Introduction

The rapid growth of decentralized finance (DeFi) in Nigeria has sparked widespread interest in understanding the backbone of this innovative financial system—blockchain consensus algorithms. As DeFi platforms reshape how financial services are accessed and utilized, these algorithms ensure the security, efficiency, and decentralization that drive their success. For Nigerians eager to embrace DeFi, understanding how these mechanisms work is essential to navigating this emerging ecosystem confidently.

Nigeria’s unique position as a global leader in cryptocurrency adoption makes this conversation especially relevant. According to Chainalysis, Nigeria ranks among the top countries for crypto usage, with blockchain technology offering a solution to challenges like limited financial inclusion and economic instability. However, to leverage the full potential of DeFi, it’s crucial to grasp how consensus algorithms support the platforms enabling seamless transactions, smart contracts, and decentralized lending systems.

This article will provide Nigerian DeFi enthusiasts with a deep dive into consensus algorithms, equipping them with the knowledge needed to thrive in the decentralized financial ecosystem. Whether you’re a seasoned crypto trader or a beginner exploring blockchain’s possibilities, this journey begins with understanding the foundations that make DeFi work.

What Are Consensus Algorithms?

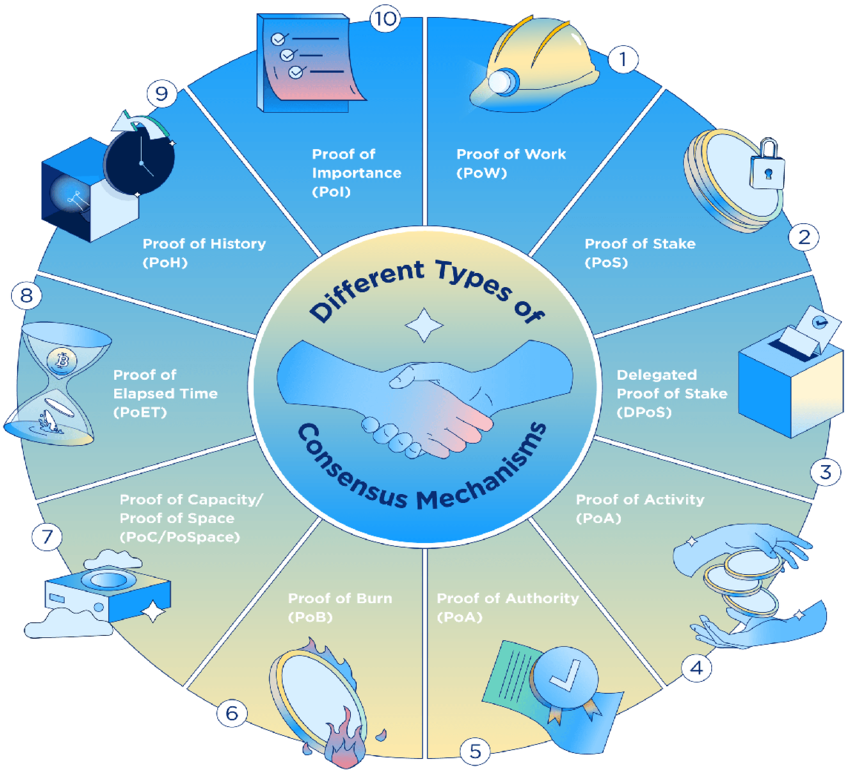

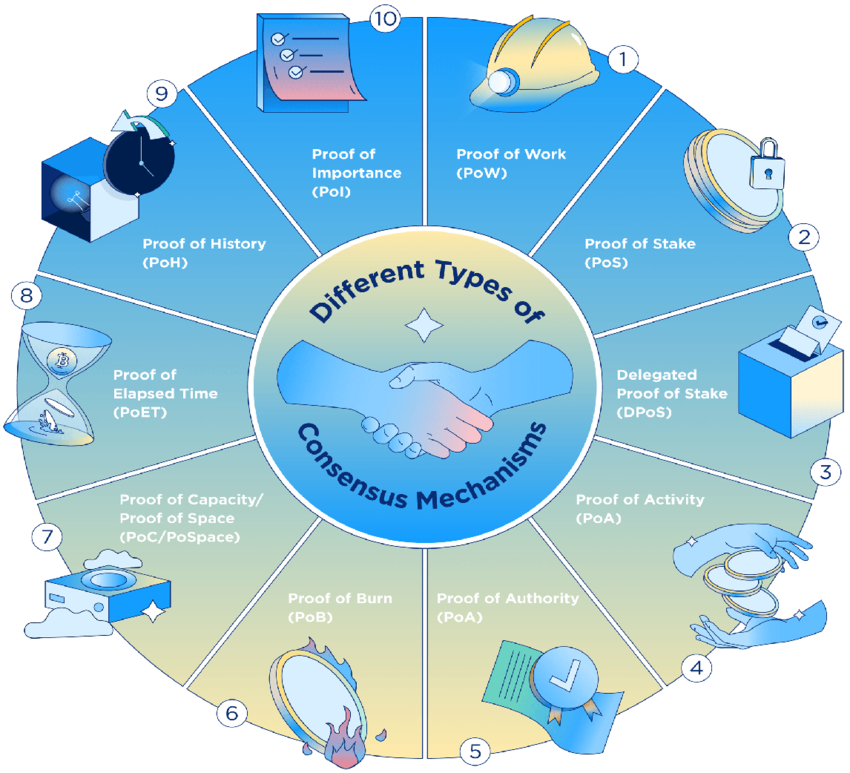

At their core, consensus algorithms are the rules and processes used by blockchain networks to validate transactions and maintain the integrity of the ledger. They ensure that all transactions are accurate and that every participant in the network has a consistent view of the data. Without consensus algorithms, blockchains—and by extension, DeFi platforms—would fail to deliver on their promise of security, transparency, and decentralization.

For instance, when you interact with a DeFi platform like Aave or Uniswap, you rely on the blockchain’s consensus mechanism to verify that the transaction you’re initiating is valid and irreversible.

Why Are Consensus Algorithms Critical for DeFi?

Consensus algorithms play a pivotal role in supporting DeFi platforms, addressing several critical needs:

- Security

DeFi platforms deal with large volumes of financial transactions daily. Consensus mechanisms protect against fraud, double-spending, and attacks such as the infamous 51% attack, where a malicious actor gains control over the majority of the network’s power.

(Did you know? A significant breach or flaw in consensus can result in losses worth millions. For Nigerian users, understanding this ensures confidence when engaging with DeFi projects.)

- Decentralization

These algorithms eliminate the need for intermediaries like banks or clearinghouses by distributing decision-making across a network of participants. This aligns perfectly with the ethos of DeFi, which aims to empower individuals rather than centralized institutions. - Efficiency

High transaction throughput is critical for DeFi platforms, especially as they grow in popularity. Consensus algorithms like Proof of Stake (PoS) are designed to handle a higher volume of transactions more efficiently than older methods like Proof of Work (PoW).

Delegated Proof of Stake (DPoS)

How It Works:

DPoS builds on PoS by allowing token holders to vote for a select group of delegates who validate transactions on their behalf.

Strengths:

- Highly scalable, capable of handling a large volume of transactions.

- Democratized participation through voting mechanisms.

Weaknesses:

- The voting system can introduce an element of centralization if few delegates dominate the network.

Use in DeFi

DPoS is commonly used by networks like TRON and EOS, which power some DeFi applications. Nigerian developers building scalable DeFi solutions may find DPoS networks appealing due to their performance advantages

Proof of Authority (PoA)

How It Works:

Proof of Authority relies on a set of pre-approved validators to confirm transactions, making it more centralized but highly efficient.

Strengths:

- High transaction throughput and low fees.

- Simple implementation, suitable for private or enterprise-level DeFi applications.

Weaknesses:

- Limited decentralization, which may conflict with the ethos of blockchain.

Use in DeFi:

PoA is typically used for enterprise blockchain solutions or permissioned networks. While less common in public DeFi, it could be relevant for government-backed blockchain projects in Nigeria, such as those addressing supply chain or financial inclusion challenges.

Why This Matters for Nigerians

For Nigerian DeFi users, choosing the right platform involves weighing the benefits of each consensus mechanism. PoS and DPoS systems are likely the most practical options, balancing scalability and cost. Additionally, understanding these mechanisms helps users identify platforms that align with their priorities, such as low fees or decentralization.

How Nigerian Enthusiasts Can Leverage Consensus Knowledge

For Nigerians venturing into the dynamic world of decentralized finance (DeFi), understanding consensus algorithms is more than just a technical exercise—it’s a tool for making informed decisions, optimizing investments, and contributing to the growth of the ecosystem. Here’s how enthusiasts can practically apply this knowledge:

1. Choose the Right DeFi Platform

Different DeFi platforms operate on blockchains with varying consensus algorithms, and each algorithm affects transaction costs, speed, and security. For Nigerian users, these factors are particularly important due to local considerations like fluctuating exchange rates and high demand for affordable financial services.

- Proof of Stake (PoS) Platforms: These are ideal for users who prioritize low transaction fees and fast processing times. Popular options include Ethereum 2.0, Binance Smart Chain, and Polygon.

- Delegated Proof of Stake (DPoS) Platforms: If scalability and frequent transactions are a priority, networks like TRON or EOS offer high-speed solutions.

2. Assess Platform Security

Consensus algorithms play a critical role in ensuring the security of a blockchain network. PoW networks, though energy-intensive, are known for their robustness, making them suitable for high-value, long-term storage of funds. Meanwhile, PoS-based platforms offer security with greater energy efficiency, making them preferable for everyday DeFi activities.

- Verify that the platform is built on a well-established blockchain with a proven consensus mechanism.

- Look for platforms with high levels of decentralization, as this reduces the risk of control by a single entity.

Practical Steps for Nigerians to Engage Safely and Effectively in DeFi

As the decentralized finance (DeFi) ecosystem continues to grow in Nigeria, taking informed and secure steps is essential to maximize benefits while mitigating risks. This section provides a practical guide for Nigerian DeFi enthusiasts to safely engage with platforms and leverage consensus algorithms effectively.

1. Understand the Platform’s Underlying Consensus Mechanism

Before committing funds to any DeFi platform, ensure you understand the consensus algorithm it operates on. This affects transaction speed, security, and cost.

- Do Your Research: Use blockchain explorers or official documentation to confirm the platform’s consensus type (e.g., PoS, DPoS).

- Consider Network Maturity: Established platforms like Ethereum 2.0 and Binance Smart Chain are generally more reliable.

(For Nigerians new to DeFi, platforms with transparent governance and active communities can provide a safer starting point.)

2. Use Secure Wallets

A secure wallet is your first line of defense when engaging with DeFi platforms. Options range from hardware wallets to mobile apps, depending on your needs.

- Hardware Wallets: For long-term storage, consider hardware wallets like Ledger or Trezor, which offer enhanced security.

- Software Wallets: MetaMask and Trust Wallet are user-friendly options for frequent DeFi interactions.

(Practical Tip: Nigerians should avoid storing private keys or recovery phrases digitally to reduce hacking risks.)

3. Prioritize Low-Fee, Efficient Platforms

Transaction costs can quickly add up, especially for frequent DeFi activities like staking, swapping, or yield farming.

- Look for platforms operating on low-fee networks, such as Binance Smart Chain or Polygon.

- Consider Layer 2 solutions like Arbitrum or Optimism, which reduce gas fees on Ethereum-based platforms.

Why Defi Matter for Nigerians

By following these practical steps, Nigerian DeFi users can engage with confidence, ensuring that their participation is both secure and impactful. The DeFi space offers immense opportunities, but the risks are equally real. Knowledge, cautious planning, and community engagement can make all the difference.

Conclusion

The rapid adoption of decentralized finance (DeFi) in Nigeria reflects the nation’s innovative spirit and the urgent need for alternative financial solutions. At the heart of this transformation are blockchain consensus algorithms, the foundational systems ensuring that DeFi platforms remain secure, efficient, and decentralized.

For Nigerian enthusiasts, understanding these algorithms is more than a technical pursuit—it’s a gateway to leveraging DeFi for wealth creation, financial inclusion, and innovation. By choosing platforms with robust and efficient consensus mechanisms, participating in activities like staking, and engaging in community governance, users can maximize the benefits of DeFi while mitigating risks.

Nigeria’s leadership in cryptocurrency adoption presents an opportunity for its citizens to shape the global DeFi narrative. By embracing blockchain technology and its consensus systems, Nigerians can not only participate in but also drive the evolution of decentralized finance. The future of finance is decentralized, and Nigeria is poised to play a leading role in its development.