The Consumer Confidence Index (CCI) is a vital economic indicator that reflects the overall sentiment of consumers regarding their financial health and the state of the economy. Developed by the Conference Board, the CCI is derived from a monthly survey that gauges consumer attitudes about current and future economic conditions. By measuring factors such as personal income, employment prospects, and overall economic outlook, the CCI provides valuable insights into consumer behavior.

For financial advisors, understanding the CCI is crucial for making informed market predictions and guiding investment strategies. A high consumer confidence level typically indicates that individuals are more willing to spend, which can drive economic growth and positively influence market performance. Conversely, a declining CCI may signal economic uncertainty, leading to reduced consumer spending and potential market downturns.

This article aims to explore the intricate relationship between the Consumer Confidence Index and market performance, providing financial advisors with actionable insights to better serve their clients. As we delve deeper, we’ll examine how changes in the CCI can serve as a predictive tool for assessing economic conditions and guiding investment decisions, ultimately enhancing your advisory practice.

The Consumer Confidence Index Explained

Components of the CCI

The Consumer Confidence Index is composed of two primary components: the Present Situation Index and the Expectations Index.

- Present Situation Index: This measures consumers’ perceptions of current economic conditions, including their assessment of job availability and personal financial situation. A strong Present Situation Index indicates that consumers feel secure in their current economic environment.

- Expectations Index: This reflects consumers’ outlook for the future, particularly regarding their financial prospects and general economic conditions over the next six months. A rising Expectations Index suggests that consumers anticipate better economic times ahead, which can lead to increased spending.

Methodology

The CCI is calculated based on responses from a monthly survey of approximately 3,000 households in the United States. Participants are asked questions about their current and future financial situations, including their views on job availability and overall economic prospects. The index is then derived from the percentage of respondents who answer positively, creating a composite score that ranges from 0 to 100. A score above 100 indicates greater consumer confidence compared to the base year (1985).

For more detailed insights on the methodology of the CCI, you can refer to the Conference Board’s official page.

Historical Context

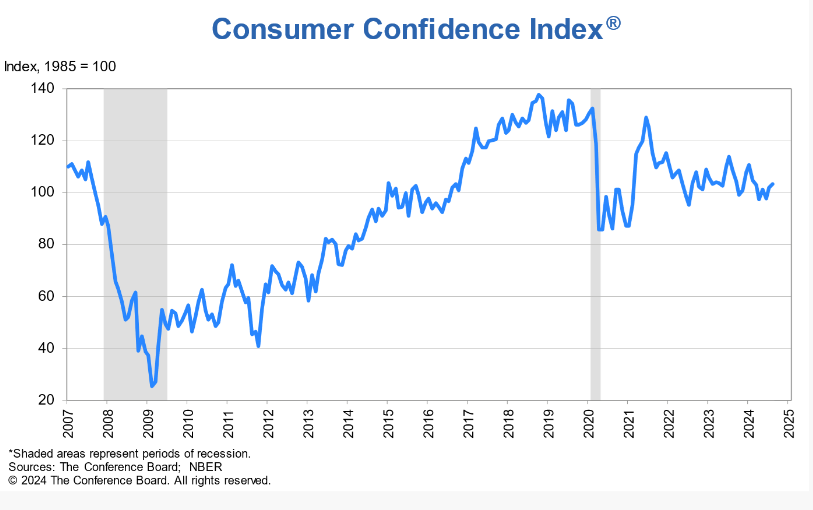

ince its inception in 1967, the CCI has become an essential tool for economists and financial analysts. It has played a significant role in understanding consumer behavior during key economic events, including recessions and recoveries. For instance, during the 2008 financial crisis, the CCI fell sharply, reflecting widespread consumer anxiety and a significant drop in spending. Conversely, in periods of economic expansion, such as post-recession recovery phases, the CCI typically rises, indicating increased consumer confidence and spending.

By examining historical trends in the CCI, financial advisors can better predict potential market movements and economic cycles. Understanding how consumer confidence has shifted in response to past events can provide valuable context for current market conditions.

The Relationship Between Consumer Confidence and Market Performance

Consumer Spending as a Driver of Economic Growth

Consumer spending is one of the most significant components of economic activity, accounting for approximately 70% of GDP in the United States. When consumers feel confident about their financial situation and the economy, they are more likely to spend money on goods and services. This increase in spending stimulates economic growth, leading to higher production levels, job creation, and overall market expansion.

The relationship between consumer confidence and spending is often cyclical. High levels of consumer confidence can lead to increased spending, which in turn supports businesses and can further boost confidence among consumers and investors alike. Conversely, when consumer confidence declines, spending typically contracts, which can trigger a slowdown in economic growth and negatively impact market performance.

Link to Stock Market Trends

Historically, there is a strong correlation between consumer confidence levels and stock market performance. When consumer confidence is high, investors may feel more optimistic about the future, leading to increased buying activity in the stock market. This can create a positive feedback loop, as rising stock prices further enhance consumer confidence, encouraging even more spending.

Conversely, a decline in consumer confidence can lead to bearish sentiment in the stock market. For example, during economic downturns or periods of uncertainty, such as the COVID-19 pandemic, consumer confidence plunged, and this was mirrored by substantial declines in stock market indices. Financial advisors need to pay close attention to CCI trends, as they can provide early warnings of potential market corrections.

Case Studies

2008 Financial Crisis: During this period, the CCI dropped significantly as consumers faced job losses and declining home values. The resulting decline in consumer spending contributed to a severe recession and a drastic fall in stock market indices.

Post-Pandemic Recovery: After the initial shock of the COVID-19 pandemic, consumer confidence rebounded as stimulus measures were introduced and vaccination rates increased. This resurgence in confidence was reflected in a robust recovery in stock markets, as consumers began to spend again, particularly in sectors like travel and hospitality.

Further Read: The Role of Business Investment in Economic Forecasting

Impact on Specific Sectors

Consumer Goods and Services

The consumer goods and services sector is directly influenced by changes in consumer confidence. When confidence is high, consumers are more willing to make discretionary purchases, such as electronics, clothing, and dining out. Retailers often report increased sales during periods of high consumer confidence, leading to higher revenues and stock prices.

For instance, during times of economic prosperity, companies like Amazon and Walmart typically see significant increases in sales as consumers feel secure in their financial situations. Conversely, during downturns, these companies may experience declines in sales, as consumers prioritize essential goods and cut back on non-essential spending.

Housing Market

The housing market is another critical area affected by consumer confidence. When consumers feel optimistic about their financial future, they are more likely to invest in real estate, leading to increased home sales and rising property values. This not only stimulates the construction industry but also impacts related sectors like home furnishings and appliances.

For example, after the initial shock of the COVID-19 pandemic, consumer confidence rebounded, leading to a surge in home purchases and a competitive housing market. The National Association of Realtors reported that existing-home sales increased significantly as buyers rushed to take advantage of low mortgage rates and favorable market conditions.

You can refer to the National Association of Realtors for more insights on housing market trends and how they relate to consumer confidence.

Financial Markets

Consumer confidence also plays a vital role in the financial markets, particularly in banking and investment sectors. High consumer confidence typically leads to increased borrowing and spending, which can drive demand for loans and credit products. Banks may see growth in mortgages, personal loans, and credit card usage when consumers feel secure about their ability to repay debt.

In contrast, a decline in consumer confidence can lead to increased defaults on loans and a tightening of credit availability, affecting the overall financial stability of institutions. Financial advisors should monitor the CCI closely, as changes can signal shifts in borrowing behavior that may influence investment strategies.

You can also Read: What is a Chartered Financial Analyst

Predictive Analysis

Using the CCI for Market Predictions

Financial advisors can use the Consumer Confidence Index (CCI) as a predictive tool to gauge potential market trends and shifts in economic conditions. By analyzing the CCI data alongside other economic indicators, advisors can develop a more comprehensive understanding of where the economy may be headed.

When consumer confidence is rising, it often signals that consumers are more likely to increase their spending. Financial advisors can interpret this as a positive economic signal, suggesting that markets may experience upward trends. Conversely, a declining CCI may indicate a forthcoming slowdown, prompting advisors to reassess their investment strategies and advise clients accordingly.

Integration with Other Economic Indicators

To enhance the predictive power of the CCI, it’s essential to integrate it with other economic indicators. Key indicators to consider include:

- Gross Domestic Product (GDP): A rising CCI often correlates with increasing GDP, indicating robust economic growth. Financial advisors can use GDP forecasts alongside the CCI to make informed predictions about market performance.

- Unemployment Rates: Lower unemployment rates typically boost consumer confidence. By monitoring changes in unemployment alongside the CCI, advisors can gain insights into labor market health and its potential impact on consumer spending.

- Inflation Rates: High inflation can erode consumer purchasing power, potentially leading to decreased consumer confidence. Advisors should monitor inflation trends to better understand how they may affect the CCI and overall market performance.

Strategies for Financial Advisors

Communicating Insights to Clients

For financial advisors, effectively conveying the significance of the Consumer Confidence Index (CCI) to clients is crucial. Clients may not fully understand how consumer sentiment affects their investment portfolios or the broader market. Therefore, advisors should take the time to explain the CCI in straightforward terms, highlighting its role as a barometer of economic health.

- Educational Materials: Create brochures or presentations that outline what the CCI is, how it is calculated, and its historical implications. Provide real-world examples of how changes in consumer confidence have impacted market conditions in the past.

- Regular Updates: Incorporate CCI data into regular performance reviews or newsletters. This keeps clients informed about current economic conditions and how these may influence their investments.

- Personalized Discussions: During client meetings, refer to the CCI when discussing market trends. Tailor the conversation to how current consumer sentiment may specifically affect the sectors or stocks in which the client is invested.

Further Read: The Role of Currency Exchange Rates in Economic Forecasting

Incorporating Consumer Confidence Index into Investment Strategies

Advisors can leverage the CCI to develop proactive investment strategies. Here are some actionable steps:

- Sector Rotation: When consumer confidence is high, consider increasing exposure to cyclical sectors such as consumer discretionary, technology, and industrials, which tend to perform well during economic expansions. Conversely, during periods of declining confidence, it may be prudent to shift investments toward defensive sectors like utilities and healthcare.

- Risk Assessment: Use the CCI as part of a broader risk management strategy. If consumer confidence starts to decline, reassess portfolio risk levels and consider reallocating assets to mitigate potential losses.

- Client-Specific Strategies: Develop tailored investment strategies that consider individual client risk tolerance and financial goals. For example, younger clients may benefit from a more aggressive approach during periods of high consumer confidence, while retirees may prefer more conservative investments during uncertain times.

Monitoring Trends

Continuous monitoring of the CCI and related economic indicators is essential for informed decision-making. Advisors should establish a routine for reviewing these metrics:

- Weekly or Monthly Check-Ins: Set a schedule for regularly reviewing the CCI and other economic indicators. This could be part of a weekly market briefing or monthly performance review.

- Utilizing Technology: Leverage financial software and market analysis tools that incorporate CCI data and other economic indicators to stay updated on market conditions and consumer sentiment.

- Staying Informed: Subscribe to financial news outlets, economic reports, and industry analyses that provide insights into consumer confidence trends and their implications for the market.

Limitations and Considerations of Consumer Confidence Index

Challenges in Interpretation

While the Consumer Confidence Index (CCI) is a valuable tool for understanding consumer sentiment, it is not without limitations. Financial advisors must be aware of potential challenges in interpreting the CCI data effectively:

- Short-Term Fluctuations: The CCI can exhibit short-term volatility based on transient factors such as seasonal changes, political events, or temporary economic disruptions. Advisors should be cautious not to overreact to sudden shifts in the index, as these may not reflect long-term trends.

- Cultural and Demographic Bias: The CCI is based on a survey of a sample population, meaning it may not fully capture the sentiments of all consumer demographics. Variations in responses across different age groups, income levels, and regions can lead to skewed interpretations. Advisors should consider these factors when evaluating the CCI’s implications for their clients’ investments.

- Lagging Indicator: The CCI is often considered a lagging indicator, meaning it typically reflects past sentiments rather than predicting future trends. While rising consumer confidence may correlate with economic growth, there can be a time lag before these changes translate into actual spending behaviors. Advisors should use the CCI in conjunction with leading indicators to form a more comprehensive market outlook.

Market Sentiment vs. Reality

Another critical consideration is the potential disconnect between consumer confidence and actual economic performance. High consumer confidence does not always guarantee economic growth; it may be influenced by factors that do not translate into spending. For example:

- Inflationary Pressures: If inflation is rising, consumers may feel confident about the economy but may also be concerned about their purchasing power. This could result in an increase in consumer confidence without a corresponding rise in spending.

- Psychological Factors: Consumer sentiment can be influenced by psychological factors, such as media portrayal of the economy or political climate, rather than concrete economic data. Advisors should remain vigilant about these influences when analyzing the CCI.

- Behavioral Economics: Understanding the psychological biases that can affect consumer decisions is crucial. Factors like herd behavior or over-optimism can skew consumer confidence, leading to potential market miscalculations.

Also Read: Why Retail Sales Figures Are a Leading Economic Indicator

Conclusion

The Consumer Confidence Index (CCI) is a powerful tool for financial advisors seeking to understand consumer sentiment and its implications for market performance. By analyzing the CCI alongside other economic indicators, advisors can gain valuable insights into potential market trends, enabling them to make informed investment decisions and provide tailored advice to their clients.

Throughout this article, we’ve explored the various components of the CCI, its relationship with consumer spending and market performance, and the specific sectors impacted by changes in consumer confidence. Additionally, we discussed how to effectively communicate these insights to clients and integrate the CCI into investment strategies.

However, it’s essential to remember the limitations of the CCI, including its potential for short-term fluctuations, cultural biases, and its role as a lagging indicator. By being aware of these challenges and considering the broader economic context, advisors can mitigate risks and enhance their predictive capabilities.

In an ever-changing economic landscape, staying attuned to consumer sentiment is crucial. By leveraging the insights provided by the CCI, financial advisors can navigate market complexities more effectively, ultimately leading to better outcomes for their clients. As consumer behavior continues to evolve, maintaining a proactive approach to analyzing the CCI will empower advisors to adapt their strategies and make informed recommendations.