different sources into forecasting models. Data integration tools help aggregate and harmonize data from various platforms, ensuring consistency and accuracy in analysis.

Enhanced Modeling Techniques

The integration of advanced modeling techniques into economic forecasting has significantly improved the accuracy and reliability of predictions. This section explores the various enhanced modeling techniques that leverage technological advancements, including machine learning, econometric models, and scenario analysis.

Advanced Econometric Models

Econometric models combine statistical methods with economic theory to analyze economic data and forecast future trends. Recent advancements in technology have led to the development of more sophisticated econometric models that enhance forecasting accuracy:

- Dynamic Models: These models account for changes over time, allowing forecasters to incorporate lagged variables and trends. By considering how past events influence current outcomes, dynamic models provide a more nuanced understanding of economic relationships.

- Structural Equation Modeling (SEM): SEM allows for the analysis of complex relationships between multiple variables. This technique is particularly useful in understanding how different economic factors interact and influence one another, leading to more accurate forecasts.

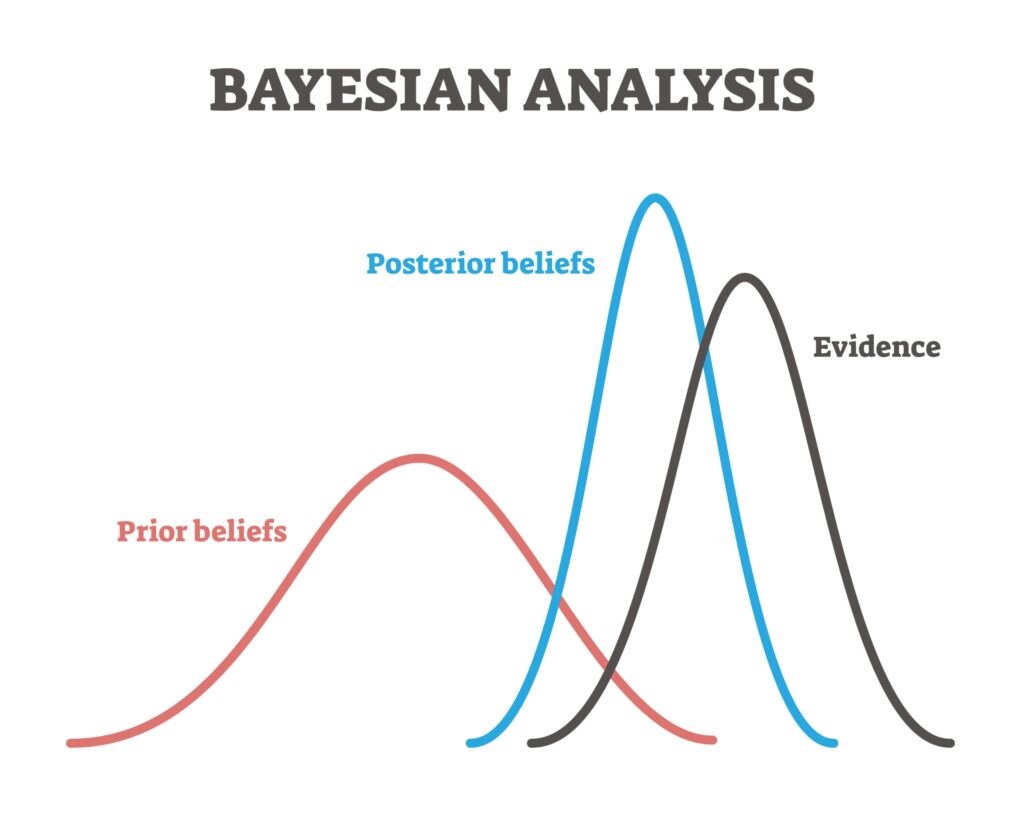

- Bayesian Econometrics: This approach incorporates prior beliefs and evidence into the modeling process, allowing for more flexible and robust forecasts. Bayesian methods can update predictions as new data becomes available, improving accuracy over time.

Challenges and Considerations

While advancements in technology and enhanced modeling techniques have significantly improved the accuracy of economic forecasting, several challenges and considerations must be addressed to ensure effective implementation. This section explores the key challenges organizations face when integrating these technologies into their forecasting processes.

Data Quality and Integrity

Data Accuracy: The reliability of economic forecasts heavily depends on the quality of the data used. Inaccurate or incomplete data can lead to misleading forecasts. Organizations must implement robust data validation processes to ensure the accuracy of their datasets.

Data Bias: Bias in data collection or processing can skew results. For instance, if certain demographics are underrepresented in the data, forecasts may not accurately reflect the broader population. Organizations should strive for representative data to mitigate this risk.

Data Integration: Combining data from multiple sources can be challenging. Inconsistent formats, varying data quality, and differing definitions can complicate the integration process. Organizations need to establish clear data governance policies to ensure consistency and reliability.

Ethical Considerations

- Transparency: As forecasting models become more complex, understanding how they arrive at predictions can be challenging. This “black box” nature of advanced models, particularly in machine learning, raises concerns about transparency. Organizations must strive to make their forecasting processes as transparent as possible to build trust among stakeholders.

- Accountability: With increased reliance on automated forecasting, questions of accountability arise. If a model produces inaccurate forecasts, it can be difficult to determine who is responsible. Organizations should establish clear accountability frameworks for their forecasting processes.

- Ethical Use of Data: The use of personal data in forecasting raises ethical concerns regarding privacy and consent. Organizations must ensure they comply with data protection regulations and ethical standards when collecting and using data for forecasting purposes.

Future Trends in Technology Economic Forecasting

As technology continues to evolve, the landscape of economic forecasting is poised for further transformation. This section explores emerging technologies and trends that are likely to shape the future of economic forecasting, offering insights into how organizations can prepare for these changes.

Emerging Technologies

Quantum Computing

Quantum computing promises to revolutionize data processing by performing complex calculations at unprecedented speeds. In economic forecasting, this can lead to:

Enhanced Computational Power: Quantum computers can analyze vast datasets and run complex simulations much faster than classical computers, enabling more intricate modeling and real-time forecasting.

Improved Optimization: Quantum algorithms can optimize economic models that involve multiple variables and constraints, leading to more accurate and efficient forecasts. Industries such as finance and logistics could greatly benefit from these advancements.

Also Read: How Accurate Are Economic Forecasts in Predicting Recessions

Blockchain Technology

Blockchain’s decentralized and secure nature can enhance data integrity and transparency in economic forecasting. Benefits include:

- Data Security: By providing a secure method for data storage and sharing, blockchain can help mitigate concerns about data manipulation and enhance trust in forecasting models.

- Smart Contracts: These self-executing contracts can automate economic transactions based on forecasted conditions, streamlining processes and reducing the risk of human error.

Conclusion

The integration of technological advancements into economic forecasting has fundamentally transformed how organizations analyze data and predict future trends. As we have explored throughout this article, the evolution from traditional methods to technology-driven approaches has led to significant improvements in forecasting accuracy, responsiveness, and decision-making capabilities.

For technology companies and other stakeholders involved in economic forecasting, the time to adapt is now. Embracing these technological advancements not only enhances forecasting accuracy but also prepares organizations to navigate the complexities of an ever-changing economic landscape. By investing in new tools, fostering collaboration between AI and human expertise, and prioritizing ethical practices, organizations can position themselves for success in the future.

The future of economic forecasting is bright, driven by innovation and technological advancement. As organizations continue to harness these tools, they will be better equipped to make informed decisions that drive growth, sustainability, and resilience in an increasingly complex world.