The Multi-Chain Reality Has Fractured DeFi

Let’s face it: DeFi liquidity is trapped. Over 100 blockchains and L2s exist today, but they operate as isolated islands. This fragmentation stifles innovation—developers can’t leverage combined assets or functionalities across chains. Worse, traditional bridges have hemorrhaged significant value from exploits, exposing a critical security crisis. For DeFi to evolve, we need secure, seamless interoperability.

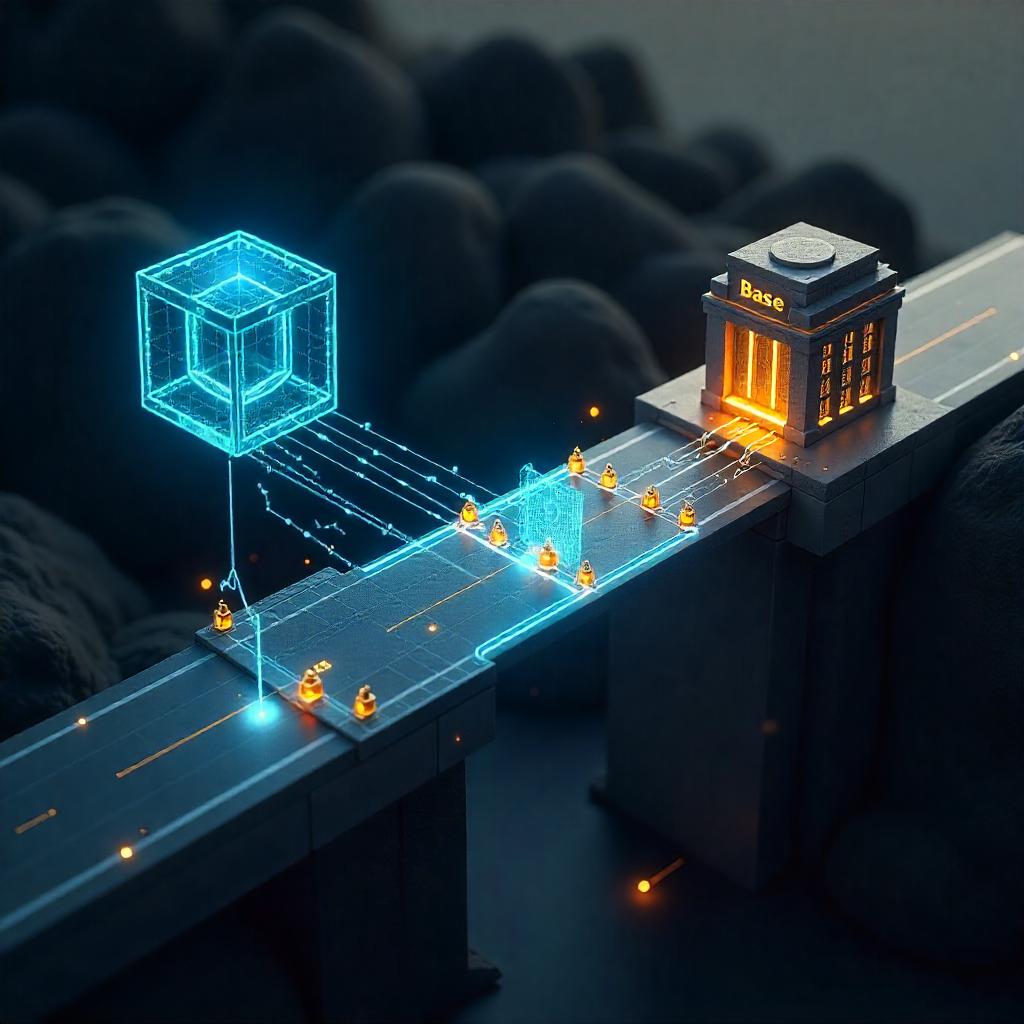

Enter Chainlink CCIP: The TCP/IP of Web3

Chainlink’s Cross-Chain Interoperability Protocol isn’t just another bridge. It’s a standardized communication layer—akin to TCP/IP in early internet—built on infrastructure securing massive transaction value. CCIP launched on Base, Coinbase’s Ethereum L2, marking a strategic leap toward unified cross-chain DeFi.

Why Base? The Perfect Cross-Chain Hub

Base isn’t “just another L2.” Its architecture delivers:

Mass onboarding: Native Coinbase integrations target millions of users and institutional fiat ramps.

Zero-friction scaling: Fast blocks and near-zero fees enable microtransactions impossible on Ethereum L1.

Chainlink SCALE synergy: Base subsidizes oracle costs, ensuring sustainable data access for dApps.

By merging CCIP’s security with Base’s scalability, developers finally have a trusted pipeline to build cross-chain applications that don’t sacrifice safety for composability.

The Stakes: Trillions in Real-World Assets

This integration isn’t just technical—it’s economic. Experiments with major financial institutions are piloting CCIP to move tokenized assets between private and public chains. Success means funneling institutional capital into DeFi, turning Base into a real-world asset gateway.

Chainlink CCIP & Base: Technical Synergies

CCIP’s Core Capabilities: Beyond Basic Bridging

CCIP transforms cross-chain development with three foundational features:

Arbitrary Messaging: Send any data between chains. Example: Trigger Ethereum-based DAO votes from a Base dApp in one transaction.

Simplified Token Transfers: Pre-deployed liquidity pools enable zero-slippage transfers. Developers set custom rate limits per token to cap exploit damage.

Programmable Token Transfers: Bundle tokens + instructions atomically. This moves beyond “dumb bridges” into orchestrated cross-chain actions.

Base’s Infrastructure: The Performance Multiplier

Base amplifies CCIP’s utility through:

Sub-Second Finality: Rapid block times process cross-chain messages faster than Ethereum L1.

Gas Efficiency: Ultra-low transaction costs—critical for high-frequency cross-chain operations.

Chainlink SCALE Integration: Base covers oracle gas fees, slashing dApp operating costs significantly.

Developer Impact

Solidity code examples demonstrate simplified CCIP execution on Base, enabling developers to send destinationChainId, receiver addresses, and encoded function calls in streamlined workflows.

The Coinbase Ecosystem Advantage

Base’s native integrations unlock unique benefits:

Fiat Onramps: Convert USD to USDC on Coinbase to Base in under 60 seconds.

Massive User Base: Tap into a vast KYC’d user base for instant dApp distribution.

Regulatory Clarity: Public compliance frameworks reduce regulatory uncertainty.

Real-World Impact

Financial infrastructure experiments use Base as the public-chain endpoint for moving tokenized assets from private ledgers. This demands Base’s enterprise-grade throughput.

Security Architecture: Mitigating Cross-Chain Risks

The Bridge Problem: Why Security Can’t Be an Afterthought

Cross-chain exploits have drained more value than most DeFi hacks combined. Standard bridges fail because they’re single points of failure. CCIP rethinks security from the ground up with a defense-in-depth approach.

CCIP’s Security Stack: Four-Layered Protection

Risk Management Network: Independent node network monitors every cross-chain message and automatically pauses transactions if anomalies appear.

Decentralized Oracle Networks: Leverages Chainlink’s existing oracle network securing billions in DeFi TVL with no new trust assumptions.

Timelocked Upgrades: Protocol changes require multi-day timelocks with community multisig veto power, preventing emergency upgrade risks.

Rate Limits: Token-specific transfer caps contain bridge-drain scenarios, with hardcoded ceilings even if admin keys compromise.

Security Benchmarks: CCIP vs. Alternatives

Comparative tables highlight CCIP’s superiority in anomaly detection, fee stability, upgrade mechanisms, and transfer safety versus standard bridges.

Why This Matters for Base Developers

When financial institutions tested CCIP for bank-to-blockchain asset transfers, they demanded cryptographic proof validity, sub-second exploit response, and audit trails. CCIP delivered all three—making Base the only L2 meeting institutional security standards.

Use Cases: Transforming DeFi on Base

Breaking Chains: From Fragmented Silos to Unified Liquidity

CCIP turns Base into a cross-chain command center. Developers now build applications leveraging assets and logic across multiple chains in a single transaction.

Institutional-Grade Applications

Cross-Chain Collateralization: Deposit ETH on Ethereum, borrow USDC on Base atomically. Live implementations let users collateralize L1 assets for L2 loans without manual bridging.

Tokenized Real-World Assets: Major bank pilots use CCIP to tokenize assets on private ledgers, bridge them to Base for trading, and maintain regulatory audit trails. Base’s compliance frameworks satisfy institutional legal requirements.

DeFi Innovations

Cross-Chain Liquid Staking: Bridge staked assets from Ethereum to Base in one transaction and auto-deposit into lending markets, earning multiple yields without liquidity fragmentation.

Unified Governance: DAOs execute gas-efficient voting on low-cost Base while counting votes on Ethereum mainnet, slashing governance costs dramatically.

NFT Interoperability: Mint NFTs on Ethereum and use them in Base-based games/metaverses via CCIP’s arbitrary messaging for ownership verification.

The Base Advantage: Speed + Cost

Comparative cost tables demonstrate actions like transferring and staking USDC or executing cross-chain votes cost fractions of a cent on Base via CCIP versus dollars on Ethereum L1. Projects leverage this for cross-chain arbitrage, capturing MEV opportunities impossible on L1.

Developer Workflow: Building Cross-Chain dApps on Base

From Concept to Cross-Chain Deployment

Chainlink CCIP on Base transforms cross-chain development from a security nightmare into a streamlined process. With audited contracts and standardized tooling, developers deploy interoperable dApps in hours instead of months.

Core Building Blocks

Simplified Token Transfers: Deploy Cross-Chain Tokens in minutes using pre-audited token pools while maintaining full control over rate limits and liquidity configurations.

Arbitrary Messaging: Send any data payload cross-chain. Practical implementations have cut governance costs by over 70%.

Programmable Token Transfers: Bundle tokens with function calls atomically. Burn-and-mint models leverage this for capital efficiency.

Fee Management & Optimization

CCIP introduces gas predictability:

LINK Payments offer significant discounts versus native gas tokens for cost-efficient high-frequency operations.

Smart Execution locks gas costs at send time, preventing failed transactions from gas spikes.

Security Best Practices

Cap daily token transfers with configurable ceilings.

Subscribe to Risk Management Network anomaly notifications.

Track pending protocol upgrades via CCIP dashboard.

Real-World Implementation

Cross-chain arbitrage systems combine all three capabilities: detecting yield opportunities on other chains, transferring assets via CCIP to Base in under a minute, and executing trades with substantial monthly savings versus traditional bridges.

Debugging Pro Tips

Use simulation tools to test cross-chain paths on Base testnet. Monitor specific transaction status codes indicating success, paused transactions, or rate limit breaches.

Early Adoption & Ecosystem Growth

Live Projects Pioneering the CCIP-Base Integration

The marriage isn’t theoretical—it’s operational. Leading DeFi projects solve real-world fragmentation:

Decentralized stablecoin protocols enable zero-slippage collateral movements between Base and Ethereum.

Cross-chain arbitrage platforms detect yield opportunities, bridge assets in seconds, and save thousands monthly.

Major synthetic asset platforms implement burn-and-mint models for cross-chain synth transfers, eliminating wrapped asset risks.

Lending protocols and NFT-driven games build cross-chain functionality atop Base using programmable token transfers.

Quantitative Traction Signals

Significant daily CCIP revenue pre-permissionless launch.

Over a thousand developers tested CCIP on testnets in early 2024.

Hundreds of millions in TVL migrated to CCIP via major bridge replacements.

Expanding the Cross-Chain Corridor

CCIP’s upgrade unlocked non-EVM compatibility, with Solana becoming the first SVM chain to integrate. This connects Base to billions in assets across dozens of chains, including Solana-native tokens.

Institutional Pipeline Acceleration

Financial messaging experiments with global banks use CCIP to move tokenized assets from private ledgers to Base. This positions Base as the public-chain endpoint for institutional real-world assets—a gateway for trillions in traditional finance value.

The Cross-Chain Era Begins

Base Transforms from L2 to Cross-Chain Orchestrator

CCIP’s integration marks a fundamental shift: Base becomes a secure hub for cross-chain innovation. By merging battle-tested security with low-cost scalability, developers bypass the bridge exploit graveyard to build truly interconnected applications.

The Institutional Onramp Accelerates

Tokenized assets move from private ledgers to Base via banking pipelines—positioning it as the public-chain entry point.

Regulatory frameworks give Base an edge in hosting tokenized stocks, bonds, and commodities, potentially funneling trillions into DeFi.

Next-Generation Technical Frontiers

Non-EVM Expansion: Solana support connects Base to billions in SVM-chain assets, enabling cross-chain DEX aggregation.

Enhanced Programmability: “Cross-chain smart accounts” could let users manage Ethereum assets via Base-based wallets, reducing gas costs by 90%+.

Zero-Knowledge Proofs: Early discussions indicate potential integration for private cross-chain settlements.

Call to Action for DeFi Developers

Testnet Deployment: Experiment with Arbitrary Messaging on Base testnet and simulate attacks to stress-test rate limits.

Grants & Incentives: Access Base’s multimillion-dollar ecosystem fund for CCIP-based projects and apply for developer programs for prioritized oracle access.

Production Launch: Deploy Cross-Chain Tokens in minutes and subscribe to real-time threat monitoring alerts.

Final Take

CCIP turns Base into Web3’s TCP/IP layer—where security isn’t sacrificed for interoperability. This unlocks trillions in tokenized assets by merging traditional finance reliability with DeFi innovation. The cross-chain future isn’t coming; it’s live on Base.