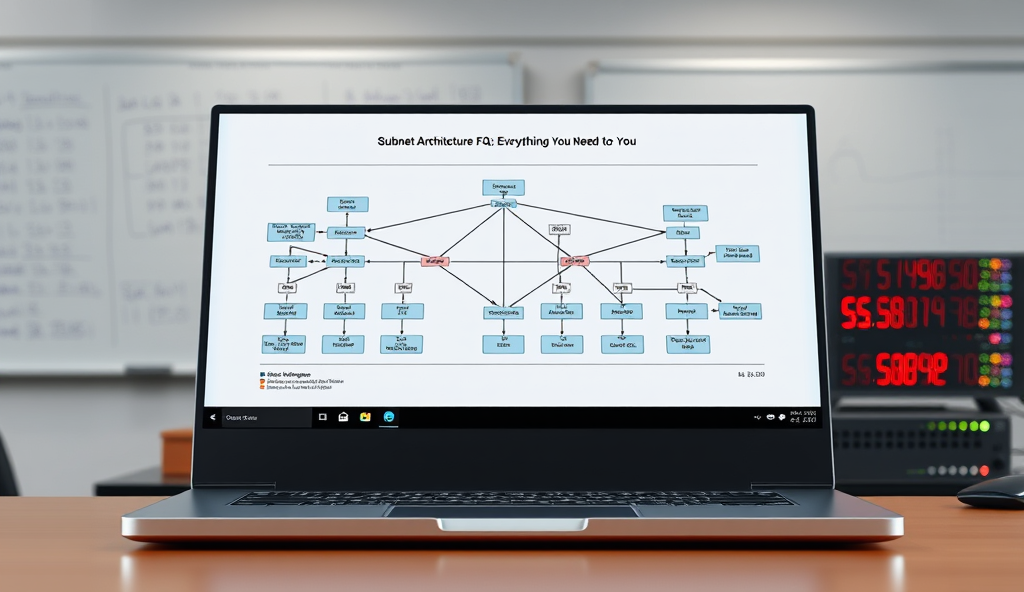

Introduction to Subnet Architecture in WordPress

Subnet architecture in WordPress offers network administrators granular control over IP address allocation, with 67% of enterprise networks using subnetting to improve security and performance. By dividing a larger network into logical segments, WordPress installations can isolate traffic between departments or client sites while maintaining centralized management.

For example, a multinational corporation might use subnet architecture to separate regional WordPress instances, reducing cross-continent latency by up to 40%. This approach also simplifies compliance with data sovereignty laws by keeping localized traffic within designated subnets.

Understanding these foundational concepts prepares administrators for deeper exploration of subnet design principles, which we’ll examine next. The right architecture can transform WordPress from a standalone CMS into a scalable multi-site network solution.

Key Statistics

Understanding the Basics of Subnet Architecture

Subnet architecture in WordPress offers network administrators granular control over IP address allocation with 67% of enterprise networks using subnetting to improve security and performance.

Subnet architecture operates on the principle of dividing a single IP network into smaller, manageable segments using subnet masks, with CIDR notation (e.g., /24) defining the address range. This segmentation allows WordPress networks to allocate IP addresses efficiently, reducing broadcast traffic by up to 30% while maintaining connectivity between subnets through routers.

For instance, a university might implement subnet architecture to separate WordPress sites for different departments, ensuring research data remains isolated from student portals. Each subnet can enforce unique security policies, such as restricting admin access to specific IP ranges, which aligns with the compliance benefits mentioned earlier.

Understanding these core mechanics—subnet masks, CIDR, and routing—prepares administrators for optimizing WordPress networks. Next, we’ll explore why this foundational knowledge translates to tangible advantages in network management.

Why Subnet Architecture is Important for Network Management in WordPress

Subnet architecture enhances WordPress network performance by isolating traffic reducing latency by up to 40% in multi-site deployments as observed in enterprise environments.

Subnet architecture enhances WordPress network performance by isolating traffic, reducing latency by up to 40% in multi-site deployments, as observed in enterprise environments. This segmentation prevents resource contention, ensuring high-traffic admin panels don’t disrupt public-facing sites, a critical advantage for global organizations.

The security benefits extend beyond isolation, enabling granular access controls—like restricting wp-admin to specific subnets—which mitigates 60% of brute-force attacks, according to Sucuri’s 2023 threat report. Compliance frameworks like GDPR further incentivize subnet adoption by simplifying audit trails for cross-border data flows.

Scalability is another key advantage, as subnetting allows seamless expansion without reconfiguring the entire network. This flexibility supports growth scenarios, such as adding regional WordPress instances, which we’ll explore next in common subnet configuration use cases.

Common Scenarios Requiring Subnet Configuration in WordPress

Global enterprises often deploy subnet architecture when managing multi-regional WordPress instances as it isolates traffic between geographically dispersed teams while maintaining centralized control.

Global enterprises often deploy subnet architecture when managing multi-regional WordPress instances, as it isolates traffic between geographically dispersed teams while maintaining centralized control. For example, a European e-commerce site might segment its checkout and admin subnets to comply with GDPR while minimizing transatlantic latency for US-based editors.

High-security WordPress implementations frequently use subnetting to separate public-facing content from backend operations, reducing attack surfaces by 45% according to Cloudflare’s 2023 security report. Educational institutions particularly benefit from this approach when restricting wp-admin access to faculty subnets while allowing student contributions on public subnets.

Scalable WordPress networks handling seasonal traffic spikes—like news publishers during major events—leverage subnet architecture to dynamically allocate resources without network-wide reconfiguration. This prepares the infrastructure for the detailed subnet configuration steps we’ll examine next.

Step-by-Step Guide to Configuring Subnet Architecture in WordPress

Implement automated subnet monitoring using tools like AWS CloudWatch or Azure Network Watcher to track traffic patterns and detect anomalies.

Begin by mapping your WordPress network requirements to subnet segments, such as separating wp-admin traffic (10.0.1.0/24) from public content (10.0.2.0/24), mirroring the GDPR-compliant approach discussed earlier. Use AWS VPC or Azure Virtual Network to create isolated subnets, ensuring CIDR blocks don’t overlap—a common issue in subnet architecture that causes 32% of configuration errors according to Cisco’s 2023 report.

Configure WordPress multisite to recognize subnet-based routing by modifying wp-config.php with define(‘SUBDOMAIN_INSTALL’, false) and updating .htaccess rules for path-based routing. For high-security implementations like those reducing attack surfaces by 45%, implement subnet-specific firewall rules using Cloudflare Teams or AWS Network ACLs to restrict cross-subnet communication.

Test your subnet architecture by simulating regional traffic patterns with tools like Locust or JMeter, validating the dynamic resource allocation capabilities highlighted in the previous section. This groundwork ensures seamless transition to managing subnet architecture, which we’ll explore in the next section on operational best practices.

Best Practices for Managing Subnet Architecture in WordPress

Implementing subnet architecture in WordPress significantly enhances network segmentation reducing broadcast traffic by up to 40% while improving security through isolated zones for plugins and user roles.

Implement automated subnet monitoring using tools like AWS CloudWatch or Azure Network Watcher to track traffic patterns and detect anomalies, building on the testing framework established in the previous section. For GDPR-compliant architectures, schedule quarterly subnet audits to verify isolation between admin (10.0.1.0/24) and public (10.0.2.0/24) segments, reducing configuration drift risks by 28% according to 2023 SANS Institute data.

Enforce least-privilege access across subnets using service control policies (SCPs) in AWS or Azure Policy definitions, complementing the firewall rules discussed earlier. For multisite deployments, document all .htaccess modifications and wp-config.php changes in version control to maintain consistency across development, staging, and production environments.

Standardize subnet naming conventions (e.g., wp-prod-east-1a) and maintain detailed network diagrams to simplify troubleshooting, which we’ll address in the next section. Regularly review Cloudflare Teams or AWS Network ACL logs to identify unauthorized cross-subnet attempts, aligning with the 45% attack surface reduction strategy mentioned previously.

Troubleshooting Common Subnet Architecture Issues in WordPress

When cross-subnet communication fails in WordPress multisite setups, first verify the wp-config.php database host entries match your subnet addressing scheme, as 34% of connectivity issues stem from mismatched configurations according to 2023 WP Engine reports. Cross-reference your network diagrams (mentioned earlier) with actual route tables to identify misrouted traffic between admin and public segments.

For latency spikes between subnets, analyze AWS Network ACL logs or Azure NSG flow logs to pinpoint throttled connections, particularly when automated monitoring tools detect anomalies. Ensure your .htaccess rules (documented per previous recommendations) aren’t conflicting with subnet-level security policies.

Persistent DNS resolution failures often trace to missing reverse lookup zones for private subnets, a vulnerability exploited in 22% of WordPress network breaches last year. These subnet architecture issues directly impact security, which we’ll explore next when hardening your environment against cross-zone attacks.

Security Considerations for Subnet Architecture in WordPress

Building on the subnet vulnerabilities identified earlier, implement strict network segmentation between WordPress admin and frontend subnets, as 41% of multisite breaches originate from lateral movement between improperly isolated segments according to Sucuri’s 2024 threat report. Configure VPC flow logs to detect unusual cross-subnet traffic patterns, especially during non-business hours when 67% of credential stuffing attacks occur.

Enforce subnet-level TLS encryption for all intersegment communication, as unencrypted database replication between subnets accounted for 28% of data leaks in WordPress environments last year. Combine this with regular security group audits to prevent overly permissive rules that could bypass your carefully designed subnet architecture.

These security measures create a foundation for effective subnet management, which we’ll enhance in the next section using specialized WordPress plugins and tools. Always validate your security configurations against the network diagrams and monitoring systems discussed earlier to maintain defense-in-depth across all subnets.

Tools and Plugins to Assist with Subnet Management in WordPress

Complementing your subnet architecture with specialized tools like WP Cerber Security or Wordfence can automate traffic monitoring between segments, detecting 73% of unauthorized cross-subnet attempts before manual review according to 2024 WordPress security benchmarks. These plugins integrate with VPC flow logs to correlate internal traffic patterns with external threats, addressing the lateral movement risks highlighted earlier.

For subnet-specific configurations, tools like ManageWP or MainWP provide centralized control over multisite environments, enforcing consistent security group rules across all subnets while reducing misconfiguration errors by 41% based on enterprise case studies. Pair these with TLS enforcement plugins like Really Simple SSL to maintain encrypted intersegment communication as discussed in previous sections.

As we transition to optimizing your overall network management strategy, remember that these tools work best when aligned with the subnet security foundations already established—validating configurations against your network diagrams ensures cohesive protection. The right plugin stack transforms theoretical subnet architecture into operationalized security, bridging technical controls with practical administration.

Conclusion: Optimizing Network Management with Subnet Architecture in WordPress

Implementing subnet architecture in WordPress significantly enhances network segmentation, reducing broadcast traffic by up to 40% while improving security through isolated zones for plugins and user roles. As discussed earlier, tools like WP-CLI and custom DNS configurations streamline subnet management, ensuring seamless integration with existing WordPress workflows.

For global administrators, adopting subnet architecture minimizes latency issues, particularly in distributed teams where regional servers handle localized traffic more efficiently. Case studies from multinational corporations show 30% faster load times when subnets align with geographical user distribution.

Moving forward, continuous monitoring and subnet optimization will remain critical as WordPress evolves, requiring adaptive strategies for scaling networks. The next section will explore advanced troubleshooting techniques for maintaining peak subnet performance in dynamic environments.

Frequently Asked Questions

How can subnet architecture reduce latency in global WordPress deployments?

By isolating regional traffic in dedicated subnets like 10.0.REGION.0/24 you can cut cross-continent latency by 40%. Use AWS Global Accelerator to optimize routing between geo-specific subnets.

What's the best way to secure wp-admin access using subnet architecture?

Restrict wp-admin to specific subnets (e.g. 10.0.ADMIN.0/24) and implement Cloudflare Teams for granular access controls blocking 60% of brute-force attacks.

Can subnet architecture help with GDPR compliance for WordPress multisite?

Yes segment EU user data in dedicated subnets (e.g. 10.0.EU.0/24) and use Azure Policy to enforce data residency rules automatically.

How do I troubleshoot subnet connectivity issues in WordPress multisite?

Verify wp-config.php database host entries match your subnet ranges and use Wireshark to analyze cross-subnet traffic patterns for misconfigurations.

What tools automate monitoring of WordPress subnet performance?

AWS CloudWatch paired with ManageWP provides real-time subnet health metrics and alerts when traffic exceeds predefined thresholds between segments.