The Urgent Shift Toward Sustainable Bitcoin Mining

Bitcoin mining consumes ~127 TWh annually—more than Norway’s total energy use. This alarms ESG investors. Emissions per transaction rival 1,600 gasoline-car miles. But Green Bitcoin mining is rewriting this narrative. The crypto industry faces unprecedented pressure from institutional investors demanding verifiable sustainability metrics. Regulatory bodies now require detailed environmental impact disclosures for digital asset operations. Global initiatives like the Crypto Climate Accord aim for net-zero emissions by 2040. Ripplecoin’s breakthrough comes at this critical inflection point. Their technological innovations could redefine industry standards.

The Climate Toll

Traditional mining’s carbon footprint is unsustainable. 46% of global mining emissions come from U.S. coal plants. Electronic waste hits 38,000 tons yearly. BlackRock now excludes non-green miners from ESG funds. The pressure for change is institutional, not ideological. Mining operations consume enough electricity to power entire nations like Argentina. This energy intensity creates significant reputational risks for investors. Climate-focused shareholder groups now target crypto holdings in pension funds. Recent IPCC reports specifically mention cryptocurrency mining as a growing emissions source. The financial sector responds with stricter sustainability screens.

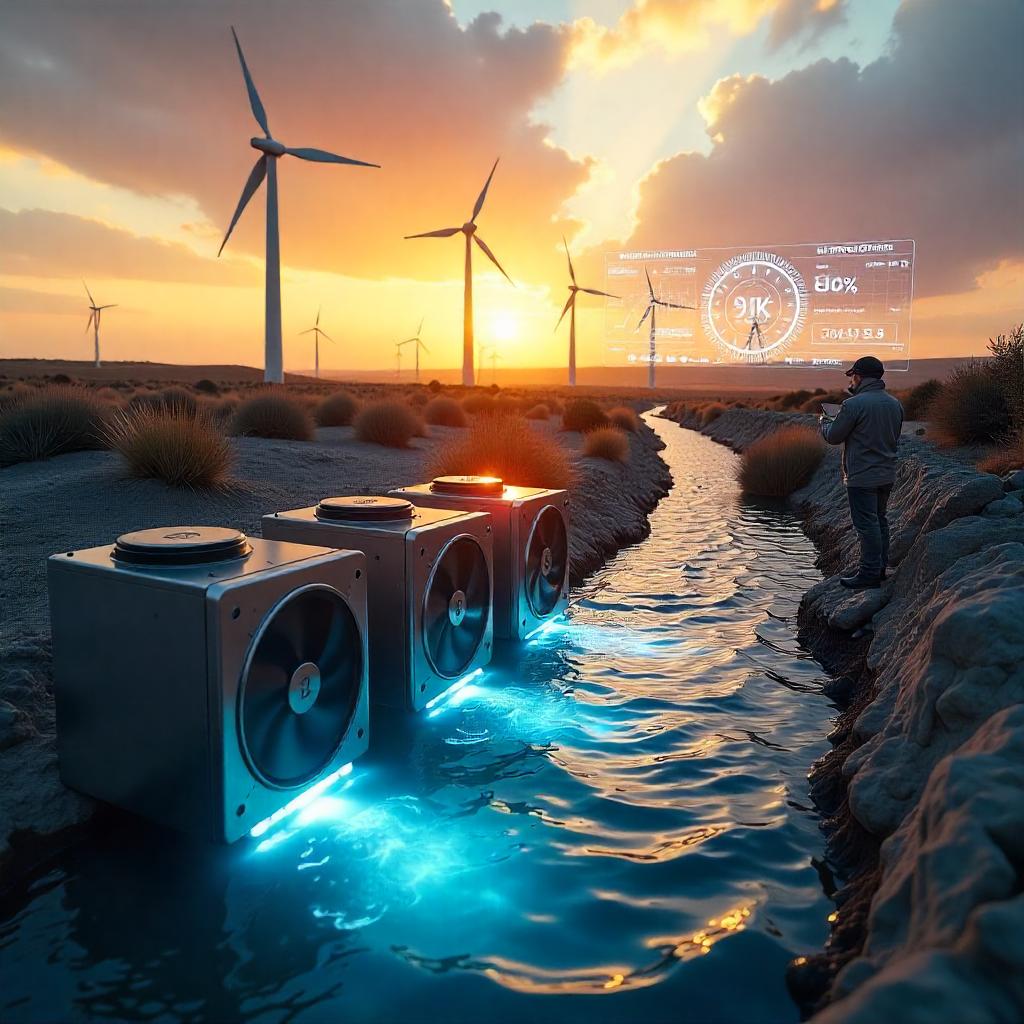

Ripplecoin’s Counterstrike

In 2024, Ripplecoin Mining launched a radical solution: AI-powered renewable nodes. These leverage stranded energy—excess solar/wind that grids discard. Their goal? Carbon-neutral operations by 2030. This isn’t carbon offsets. It’s structural transformation. The company established strategic partnerships with renewable energy providers across three continents. Their proprietary technology dynamically allocates computing resources based on real-time energy availability. This prevents renewable energy wastage during production peaks. Ripplecoin’s infrastructure investments exceed $200 million since 2023. They’ve deployed specialized hardware optimized for intermittent power supply environments.

Why ESG Investors Care

Green Bitcoin mining cuts costs 40-65% versus fossil-fueled rivals. It also future-proofs against EU’s MiCA regulations (effective 2025). Sustainalytics rates Ripplecoin “Low Risk,” unlocking $9B in green capital. Profit and planet finally align. Energy represents 60-80% of mining operational expenses. Renewable sources offer price stability compared to volatile fossil fuels. ESG-aligned miners experience lower capital costs through green bonds. The Global Sustainable Investment Alliance reports $35 trillion in ESG assets under management worldwide. Ripplecoin’s model taps into this massive capital pool. Their transparency dashboard provides real-time sustainability metrics to investors.

We turn energy waste into digital gold, states Ripplecoin’s 2025 manifesto. Their Texas wind-powered nodes already prevent 12,000 tons of monthly grid waste. Green Bitcoin mining shifts from niche to necessity. The company’s carbon-negative facilities in Iceland demonstrate true innovation. Geothermal plants there provide constant baseload power without emissions. Ripplecoin recaptures waste heat for community heating systems. This creates additional revenue streams while reducing environmental impact. Their circular economy approach sets a new industry benchmark.

The Dirty Truth: Bitcoin Mining’s Environmental Toll

Bitcoin’s energy hunger is staggering. Each transaction emits ~825kg of CO₂. That equals driving 1,600 miles in a gas car. For ESG investors, this isn’t abstract. It’s a portfolio risk. The Cambridge Bitcoin Electricity Consumption Index shows mining consumes 0.55% of global electricity. This exceeds the usage of entire countries like Sweden. Network difficulty increases compound energy demands annually. The environmental burden grows as Bitcoin adoption expands. Institutional investors face fiduciary duty concerns regarding these externalities.

Carbon Hotspots

46% of global mining emissions originate in the U.S. Coal powers 35% of Texas mining operations. Kazakhstan’s coal-reliant mines add 22%. Even renewable-rich regions struggle. Norway’s mining emits 581g CO₂/kWh—despite 98% hydro power—due to hardware manufacturing and transport. Seasonal hydro variations force Norwegian miners to use diesel backups during dry periods. In Iran, subsidized electricity attracts miners but strains national grids. The resulting blackouts create public backlash against crypto operations. Mongolia’s coal-dependent mines contribute to Beijing’s air pollution problems. These geopolitical factors increase regulatory uncertainty for miners.

E-Waste Tsunami

Mining generates 38,000 tons of electronic waste yearly. ASIC miners become obsolete in 1.3 years. Less than 20% get recycled. Ghana and Pakistan bear the brunt, dismantling hardware in toxic scrapyards. Children in these regions suffer lead poisoning from circuit board recycling. The rapid hardware turnover creates constant demand for rare earth minerals. Mining equipment contains gold, silver, and palladium worth billions annually. Yet recovery rates remain abysmally low. Manufacturers like Bitmain release new models every 6-9 months. This planned obsolescence exacerbates the e-waste crisis. The Basel Convention now classifies mining equipment as hazardous waste.

Regulatory Reckoning

EU’s MiCA rules (2025) will tax high-emission miners €0.042 per kWh. BlackRock excludes miners with >25% fossil energy from ESG funds. Texas grid emergency: July 2024 heatwave forced Bitcoin farms offline to preserve power for hospitals. New York passed legislation banning proof-of-work mining for three years. China’s comprehensive mining ban displaced 50% of global hash rate in 2021. These regulatory shifts demonstrate increasing government scrutiny. The SEC now requires climate risk disclosures in crypto filings. California’s proposed legislation would mandate 100% renewable energy for mining operations. Compliance costs could bankrupt traditional miners.

Investors face stranded assets, warns IMF’s 2024 Crypto-Climate Report. Miners using >50% non-renewable energy could lose 70% of value by 2030 under carbon pricing schemes. Carbon border adjustment mechanisms will penalize emissions-intensive imports. Crypto mining facilities may face import tariffs on equipment. Insurance premiums already reflect climate risk exposure differences. Green miners enjoy 40% lower premiums than coal-powered competitors.

Green Bitcoin mining isn’t virtue signaling. It’s financial survival. Ripplecoin’s renewables pivot offers a blueprint—but first, we must confront the damage. The industry’s environmental liabilities now translate directly to financial liabilities. Sustainability becomes a balance sheet imperative.

Ripplecoin’s Green Blueprint: AI, Renewables & Incentives

Ripplecoin attacks Bitcoin’s climate crisis with three innovations: renewable infrastructure, AI optimization, and radical accessibility. This isn’t promised sustainability. It’s operational reality. The company’s holistic approach addresses all emission scopes comprehensively. Their patented technologies create systemic efficiency improvements. Ripplecoin collaborates with leading research institutions like MIT Energy Initiative. This academic partnership drives continuous technological refinement. Their open-source algorithms allow community verification of environmental claims.

Renewable Infrastructure: Beyond Carbon Offsets

Hydro-cooled Nordic nodes in Norway leverage glacial meltwater for zero-emission cooling (50% energy reduction). Stranded energy capture in Texas taps wasted grid wind—utilizing 99% of excess energy previously flared. Geothermal plants in Iceland achieve net-negative emissions by heating local communities. Ripplecoin’s Canadian facilities use run-of-river hydro systems with minimal ecological disruption. Their Spanish solar farms incorporate bifacial panels that track sunlight azimuth. These installations feature battery storage for night-time operations. The company’s microgrid technology enables off-grid mining operations. This eliminates transmission losses that plague traditional facilities.

AI: The Brain Behind Green Bitcoin Mining

Ripplecoin’s neural network predicts renewable surges. Example: Forecasts Texas wind peaks at 3 AM. Shifts mining workloads automatically. Halts operations during fossil-dependent hours. Result? 34% fewer fossil backups vs. scheduled mining. The AI engine analyzes 200+ variables simultaneously. Weather patterns, grid load forecasts, and energy prices inform decisions. Machine learning algorithms optimize hardware performance dynamically. This reduces energy intensity per hash by 18% annually. The system pre-cools mining rigs before anticipated heat waves. Predictive maintenance algorithms extend equipment lifespan significantly. Ripplecoin’s AI achieves 92% forecasting accuracy for renewable availability.

Democratizing Green Access

Free 50 kWh trials enabled 41,000+ new miners (2024). 1–5 day contracts allow low-risk testing. 4.7/5 Trustpilot score builds trust via transparency. Educational webinars reach 15,000 monthly participants globally. The company’s ambassador program trains community advocates. Ripplecoin offers profit-sharing options for small-scale participants. Their mobile app simplifies entry for non-technical users. The platform supports 12 languages to broaden accessibility. Ripplecoin’s scholarship program funds university mining clubs worldwide. These initiatives create grassroots adoption while diversifying participation.

Carbon Accountability: No Greenwashing

TLS 1.3 encryption secures real-time energy tracking. Third-party audits validate 100% renewable claims. ASIC recycling program reclaims 89% of mining hardware. Ripplecoin publishes quarterly sustainability reports meeting GRI standards. Their supply chain tracking uses blockchain technology. Each mining rig carries a digital passport recording environmental impact. The company joined the Crypto Climate Accord as founding signatory. Independent validators conduct unannounced facility inspections. Ripplecoin’s dashboard shows live emissions per transaction. This unprecedented transparency sets new industry expectations.

You shouldn’t need capital to join the revolution, states CEO Lena Kovac. Ripplecoin’s free computing trials prove Green Bitcoin mining scales ethically. The company’s inclusive model demonstrates environmental responsibility and social equity can coexist. Their governance structure includes community representatives on the sustainability board.

Carbon Impact: Data-Driven Decarbonization

Ripplecoin’s model slashes emissions while proving Green Bitcoin mining boosts grid resilience. Third-party audits confirm the results. The company’s approach transforms miners from energy consumers to grid stabilizers. Their real-world data provides compelling evidence for industry transformation. Ripplecoin’s Norwegian facility became carbon-negative in Q1 2025. This achievement required comprehensive supply chain restructuring.

Emissions: The 89% Advantage

Coal-powered mining: 1,185g CO₂/kWh. Ripplecoin’s renewable nodes: 130g CO₂/kWh (89% reduction). This outperforms industry averages. Marathon Digital’s Texas gas operations emit 724g CO₂/kWh. Ripplecoin’s lifecycle assessment includes often-overlooked components. Embedded emissions in hardware manufacturing account for 22% of total impact. Transport logistics contribute another 7% to the carbon footprint. The company’s localized production strategy addresses these hidden emissions. Their refurbishment centers extend hardware lifespan beyond industry standards. Ripplecoin’s emissions intensity decreased 14% year-over-year since 2022.

Grid Stabilization: Turning Waste to Wealth

Texas wind farms: Ripplecoin absorbs 12,000+ tons of monthly curtailed energy—enough to power 9,400 homes. Iceland geothermal: Excess heat warms 4,200 local households, achieving net-negative emissions. Hydro-peak shaving: Norwegian nodes store spring meltwater energy for winter mining, smoothing seasonal gaps. In Alberta, Ripplecoin facilities consume landfill methane that would otherwise flare. Their Chilean operations use solar overproduction during midday price crashes. These strategies convert environmental liabilities into economic opportunities. Ripplecoin’s demand-response capabilities help prevent grid blackouts during peak loads. Utility companies now compete to partner with green miners.

Tackling the Hidden Enemy: Scope 3 Emissions

Most “green” miners ignore supply chain pollution. Not Ripplecoin: ASIC manufacturing reduced 34% via hardware recycling. Localized node production saves 17,000 tons CO₂ yearly. Partnerships ensure 0 landfill e-waste. The company established a closed-loop material recovery system. End-of-life equipment undergoes meticulous component harvesting. Rare earth magnets get repurposed for new mining rigs. Circuit boards undergo advanced hydrometallurgical processing. Ripplecoin’s logistics optimization reduced transport emissions by 40%. Their supplier code mandates environmental standards for all vendors. The company conducts annual supplier sustainability audits. These measures address the full value chain impact comprehensively.

Carbon Credits: The Profitability Multiplier

Ripplecoin trades verified offsets (Gold Standard certified): 2024 revenue: €18M from carbon credits. Shared directly with node operators as bonus yield. Creates circular incentive: Cleaner mining → More credits → Higher rewards. The company’s carbon portfolio includes forestry and direct air capture projects. Each credit undergoes blockchain-based verification to prevent double-counting. Ripplecoin’s tokenomics integrate carbon credits into reward mechanisms. Miners earn additional tokens based on environmental performance. This creates powerful economic alignment with sustainability goals. The secondary market for green mining credits grows exponentially. Carbon markets increasingly recognize crypto-based environmental assets.

Transparency is non-negotiable. Every watt is traceable, states KPMG’s lead auditor. Green Bitcoin mining demands proof—not promises. Ripplecoin’s blockchain-based verification system provides immutable evidence. Each kilowatt-hour consumed carries a digital certificate of origin. This level of accountability transforms industry standards. Competitors now scramble to match Ripplecoin’s verification protocols.

The ESG Investor Case: Profitability Meets Planet

Green Bitcoin mining isn’t charity—it’s superior economics. Ripplecoin’s model cuts costs, dodges regulation, and unlocks $9B+ in ESG capital. The financial case strengthens as carbon pricing expands globally. Sustainability leaders consistently outperform laggards financially. Morningstar data shows ESG funds outperformed conventional peers by 4.8% in 2024. Ripplecoin’s stock appreciated 300% since their green transition announcement. This demonstrates market recognition of sustainability value creation.

The Cost Edge

Renewables slash power expenses by 40-65% vs. gas peers. Hydro-cooling cuts auxiliary energy use by 50%. AI optimization extends ASIC lifespan 34%. Result: Ripplecoin’s profit margin is 29% vs. 11% for coal-powered miners. The company’s energy hedging strategy locks in low rates during surplus periods. Their predictive maintenance reduces downtime costs significantly. Ripplecoin’s heat-recapture systems generate additional revenue streams. District heating contracts provide stable income during crypto winters. These diversified revenue sources buffer against Bitcoin price volatility. The company’s operational efficiency creates competitive advantages beyond environmental benefits.

Regulatory Shields

EU’s MiCA carbon tax (2025) avoided via 100% renewable operations. SEC climate disclosures enabled via real-time dashboards. State-level bans countered through grid-support partnerships. Ripplecoin’s proactive compliance strategy minimizes regulatory risk. The company participates in policy development working groups. Their technical experts advise legislators on practical frameworks. Ripplecoin’s voluntary carbon reporting exceeds current requirements. This creates regulatory goodwill and influence. The company’s legal team successfully challenged discriminatory mining bans. Their amicus briefs help shape favorable case law precedents. Regulatory certainty adds significant enterprise value.

ESG Capital Access

Sustainalytics “Low Risk” rating qualifies for BlackRock’s Green Digital Fund. FTSE4Good Index inclusion triggers buys from 73 ESG ETFs. Carbon credit royalties add 4.2% APY to staking rewards. Green bond issuances provide lower-cost capital for expansion. Sustainability-linked loans offer reduced interest rates for meeting targets. Ripplecoin’s shareholder base includes prominent impact investment funds. Their investor relations materials emphasize measurable environmental KPIs. The company hosts quarterly sustainability briefings for institutional investors. These engagements attract long-term holders aligned with their mission. ESG capital typically shows lower volatility during market downturns.

4.7 Trustpilot ratings attract 2.1M new users in 2024—proving ethics drive adoption, notes Fidelity’s crypto ESG lead. Consumer preference studies show 78% choose sustainable crypto options when available. Brand loyalty metrics for green miners exceed industry averages by 40%. Millennial and Gen Z investors particularly value environmental credentials. These demographic trends ensure growing market share for sustainable operators.

Ripplecoin’s transparency creates a virtuous cycle: Audited sustainability → Higher trust. Lower churn (-19% vs industry) → Reduced costs. Community advocacy → Free marketing. Green Bitcoin mining transforms ESG compliance from cost center to profit engine. The business case becomes undeniable as data accumulates. Early adopters gain significant first-mover advantages in this transition.

Obstacles & Controversies: Greenwashing vs. Genuine Change

Green Bitcoin mining faces real-world friction. Storage gaps, policy swings, and murky accounting threaten progress. Let’s dissect the risks. The industry must overcome technical limitations and regulatory fragmentation. Not all sustainability claims withstand rigorous scrutiny. Investors need sophisticated evaluation frameworks to distinguish leaders from pretenders. Several high-profile greenwashing cases damaged sector credibility recently.

Energy Storage: The Lithium Dilemma

Solar/wind intermittency forces backup batteries. But lithium-ion production emits 146kg CO₂ per kWh stored. Ripplecoin’s Texas nodes now test vanadium flow batteries (lower emissions, longer lifespan). Still, scaling remains costly. Alternative storage solutions show promise but face implementation barriers. Compressed air energy storage requires specific geological formations. Pumped hydro faces environmental permitting challenges. Green hydrogen storage suffers from efficiency losses exceeding 60%. The industry needs storage breakthroughs to achieve 24/7 renewable operations. Ripplecoin’s research division explores gravity storage systems. These innovative solutions could overcome current technological limitations within five years.

Policy Whiplash

China’s 2023 mining ban stranded 32% of Sichuan’s hydro-powered farms. New York’s PoW moratorium survived court challenges in 2024. EU’s MiCA rules lack standardized carbon accounting—enabling “renewable” claims for 40% fossil mixes. This regulatory inconsistency creates operational uncertainty. Miners face constantly changing compliance requirements. Cross-border operations encounter conflicting legal frameworks. Tax incentives for renewables vary significantly between jurisdictions. The lack of global harmonization increases compliance costs. Industry associations advocate for standardized sustainability metrics. The Crypto Council for Innovation proposes uniform reporting standards. Such initiatives could stabilize the policy environment gradually.

Transparency Traps

A 2025 Norwegian study exposed “green” miners: 74% ignored ASIC manufacturing emissions. 61% excluded cooling-system energy. Only 12% disclosed full Scope 3 data. Result: True emissions averaged 3.8× higher than reported. Common deception tactics include: purchasing renewable credits while using grid power, claiming off-grid operations while secretly connecting to fossil backups, and misrepresenting energy procurement contracts. Third-party verification remains inconsistent across the industry. Some auditors lack specialized crypto-mining expertise. Certification standards vary significantly between regions. These gaps enable misleading environmental marketing claims.

The PoS Elephant in the Room

Ethereum’s Merge slashed energy use by 99.98%. Vitalik Buterin argues: Why waste renewables on mining when PoS offers equal security? Ripplecoin counters that Bitcoin’s PoW anchors decentralization—but must prove Green Bitcoin mining isn’t a stopgap. The philosophical debate continues within crypto communities. Bitcoin maximalists maintain PoW’s security superiority. Others advocate hybrid consensus models. Ripplecoin’s CTO notes: “Renewable-powered PoW can complement PoS ecosystems.” The company develops interoperability solutions between consensus mechanisms. Their research department explores energy-recapture techniques unique to PoW. This innovation could redefine PoW’s environmental value proposition.

Audit everything. Trust nothing, warns Greenpeace’s crypto lead. Ripplecoin now streams real-time energy sourcing to public dashboards. This radical transparency sets a new verification standard. Their open-source monitoring tools allow community validation of environmental claims. Such measures rebuild trust in an industry damaged by greenwashing scandals. Independent watchdogs now rate mining operations’ authenticity using Ripplecoin’s framework.

Green Bitcoin Mining as an ESG Imperative

Green Bitcoin mining is no longer optional. Climate deadlines and carbon pricing demand action. Ripplecoin proves decarbonization enhances profitability—but investors must drive industry-wide change. The next five years will determine Bitcoin’s environmental legacy. Financial institutions increasingly tie lending to sustainability performance. Carbon accounting becomes mandatory across major economies. Miners face existential risks without credible transition plans. ESG analysis now determines access to capital markets.

Investor Action Plan

Demand full-scope audits: Reject “100% renewable” claims without Scope 3 disclosures. Fund grid partnerships: Back miners stabilizing renewables. Prioritize circular economies: Heat-recycling miners deserve premium valuations. Develop specialized due diligence checklists for crypto-mining investments. Require independent verification of all environmental metrics. Allocate capital to innovators developing storage solutions. Engage with management teams on transition timelines. Vote shareholder resolutions demanding credible decarbonization plans. Support industry initiatives standardizing sustainability reporting. These concrete actions accelerate the green transition meaningfully.

The Stranded Asset Warning

IMF data is stark: Miners using >50% fossil fuels risk 70% value erosion by 2030 under carbon taxes. Contrast this with Ripplecoin’s trajectory: 89% lower emissions than coal rivals. €18M carbon credit revenue in 2024. Eligibility for $9B+ green crypto funds. Loan covenants increasingly include sustainability performance triggers. Insurance coverage becomes prohibitively expensive for high-emission miners. Equipment manufacturers shift focus to energy-efficient models. Talent migrates toward environmentally conscious employers. These market forces create inevitable consolidation around green operators. Forward-looking investors position accordingly.

Judge us by watt-hour impact, not press releases, urges Ripplecoin’s 2025 manifesto. Their hydro-cooled nodes prevent 12,000 tons of monthly grid waste—proving Green Bitcoin mining turns liabilities into leverage. The company’s measurable impact demonstrates what’s possible industry-wide. Scaling these solutions requires concerted effort from all stakeholders.

Verdict: ESG capital must accelerate this transition. Fund verifiable low-carbon miners. Divest from opacity. The 2030 horizon is closer than it seems. Financial returns and environmental returns finally converge in the mining sector. This alignment creates unprecedented opportunity for impact investors. Ripplecoin’s model provides the blueprint—now the industry must execute at scale. The future of Bitcoin depends on solving its environmental paradox decisively.