Gross Domestic Product (GDP) growth rates are critical indicators that reflect the economic performance of a country. They measure the annual percentage increase in the value of all goods and services produced within a nation’s borders, providing insight into the economic health and vitality of a region. Understanding GDP growth rates is essential for policy makers as these figures influence decisions on fiscal policies, budget allocations, and overall economic strategy.

In today’s rapidly changing economic landscape, characterized by global challenges such as pandemics, trade disputes, and environmental crises, the significance of GDP growth rates cannot be overstated. They serve not only as a benchmark for economic performance but also as a guide for implementing effective policies aimed at fostering sustainable growth.

This article aims to explore the multifaceted nature of GDP growth rates, analyzing their significance as an economic indicator. By examining current trends, underlying factors, and the implications for policy formulation, we seek to equip policy makers with the insights needed to navigate the complexities of economic management in a dynamic world.

Understanding GDP Growth Rates

What is GDP?

Gross Domestic Product (GDP) is a comprehensive measure of a nation’s overall economic activity. It represents the total monetary value of all finished goods and services produced within a country during a specific time period, typically annually or quarterly. GDP is a crucial indicator used by policy makers to gauge the economic performance of a nation and assess its growth trajectory.

Components of GDP

GDP is typically calculated using three primary approaches:

Production Approach: This method calculates GDP by summing the value added at each stage of production across all sectors of the economy.

Income Approach: This approach totals all incomes earned by individuals and businesses, including wages, profits, rents, and taxes, minus subsidies.

Expenditure Approach: The most common method, it calculates GDP as the sum of consumption, investment, government spending, and net exports (exports minus imports).

Each of these approaches provides a different perspective on economic activity, but they ultimately yield the same GDP figure.

Nominal vs. Real GDP

Understanding the distinction between nominal and real GDP is crucial for accurate GDP growth analysis.

- Nominal GDP measures the value of goods and services at current market prices, without adjusting for inflation. As a result, it can present an inflated view of economic growth during periods of rising prices.

- Real GDP, on the other hand, adjusts for inflation, providing a more accurate reflection of an economy’s true growth by measuring the value of goods and services at constant prices. This adjustment allows policy makers to assess whether an increase in GDP is due to actual growth or simply a result of inflation.

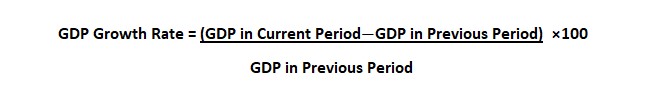

Calculation of GDP Growth Rates

To calculate GDP growth rates, the following formula is typically used:

This formula allows for the comparison of economic performance over different time periods, helping policy makers understand trends and make informed decisions regarding economic policies.

Importance of Accurate GDP Growth Analysis

Accurate GDP growth analysis is vital for policy makers for several reasons:

Economic Planning: It provides a basis for formulating fiscal policies, budget allocations, and investment strategies.

Monitoring Economic Health: Regular analysis helps in identifying economic cycles, enabling timely interventions during downturns.

International Comparisons: GDP growth rates facilitate comparisons with other nations, helping to assess competitive standing in the global economy.

For further reading on GDP calculation methods and significance, you can explore resources from the World Bank and the International Monetary Fund (IMF).

Importance of GDP Growth Rates

Indicator of Economic Health

GDP growth rates serve as a vital indicator of a nation’s economic health. A rising GDP growth rate generally signifies a robust economy, characterized by increased production, higher employment levels, and improved consumer confidence. Conversely, declining or stagnant GDP growth can signal economic distress, prompting concerns about rising unemployment and reduced public spending.

Correlation with Employment Rates

One of the most significant relationships observed is between GDP growth and employment. As GDP increases, businesses often expand operations, leading to job creation. This, in turn, boosts consumer spending, which further stimulates economic activity. For policy makers, understanding this correlation is crucial when designing employment policies and labor market interventions.

Impact on Consumer Confidence and Spending

GDP growth rates also influence consumer confidence. When people perceive that the economy is growing, they are more likely to make significant purchases, invest in homes, and contribute to economic growth. Policy makers often monitor GDP growth trends to gauge public sentiment and adjust fiscal policies accordingly. For instance, during periods of low GDP growth, governments might implement stimulus measures to encourage spending.

Comparison with Other Economic Indicators

While GDP growth rates are essential, they should not be viewed in isolation. Policy makers must consider other indicators, such as inflation rates and unemployment figures, to obtain a comprehensive view of the economic landscape. For example, a high GDP growth rate accompanied by rising inflation may necessitate different policy responses than a lower growth rate with stable prices.

Global Context and Economic Stability

In an increasingly interconnected global economy, the impact of GDP growth extends beyond national borders. Policy makers must analyze how domestic GDP growth rates compare to global trends, as this can affect trade relations, investment flows, and currency stability. Ensuring economic stability requires that policy makers remain vigilant about both domestic and international economic conditions.

Also Read: Why Emerging Markets are Becoming Attractive for Foreign Direct Investment

Analyzing Current Trends in GDP Growth Rates

Recent Data Overview

The analysis of current economic trends in GDP reveals vital insights into the performance of national and global economies. Recent reports indicate that many economies are experiencing fluctuations in GDP growth rates due to various factors, including the aftermath of the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions. For instance, according to the International Monetary Fund (IMF), the global economy is projected to grow at a moderate pace, with significant variances across regions.

Historical Trends and Comparisons

Examining historical data allows policy makers to identify patterns and cycles in economic growth. For example, post-recession recoveries typically show a rebound in GDP growth rates, while periods of economic expansion may lead to gradual declines as the economy stabilizes. By comparing current GDP growth rates with historical averages, policy makers can assess whether recent changes are part of a broader trend or indicative of emerging economic challenges.

Factors Influencing GDP Growth

Numerous factors influence current GDP growth rates, and understanding these is crucial for policy makers:

- Domestic Policies: Government spending, taxation, and regulatory frameworks can significantly impact economic growth. For instance, expansionary fiscal policies during economic downturns often lead to increased GDP through enhanced public investment.

- Global Economic Conditions: International trade dynamics, commodity prices, and foreign investment flows are critical in shaping domestic GDP growth. Policy makers must remain attuned to global economic trends that could affect local industries.

- Technological Advances: Innovations can drive productivity and efficiency, contributing to higher GDP growth rates. Policy makers should consider how to foster an environment conducive to technological development.

- Demographic Trends: Population growth and shifts in demographics can influence labor supply and consumer demand, affecting overall economic growth. Understanding these trends can help in formulating effective economic policies.

Regional Variations in GDP Growth

It’s essential to consider regional disparities in GDP growth rates. Some regions may experience robust growth due to favorable conditions, such as access to resources or investment in infrastructure. In contrast, others may struggle due to economic challenges or declining industries. For instance, emerging markets often show higher growth rates compared to developed economies due to their potential for expansion and development.

Significance of GDP Growth Rates for Policy Makers

GDP growth rates are crucial for informing economic policy decisions. They provide a quantitative basis for evaluating the effectiveness of existing policies and determining the need for new interventions. When GDP growth is robust, policy makers may choose to prioritize initiatives that further stimulate growth, such as infrastructure investments or tax incentives for businesses. Conversely, during periods of low or negative growth, policy makers may need to implement countercyclical measures to stabilize the economy.

Use in Budget Planning and Fiscal Policies

Understanding GDP growth is essential for budget planning. Projected growth rates influence government revenue estimates, enabling policy makers to allocate resources effectively. For instance, a higher expected GDP growth rate may lead to increased tax revenues, allowing for expanded public services or investment in critical infrastructure. On the other hand, if GDP growth is projected to slow, policy makers may need to adjust spending plans to avoid deficits.

Shaping Monetary Policy Decisions

GDP growth rates are a key factor in the formulation of monetary policy. Central banks closely monitor these rates to make decisions regarding interest rates and money supply. For example, if GDP growth is strong and inflation is rising, central banks may increase interest rates to prevent the economy from overheating. Conversely, during periods of low growth, they might lower interest rates to encourage borrowing and investment. The Federal Reserve and other central banks globally utilize GDP data to guide their monetary policy frameworks.

Role in Crisis Management and Recovery

During economic crises, GDP growth rates serve as critical indicators for assessing recovery efforts. Policy makers use these rates to evaluate the effectiveness of stimulus packages and other economic interventions. For instance, in response to the COVID-19 pandemic, many governments implemented significant fiscal measures aimed at revitalizing their economies. Monitoring GDP growth rates during recovery periods allows policy makers to adjust strategies based on observed outcomes.

Challenges in Interpreting GDP Growth Rates

Limitations of GDP as an Indicator

While GDP growth rates are widely used to assess economic performance, they have notable limitations that policy makers must consider. These limitations can lead to misinterpretations or incomplete assessments of economic health.

- Oversights in Economic Well-Being

GDP measures the total economic output but does not account for the distribution of income among residents of a country. A rising GDP may mask underlying issues such as income inequality, where the wealth generated from growth benefits only a small segment of the population. This lack of consideration for income distribution can lead policy makers to adopt strategies that do not address societal disparities. - Exclusion of Non-Market Transactions

GDP calculations typically exclude non-market transactions, such as household work and volunteer services. These contributions, while significant to societal well-being, do not enter formal economic metrics. As a result, rising GDP may not accurately reflect improvements in quality of life or community welfare. - Environmental Costs

Another critical limitation is that GDP growth does not account for environmental degradation or resource depletion. Economic activities that contribute to GDP can have detrimental effects on the environment, such as pollution and loss of biodiversity. This oversight can lead policy makers to prioritize short-term economic gains over long-term sustainability. For more on this topic, the United Nations Environment Programme (UNEP) provides insights into the disconnect between GDP growth and environmental health. - Influence of Informal Economy

In many countries, especially developing ones, a significant portion of economic activity occurs in the informal sector, which is not captured in official GDP statistics. This can result in an underestimation of the actual economic output and growth, leading policy makers to make decisions based on incomplete data. - Short-Term Focus

GDP growth rates are often reported on a quarterly basis, which can encourage a short-term focus among policy makers. This emphasis on immediate results may detract from considerations of long-term economic stability and growth, fostering policies that prioritize quick fixes over sustainable development.

Regional Disparities and Variations

Moreover, interpreting GDP growth rates requires careful consideration of regional disparities. Different areas within a country may experience varying growth rates due to local economic conditions, resource availability, and infrastructure development. Policy makers need to ensure that their strategies address these regional differences to promote balanced and inclusive economic growth.

Conclusion

Understanding GDP growth rates is essential for policy makers tasked with navigating the complexities of economic management. As a key indicator of economic health, GDP growth provides critical insights into the overall performance of a nation’s economy and informs a wide range of policy decisions.

Looking ahead, the role of GDP growth rates in future policy development will continue to be significant. As economies face new challenges—such as climate change, technological disruption, and shifting demographics—policy makers must adapt their strategies to ensure that growth is both inclusive and sustainable.

Integrating GDP growth rates with other indicators of well-being, such as environmental sustainability and social equity, will be essential for crafting policies that address both current and future economic challenges. This holistic approach can lead to more effective governance and improved outcomes for all citizens.

As policy makers engage with GDP data, it is imperative to adopt a comprehensive perspective that considers both the benefits and limitations of this key economic indicator. By doing so, they can cultivate an economic environment that not only drives growth but also prioritizes the welfare of society and the health of the planet.

For further exploration of how GDP growth rates can inform future policies, resources from the World Economic Forum and the International Monetary Fund (IMF) offer extensive insights and analyses.