Introduction

Bitcoin mining has evolved from a niche hobby into a major industry, attracting a diverse range of participants from casual enthusiasts to professional miners. As Bitcoin’s value and the complexity of its network continue to grow, understanding the profitability of mining operations has become increasingly crucial for anyone involved in the space.

Evaluating the potential profitability of Bitcoin mining involves more than just considering the price of Bitcoin. It requires a nuanced analysis of several interrelated factors, including the current mining difficulty, the efficiency of your mining hardware, electricity costs, and the fluctuating market price of Bitcoin. Each of these elements plays a significant role in determining whether a mining operation will be profitable or if it may lead to financial losses.

In this comprehensive guide, we’ll delve into the key metrics and calculations needed to assess Bitcoin mining profitability. We’ll explore how to gather the necessary data, use mining profitability calculators, and perform manual calculations to gain a clear understanding of your potential returns. Whether you’re considering starting a new mining venture or optimizing an existing setup, this guide will equip you with the knowledge to make informed decisions and enhance your mining strategy.

Key Metrics for Profitability Analysis

Evaluating Bitcoin mining profitability involves analyzing several key metrics. Each of these metrics provides insight into different aspects of your mining operation and contributes to an overall understanding of potential profitability. Here’s a breakdown of the most important metrics to consider:

Bitcoin Difficulty

Definition: Bitcoin difficulty refers to how challenging it is to find a new block in the Bitcoin blockchain. It adjusts approximately every two weeks to ensure that blocks are mined roughly every 10 minutes, regardless of the total computational power of the network.

Impact on Profitability: As more miners join the network and the collective computational power increases, the difficulty level rises. Higher difficulty means that miners need more computational power to solve the cryptographic puzzles required to mine a block, which can decrease profitability. Conversely, lower difficulty can improve profitability if other factors remain constant.

Hash Rate

Definition: Hash rate is the measure of computational power used in Bitcoin mining. It indicates how many hashes (or calculations) your mining hardware can perform per second.

Impact on Profitability: A higher hash rate increases the likelihood of solving the cryptographic puzzle first and earning Bitcoin rewards. However, higher hash rates often require more advanced (and expensive) hardware and increased electricity consumption. Balancing hash rate with efficiency is crucial for maximizing profitability.

Electricity Costs

Definition: Electricity costs are the expenses associated with powering your mining equipment. This can vary widely depending on your location and the energy efficiency of your mining hardware.

Impact on Profitability: Electricity is one of the largest operational costs in Bitcoin mining. High electricity costs can significantly erode your mining profits. Efficient mining hardware and lower electricity rates can help improve overall profitability. It’s essential to calculate and monitor electricity costs closely to ensure they don’t outweigh the benefits of mining.

Bitcoin Price

Definition: The Bitcoin price is the market value of one Bitcoin, which fluctuates based on supply, demand, and market sentiment.

Impact on Profitability: The price of Bitcoin directly affects your mining profitability. A higher Bitcoin price increases the value of the rewards you receive from mining. However, Bitcoin’s price is highly volatile, which can lead to fluctuations in profitability. Keeping track of market trends and price forecasts can help you make better decisions about when to mine or invest in mining operations.

Calculating Mining Profitability

To determine the profitability of Bitcoin mining, you’ll need to perform calculations that take into account various factors such as mining difficulty, hash rate, electricity costs, and Bitcoin price. This section will guide you through a step-by-step process for calculating your potential returns, including both manual calculations and using online tools.

Step-by-Step Guide to Calculation

1. Gather Necessary Data

Before you start your calculations, collect the following information:

- Current Bitcoin Difficulty: This can be found on various cryptocurrency tracking websites or directly from mining pool statistics.

- Hash Rate: The hash rate of your mining hardware, which can be found in the hardware specifications or mining software.

- Electricity Costs: Your local electricity rate, typically measured in cents or dollars per kilowatt-hour (kWh).

- Bitcoin Price: The current market price of Bitcoin, which can be found on cryptocurrency exchanges or financial news websites.

2. Use Mining Profitability Calculators

There are several online mining profitability calculators that simplify the process of calculating your potential returns. Popular tools include:

- WhatToMine: A widely used calculator that provides estimates based on various hardware and electricity costs.

- CryptoCompare: Offers detailed calculations and allows you to compare different mining setups.

- NiceHash Profitability Calculator: Provides estimates based on hash rate and electricity costs.

Example:

- Enter your hardware hash rate.

- Input your electricity cost per kWh.

- Specify your local Bitcoin difficulty and current Bitcoin price.

- The calculator will provide an estimate of daily, monthly, and yearly profitability.

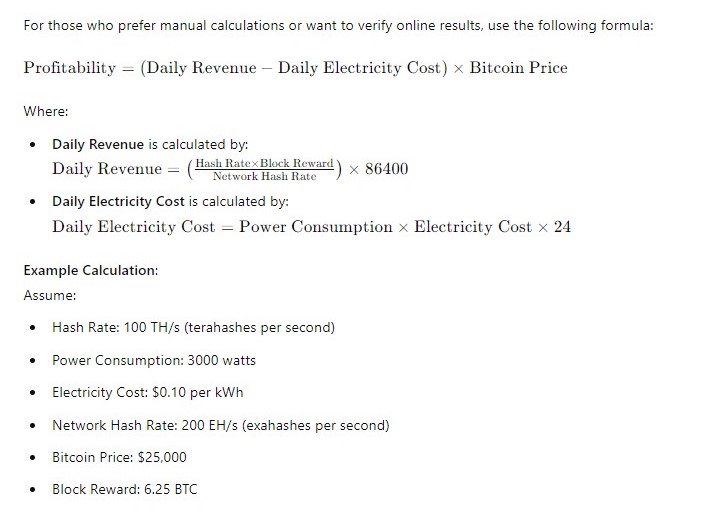

Calculate:

- Daily Revenue

- Daily Electricity Cost

Subtract the Daily Electricity Cost from the Daily Revenue and multiply by the Bitcoin Price to get the profitability.

Example Calculation with Real-World Data

To provide a concrete example, let’s assume the following data:

- Hash Rate: 100 TH/s

- Power Consumption: 3000 watts

- Electricity Cost: $0.10 per kWh

- Network Hash Rate: 200 EH/s

- Bitcoin Price: $25,000

- Block Reward: 6.25 BTC

Factors Affecting Profitability

Understanding the key factors that influence Bitcoin mining profitability is essential for optimizing your mining operations. Several elements can significantly impact your returns, including hardware efficiency, electricity rates, network difficulty, and Bitcoin price volatility. Here’s an in-depth look at these critical factors:

Hardware Efficiency

Definition: Hardware efficiency refers to how effectively your mining equipment performs relative to its power consumption. More efficient hardware can generate more hashes per unit of energy, leading to better profitability.

Impact on Profitability:

- Performance: Higher efficiency hardware generally has a higher hash rate and lower power consumption, which can improve profitability.

- Initial Investment: Efficient mining equipment often comes with a higher upfront cost. Weighing this cost against potential returns is crucial.

- Example: ASIC miners are typically more efficient than GPUs, providing higher hash rates with lower power consumption.

Electricity Rates

Definition: Electricity rates refer to the cost per kilowatt-hour (kWh) of electricity, which varies by location and provider.

Impact on Profitability:

- Cost Proportion: Electricity is one of the largest operational expenses in mining. Lower electricity rates can significantly enhance profitability.

- Regional Variations: Electricity costs can vary widely, making it important to consider regional differences when planning mining operations.

- Strategies: Some miners opt to relocate their operations to areas with cheaper electricity or use renewable energy sources to reduce costs.

Network Difficulty Changes

Definition: Network difficulty is a measure of how challenging it is to mine a new Bitcoin block. It adjusts approximately every two weeks based on the total computational power of the network.

Impact on Profitability:

- Increasing Difficulty: As more miners join the network, the difficulty increases, making it harder to solve blocks and earn rewards. This can decrease profitability if your hardware doesn’t keep up with the changes.

- Decreasing Difficulty: Conversely, if difficulty decreases, mining becomes easier, potentially increasing profitability. However, this is often a temporary condition and can change rapidly.

Bitcoin Price Volatility

Definition: Bitcoin price volatility refers to the fluctuations in the market value of Bitcoin.

Impact on Profitability:

- Price Fluctuations: Bitcoin’s price can be highly volatile, which means mining profitability can vary significantly. A sudden drop in Bitcoin price can impact your returns, even if your mining operation is efficient.

- Long-Term Trends: While short-term volatility can affect profitability, long-term trends and price movements are more relevant for assessing overall profitability. Keeping track of market trends can help in making informed decisions about mining investments.

Tools and Resources for Evaluating Profitability

To accurately evaluate Bitcoin mining profitability, leveraging various tools and resources can streamline the process and provide valuable insights. Here’s an overview of some of the most useful tools and resources available for assessing mining profitability:

Online Profitability Calculators

Online calculators simplify the process of determining mining profitability by incorporating real-time data and automated calculations. Here are a few popular options:

- WhatToMine

- Features: Allows users to input their hardware specifications, electricity costs, and location to calculate potential profits for various cryptocurrencies, including Bitcoin.

- Website: WhatToMine

- CryptoCompare

- Features: Provides detailed profitability calculations based on hardware hash rate, electricity costs, and network difficulty. Users can compare different mining setups and see potential returns.

- Website: CryptoCompare

- NiceHash Profitability Calculator

- Features: Offers estimates based on hash rate and electricity costs. It includes options to compare various mining hardware and see potential earnings.

- Website: NiceHash Calculator

Software Solutions

Several software solutions offer built-in tools for profitability analysis, allowing miners to monitor and optimize their operations:

- CGMiner

- Features: A popular mining software that includes features for performance monitoring and profitability analysis.

- Website: CGMiner

- BFGMiner

- Features: Similar to CGMiner, BFGMiner provides detailed information about mining performance and profitability.

- Website: BFGMiner

- MinerGate

- Features: Provides an easy-to-use interface for monitoring mining operations and profitability across different cryptocurrencies.

Community and Forums

Engaging with the cryptocurrency mining community can provide valuable insights and real-world experiences. Here are some resources to consider:

- BitcoinTalk Forum

- Features: A large forum where miners discuss hardware, software, and profitability. It’s a valuable resource for up-to-date information and troubleshooting tips.

- Website: BitcoinTalk

- Reddit Mining Subreddits

- Features: Subreddits like r/BitcoinMining and r/CryptoCurrency offer discussions and advice on mining profitability, hardware recommendations, and market trends.

- Website: r/BitcoinMining | r/CryptoCurrency

- Mining Hardware Reviews

- Features: Websites that offer reviews and comparisons of mining hardware can help you choose the best equipment for profitability.

- Examples: ASIC Miner Value | Mining Pool Stats

Research and Analysis Tools

For a more detailed analysis of mining profitability, consider using these research tools:

- Blockchain Explorers

- Features: Tools like Blockchain.com and Blockchair allow you to explore transaction data and network statistics, which can inform profitability calculations.

- Economic and Market Analysis

- Features: Platforms such as CoinMarketCap and CoinGecko provide market data and price trends that are crucial for evaluating the impact of Bitcoin price on profitability.

Strategies to Improve Profitability

Enhancing the profitability of Bitcoin mining involves optimizing various aspects of your mining operation. By implementing effective strategies, you can maximize returns and minimize costs. Here are some key strategies to consider for improving your mining profitability:

Optimizing Mining Setup

1. Choose Efficient Hardware

- Invest in Modern ASIC Miners: Modern ASIC (Application-Specific Integrated Circuit) miners offer higher hash rates and better energy efficiency compared to older models or GPUs. Select hardware with a high hash rate-to-power consumption ratio.

- Regular Upgrades: Periodically upgrade your hardware to keep pace with advancements in mining technology. This can improve performance and efficiency.

2. Enhance Cooling Solutions

- Effective Cooling Systems: Implement advanced cooling solutions, such as industrial fans or air conditioning, to maintain optimal operating temperatures and extend the life of your hardware.

- DIY Cooling: For smaller setups, consider DIY cooling solutions such as custom ventilation systems or liquid cooling.

Reducing Costs

1. Lower Electricity Costs

- Time-of-Use Rates: Take advantage of time-of-use electricity rates by mining during off-peak hours when electricity prices are lower.

- Negotiate with Providers: If possible, negotiate with your electricity provider for better rates or consider switching to a provider offering lower rates.

2. Use Renewable Energy

- Solar Power: Install solar panels to reduce reliance on grid electricity and lower energy costs in the long run.

- Wind Power: In areas with consistent wind, wind turbines can be an effective way to generate electricity for mining.

Conclusion

Bitcoin mining can be a rewarding endeavor when approached with careful planning and strategic execution. The dynamic nature of the cryptocurrency market requires miners to be adaptable and proactive. By continuously monitoring performance, optimizing setups, and staying informed about market developments, miners can enhance their profitability and achieve their financial goals.

Remember that profitability is not guaranteed and can fluctuate based on various factors. Conduct thorough research, use the right tools, and consider both short-term and long-term strategies to maximize your chances of success in the competitive world of Bitcoin mining.

As you move forward with your mining operations, keep these insights and strategies in mind to navigate the challenges and opportunities that lie ahead. Whether you’re a seasoned miner or just starting, a well-informed approach will help you make the most of your investment and efforts in Bitcoin mining.